Daily Newsletter Oct 26 '22

What is included in tomorrow's game plan?

Daily Recap

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Day Trade Stock Ideas - $AMD | $COIN - Details will be provided in Discord

Today's Recap

Market Snapshot

Market Heatmap

Sector Heatmap

Market Recap

Today's trade was distinctly positive as the major averages built on recent gains. A big pullback in Treasury yields precipitated broad buying interest in the stock market. The 10-yr note yield fell 13 basis points to 4.11% and the 2-yr note yield fell two basis points to 4.46%. The S&P 500 closed well above the 3,800 level after dipping below 3,500 on October 13.

The moves in the Treasury market followed some weak-looking home price data for August that was contained in the FHFA Housing Price Index (-0.7% m/m) and the S&P Case-Shiller 20-City Composite Index (+13.1% yr/yr, but down from +16.0% yr/yr in July). Those reports supported market participants' growing belief that the Fed may soften its approach after the November meeting.

To be fair, buying momentum in the Treasury market lost some of its vigor following the weak 2-yr bond auction, which saw a high yield of 4.46% tail the when-issued yield by 1.2 basis points. The stock market, however, remained on a steady incline.

Favorable quarterly results from names like Coca-Cola (KO 58.95, +1.38, +2.4%), General Motors (GM 37.01, +1.29, +3.6%), and Sherwin-Williams (SHW 220.20, +7.67, +3.6%) added fuel to the rally effort.

Mega cap stocks had a strong showing, offering additional support to the broader market. The Vanguard Mega Cap Growth ETF (MGK) closed up 2.3% versus a 1.6% gain in the S&P 500.

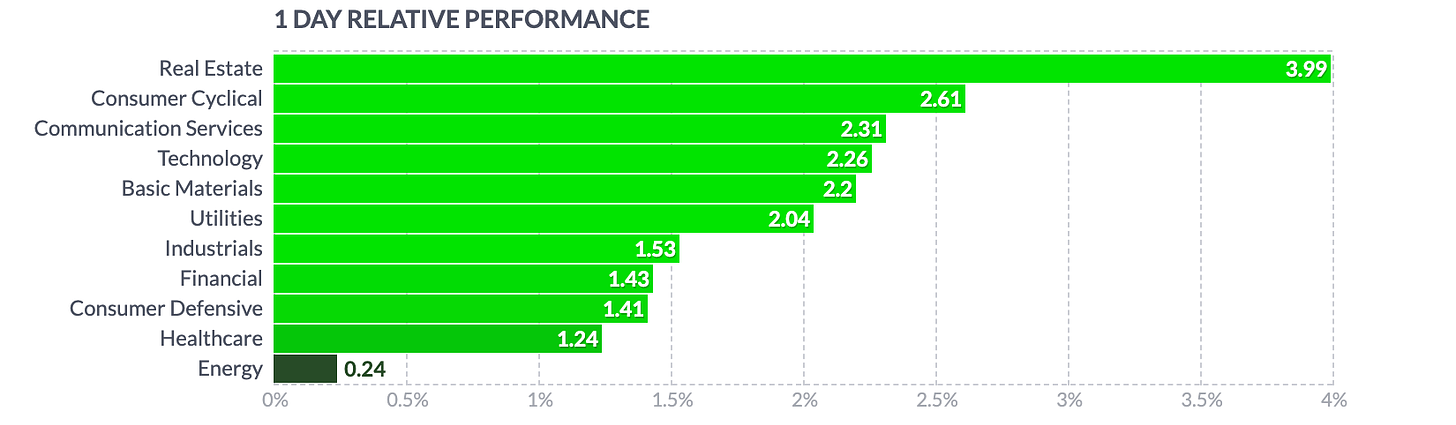

Ten of the 11 S&P 500 sectors logged gains on the day led by the real estate sector (+3.9%). The energy sector (-0.1%) was alone in negative territory despite a modest increase in oil prices. WTI crude oil futures rose 0.4% to $84.97/bbl.

Small and mid cap stocks fared better than their larger peers today. The Russell 2000 (+2.7%) and S&P Mid Cap 400 (+2.5%) showed some of the biggest gains among the indices.

Ahead of Wednesday's open, Automatic Data (ADP), Boeing (BA), Bristol-Myers (BMY), General Dynamics (GD), Harley-Davidson (HOG), Hilton (HLT), Kraft Heinz (KHC), Norfolk Southern (NSC), Roper (ROP), Seagate Tech (STX), Waste Mgmt (WM) headline the earnings reports.

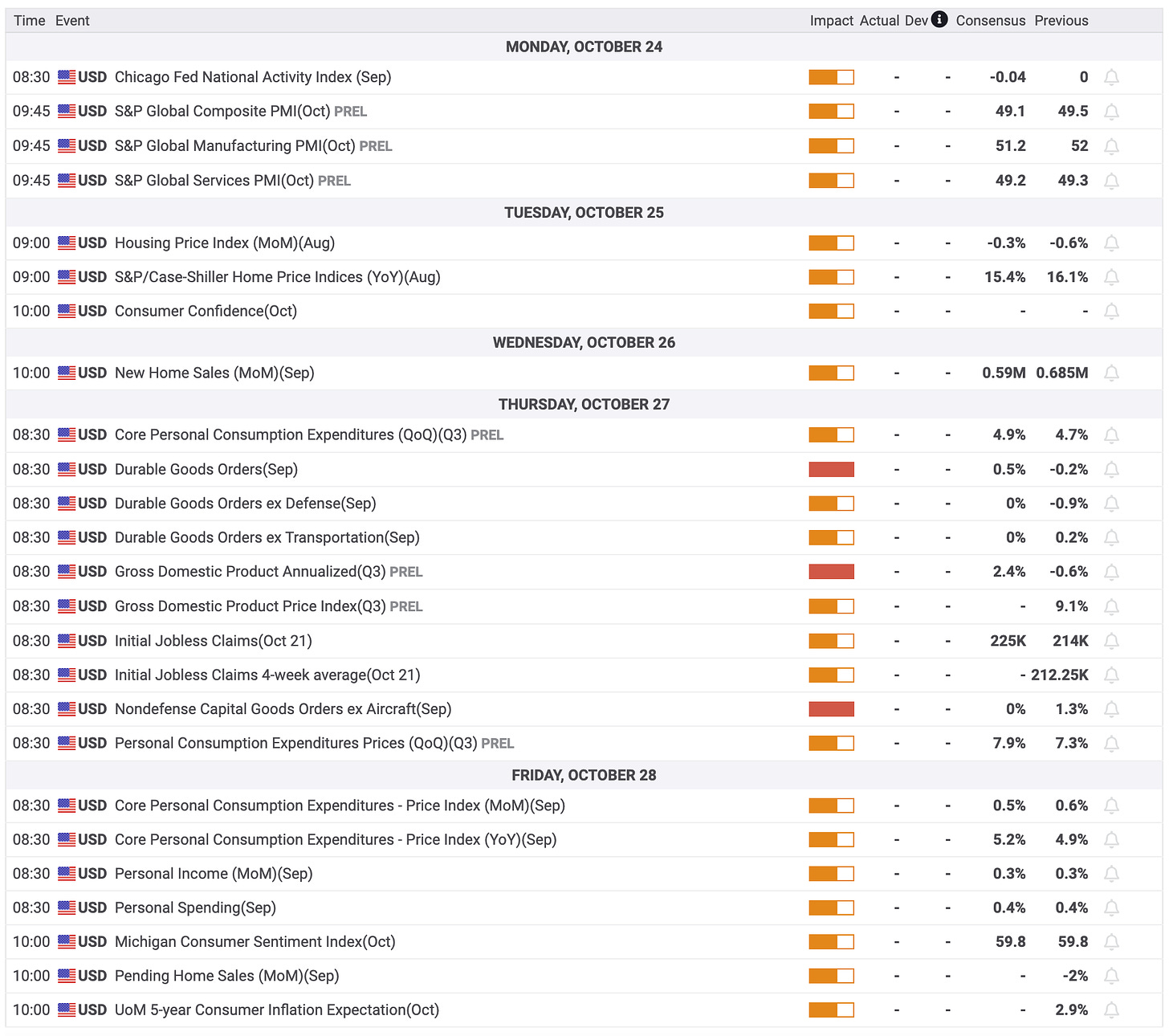

Market participants will receive a slew of economic data tomorrow that includes:

7:00 ET: Weekly MBA Mortgage Index (prior -4.5%)

8:30 ET: September advance goods trade deficit (prior -$87.30 bln), September advance Retail Inventories (prior 1.4%), and September advance Wholesale Inventories (prior 1.3%)

10:00 ET: September New Home Sales (Briefing.com consensus 575,000; prior 685,000)

10:30 ET: Weekly crude oil inventories (prior -1.73 mln)

Reviewing today's economic data:

August FHFA Housing Price Index -0.7% (Briefing.com consensus -0.7%); Prior -0.6%

August S&P Case-Shiller Home 13.1% (Briefing.com consensus 14.0%); Prior was revised to 16.0% from 16.1%

October Consumer Confidence 102.5 (Briefing.com consensus 105.5); Prior was revised to 107.8 from 108.0

The key takeaway from the report is that consumers' concerns about inflation picked up again in October on the back of rising gas and food prices.

Dow Jones Industrial Average: -12.4% YTD

S&P Midcap 400: -16.1% YTD

S&P 500: -19.0% YTD

Russell 2000: -20.0% YTD

Nasdaq Composite: -28.4% YTD

source: briefing.com