Daily Newsletter Oct 25 '22

What is included in tomorrow's game plan?

Daily Recap

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Day Trade Stock Ideas - $NVDA | $TSLA - Details will be provided in Discord

Today's Recap

Market Snapshot

Market Heatmap

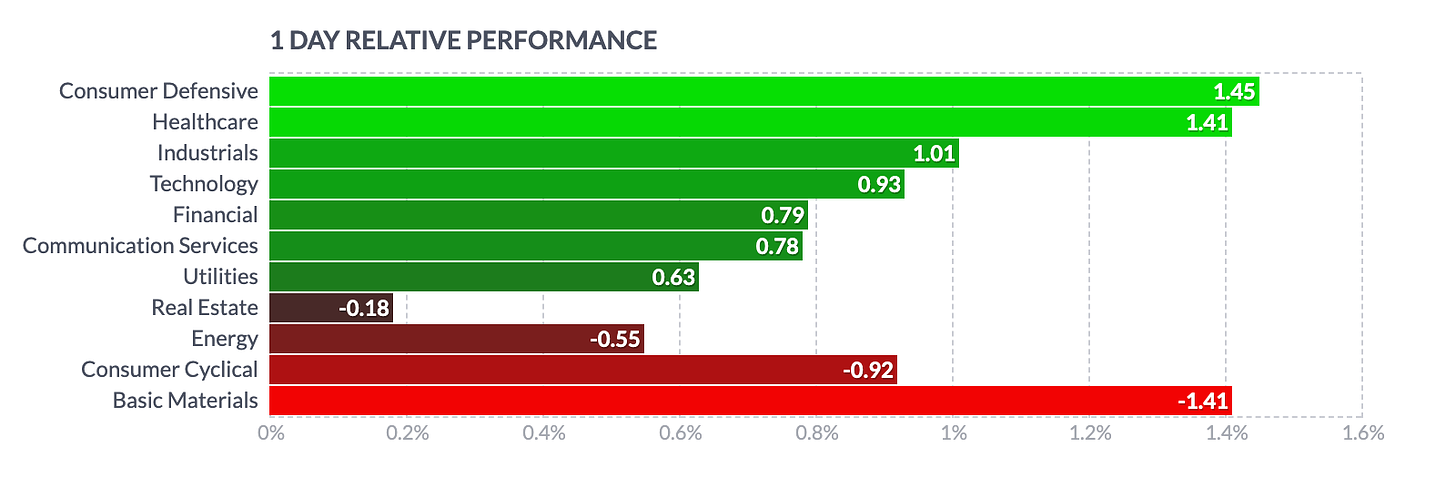

Sector Heatmap

Market Recap

The stock market logged sizable gains today, building on last week's rally. The day started on a mixed note, however, with the major averages oscillating around the flat line as the 10-yr Treasury note yield tested the 4.30% level. Selling quickly subsided in the Treasury market and stocks built upside momentum. The S&P 500, which slipped below 3,500 on October 13, briefly traded above 3,800 before ending just below that level.

The 10-yr note yield ultimately settled up two basis points to 4.23%. The 2-yr note yield fell three basis points to 4.48%.

Notably, the stock market held up pretty well even as the 10-yr note yield reached its session high. Market participants remain drawn to the notion that the Fed could take a less aggressive rate-hike approach in December and beyond. Today's weak preliminary Manufacturing and Services PMI data for October from IHS Markit supported this thinking.

Many stocks came along for the rally, which left nine of the 11 S&P 500 sectors in positive territory. Health care (+1.9%) held the top spot while materials (-0.6%) fell to the bottom.

One notable area of weakness was Chinese stocks and U.S. stocks with high exposure to the Chinese market. This comes after Xi Jinping secured an unprecedented, third five-year term to serve as China's leader. That wasn't surprising, but it did come as a shock to many investors that he managed to surround himself only with loyalists who are apt to help him pursue tighter regulations and the continuation of China's zero-Covid policy.

JD.com (JD 36.66, -5.49, -13.0%) and Pinduoduo (PDD 44.46, -14.51, -24.6%) were losing standouts for Chinese stocks while Las Vegas Sands (LVS 35.05, -4.02, -10.3%) and Starbucks (SBUX 83.76, -4.85, -5.5%) also suffered losses on concerns related to Xi's power grab.

Energy complex futures settled in mixed fashion. WTI crude oil futures fell 0.3% to $84.64.bbl while natural gas futures rose 5.2% to $5.21/mmbtu.

Also, it has been reported that Rishi Sunak will be the next UK prime minister.

General Motors (GM), Valero Energy (VLO), Centene (CNC), UPS (UPS), Sherwin-Williams (SHW), PulteGroup (PHM), Haliburton (HAL), General Electric (GE), Raytheon Technologies (RTX), Biogen (BIIB), Coca-Cola (KO), and 3M (MMM) headline the earnings reports ahead of Tuesday's open.

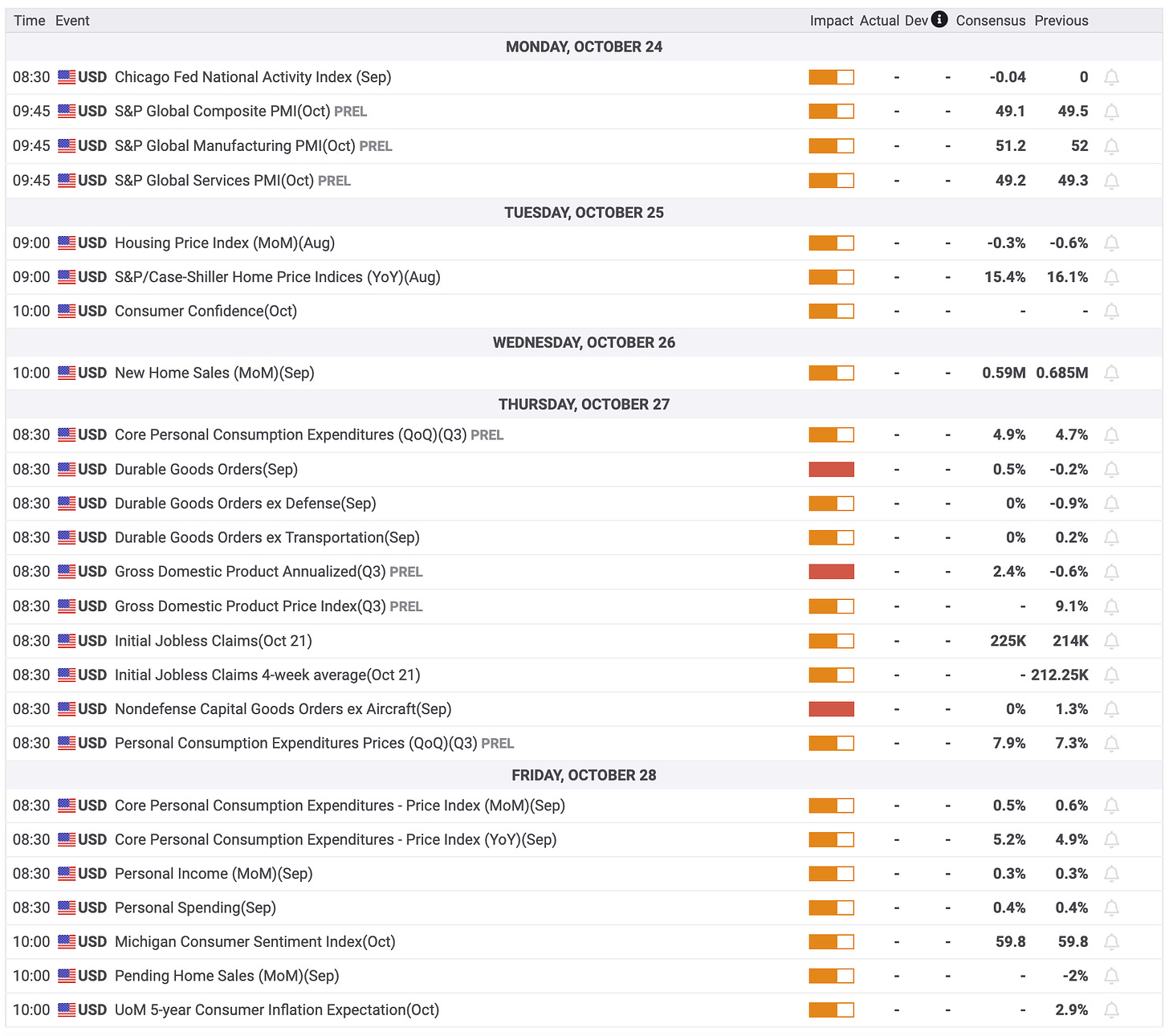

Looking ahead to Tuesday, market participants will receive the following economic data:

9:00 ET: August FHFA Housing Price Index (Briefing.com consensus -0.7%; prior -0.6%), August S&P Case-Shiller Home Price Index (Briefing.com consensus 14.0%; prior 16.1%)

10:00 ET: October Consumer Confidence (Briefing.com consensus 105.5; prior 108.0)

Economic data today was limited to the preliminary October IHS Markit Manufacturing PMI, which came in at 49.9 versus the prior reading of 52.0 and the preliminary October IHS Markit Services PMI came in at 46.6 versus the prior reading of 49.3.

Dow Jones Industrial Average: -13.3% YTD

S&P Midcap 400: -18.1% YTD

S&P 500: -20.3% YTD

Russell 2000: -22.1% YTD

Nasdaq Composite: -30.0% YTD

source: briefing.com