Daily Newsletter Oct 21 '22

What is included in tomorrow's game plan?

Daily Recap

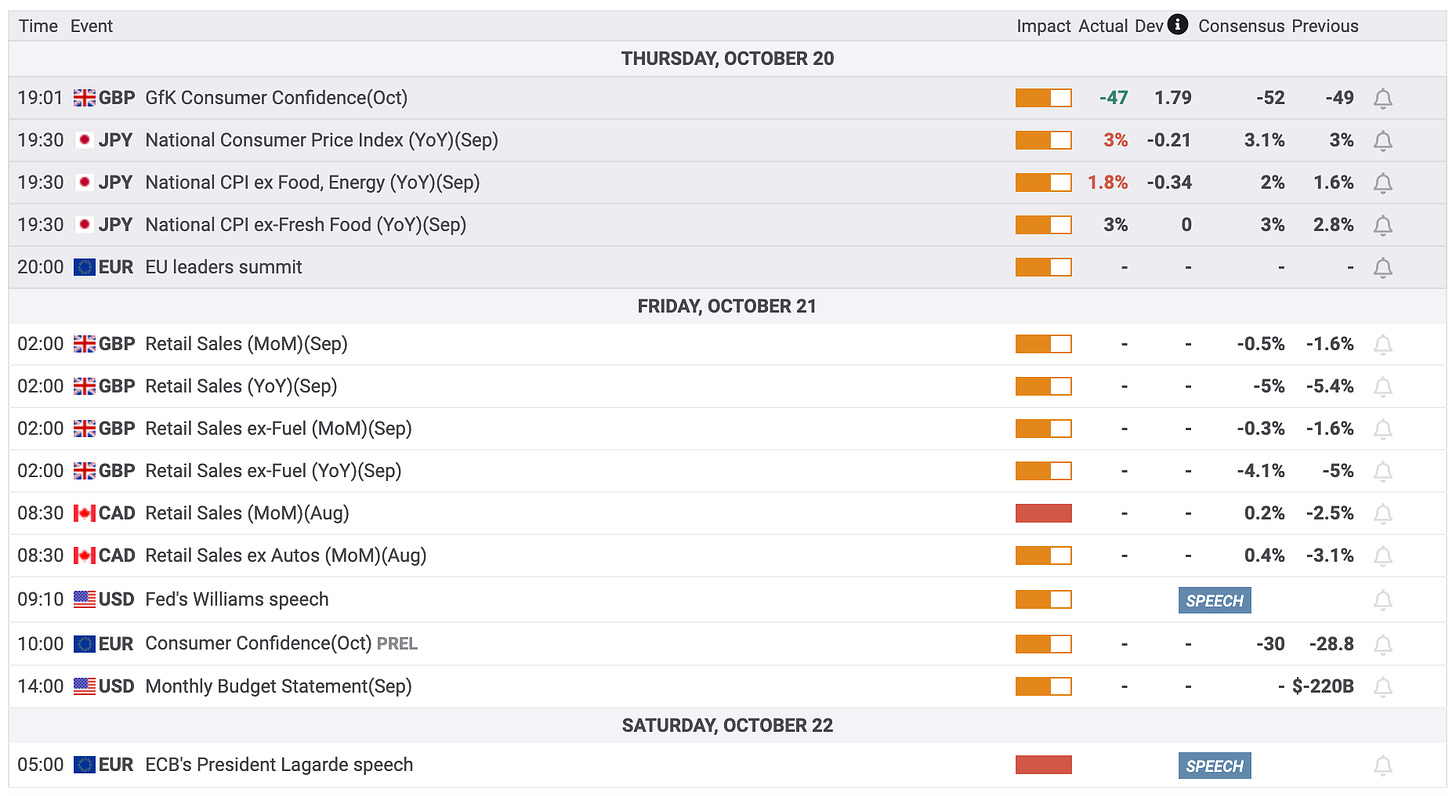

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Day Trade Stock Ideas - $NVDA | $ABNB - Details will be provided in Discord

Today's Recap

Market Snapshot

Market Heatmap

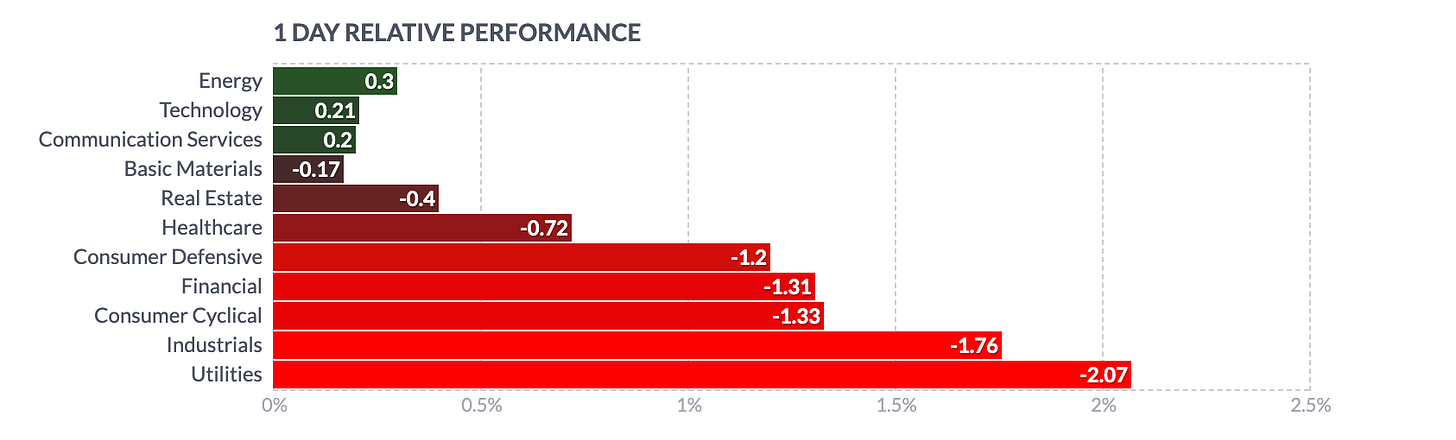

Sector Heatmap

Market Recap

It was another choppy session for the stock market. The major averages had a lackluster start to the day before shifting into rally mode as longer dated yields pulled back from their overnight high (4.18%) and the S&P 500 found support at the 3,700 level. The stock market quickly shifted into retreat mode as the 10-yr note yield started to climb, ultimately settling at a fresh high for the year and its highest point since 2008 (4.23%).

The Treasury market reacted to Philadelphia Fed President Harker (2023 FOMC voter) saying he expects the fed funds rate to be well above 4.00% by end of the year, according to CNBC, "given our frankly disappointing lack of progress on curtailing inflation." That view ignited renewed selling pressure in longer dated Treasury securities.

The 2-yr note, which is more sensitive to changes in the fed funds rate, had a more mild reaction as the fed funds futures market was already positioned for a fed funds rate well above 4.00% by the end of the year. Still, the 2-yr note yield settled at a fresh high for the year (4.60%).

Market breadth reflected broad selling interest. Decliners led advancers by a greater than 2-to-1 margin at the NYSE and a 3-to-2 margin at the Nasdaq.

There were some bright spots in the market, however, that were driven by better-than-expected quarterly results from notable companies.

A big price gain in AT&T (T 16.74, +1.20, +7.7%) boosted the S&P 500 communication services sector (0.4%) to first place on the day. The information technology sector (+0.1%) held up better than the broader market thanks to the post-earnings responses in IBM (IBM 128.30, +5.79, +4.7%) and Lam Research (LRCX 355.87, +25.79, +7.8%). The latter also boosted the PHLX Semiconductor Index, which closed up 0.7%.

Meanwhile, the consumer discretionary sector (-1.7%) closed near the bottom of the pack thanks to heavy selling of Tesla (TSLA 207.28, -14.76, -6.7%) after it missed on Q3 revenue estimates. To be fair, Tesla said it sees excellent demand in the fourth quarter.

Energy complex futures settled in mixed fashion. WTI crude oil futures rose 0.1% to $84.49/bbl while natural gas futures fell 1.5% to $5.37/mmbtu.

In another notable development today, Liz Truss announced her resignation as UK Prime Minister roughly six weeks after starting the position. She will stay on until a leadership election is held in the next week.

Ahead of Friday's open, Verizon (VZ), HCA (HCA), American Express (AXP), and Schlumberger (SLB) headline the earnings reports.

There is no U.S. economic data of note tomorrow.

Reviewing today's economic data:

Weekly Initial Claims 214K (Briefing.com consensus 233K); Prior was revised to 226K from 228K; Weekly Continuing Claims 1.385 mln; Prior was revised to 1.364 mln from 1.368 mln

The key takeaway from the report is that it covers the week in which the survey for the October employment report was conducted. The low level of initial claims will feed expectations for another solid increase in nonfarm payrolls. In turn, it will drive a belief that the Fed is going to stay aggressive with its rate hikes.

October Philadelphia Fed Index -8.7 (Briefing.com consensus -5.0); Prior -9.9

September Existing Home Sales 4.71 mln (Briefing.com consensus 4.70 mln); Prior was revised to 4.78 mln from 4.80 mln

The key takeaway from the report is that higher mortgage rates are taking a bite out of existing home sales, having created affordability pressures for prospective buyers and deferred listing decisions for potential sellers who see an expensive repurchase proposition.

September Leading Economic Index -0.4 (Briefing.com consensus -0.3%); Prior was revised to 0.0% from -0.3%

Dow Jones Industrial Average: -16.5% YTD

S&P Midcap 400: -20.3% YTD

S&P 500: -23.1% YTD

Russell 2000: -24.1% YTD

Nasdaq Composite: -32.2% YTD

source: briefing.com