Daily Newsletter Oct 19 '22

MyntBit's Daily Newsletter is dedicated to providing traders with today's recap and bringing setups to watch for stocks and futures for the next trading day.

What is included in tomorrow's game plan?

Daily Recap

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Day Trade Stock Ideas - $AAL | $DIS - Details will be provided in Discord

Today's Recap

Market Snapshot

Market Heatmap

Sector Heatmap

Market Recap

Today's trade was decidedly positive, building on yesterday's gains. The Dow, Nasdaq, and S&P 500 were up 2.2%, 2.8%, and 2.3%, respectively, at this morning's highs. The major averages took a sharp turn lower after the 10-yr Treasury note yield breached 4.00%. They recovered from session lows as selling eased up in the Treasury market and the S&P 500 found support at the 3,700 level.

The initial upside drive was partially fueled by better-than-expected earnings results from Dow components Goldman Sachs (GS 313.85, +7.14, +2.3%) and Johnson & Johnson (JNJ 166.01, -0.58, -0.4%), yet it was largely driven by a technically-oriented rebound effort that spurred short-covering activity and a fear of missing out on further gains. A BofA fund manager survey showing the largest cash holdings (6.3%) since April 2001 also helped fuel a contrarian trade.

The stock market lost some momentum and hit session lows as the 10-yr note yield reached 4.06% and the 2-yr note yield reached 4.48%. Stocks recovered as selling abated in the Treasury market and the 10-yr note yield ultimately settled at 4.00%. The 2-yr note yield settled at 4.44%.

Equities took a second leg lower this afternoon as Apple (AAPL 143.75, +1.34, +0.9%) plunged following news it has lowered iPhone 14 Plus production, according to The Information. The major indices again recovered as Apple reclaimed some gains.

The market showed impressive resilience today, maintaining a positive position even at session lows.

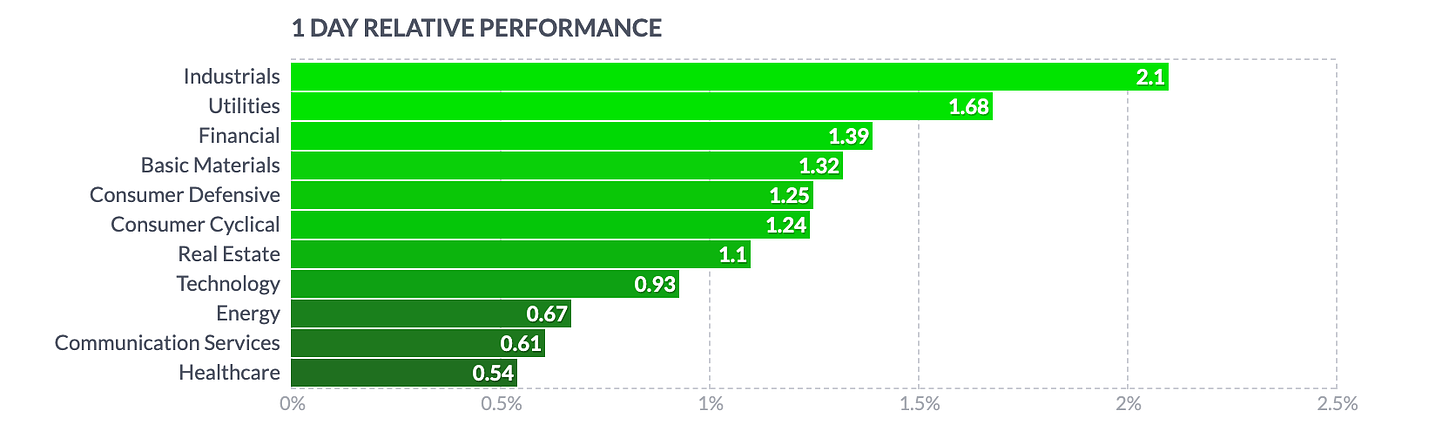

A broad rally effort left all 11 S&P 500 sectors in positive territory. Industrials (+2.4%) held the top spot thanks to earnings-driven gains in Lockheed Martin (LMT 431.84, +34.53, +8.7%). Meanwhile, communication services (+0.5%) brought up the rear.

The advance-decline line favored advancers by a greater than 2-to-1 margin at the NYSE and roughly the same margin at the Nasdaq.

The PHLX Semiconductor Index (+0.4%) notably lagged the broader market today, held back in part by Intel (INTC 25.87, -0.55, -2.1%), which felt the pinch of a reduced valuation for the IPO of its Mobileye unit.

Energy complex futures made sizable downside moves this session. WTI crude oil futures fell 3.8% to $82.22/bbl and natural gas futures fell 4.3% to $5.73/mmbtu.

Ahead of Wednesday's open, Abbott Labs (ABT), Ally Financial (ALLY), ASML (ASML), Citizens Financial Group (CFG), Procter & Gamble (PG), Prologis (PLD), Travelers (TRV), Winnebago (WGO) headline the earnings reports.

Looking ahead to Wednesday, market participants will receive the following economic data:

7:00 a.m. ET: Weekly MBA Mortgage Applications Index (prior -2.0%)

8:30 a.m. ET: September Housing Starts (Briefing.com consensus 1.465 million; prior 1.575 million) and September Building Permits (Briefing.com consensus 1.550 million; prior 1.517 million)

10:30 a.m. ET: Weekly EIA Crude Oil Inventories (prior +9.88 million)

2:00 p.m. ET: October Fed Beige Book

Reviewing today's economic data:

Total industrial production increased 0.4% month-over-month in September (Briefing.com consensus 0.1%) following an upwardly revised 0.1% decline (from -0.2%) in August. The capacity utilization rate increased to 80.3% (Briefing.com consensus 79.9%) from an upwardly revised 80.1% (from 80.0%) in August.

The key takeaway from the report is that the output of consumer goods decreased 0.6% at an annual rate in the third quarter, much slower than the rate of change of 3.1% in the second quarter.

October NAHB Housing Market Index came in at 38 (Briefing.com consensus 44) after a prior reading of 46

Dow Jones Industrial Average: -16.0% YTD

S&P Midcap 400: -17.6% YTD

S&P 500: -22.0% YTD

Russell 2000: -21.8% YTD

Nasdaq Composite: -31.1% YTD

source: briefing.com

Market Trader by MyntBit

Market Trader Edition No. 9