Daily Newsletter Oct 11 '22

MyntBit's Daily Newsletter is dedicated to providing traders with today's recap and bringing setups to watch for stocks and futures for the next trading day.

What is included in tomorrow's game plan?

Daily Recap

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Day Trade Stock Ideas - AVGO

Today's Recap

Market Snapshot

Market Heatmap

Sector Heatmap

Briefing Market Update

It was another weak session for the stock market. The major indices opened to modest gains before sizable losses in mega-cap and semiconductor stocks dragged the market into negative territory. Some concerning remarks from JPMorgan Chase CEO Jamie Dimon coincided with the market falling to session lows while remarks from Fed Vice Chair Brainard coincided with the market climbing off those levels.

According to CNBC, Mr. Dimon said he expects the U.S. to enter a recession in 6-9 months, adding that he thinks the S&P 500 could easily fall another 20%.

Fed Vice Chair Brainard said later today in a speech that, "...moving forward deliberately and in a data-dependent manner will enable us to learn how economic activity, employment, and inflation are adjusting to cumulative tightening in order to inform our assessments of the path of the policy rate." Market participants seemingly liked the idea that this could be a bit of a carrot from a Fed official implying that the pace of rate hikes could eventually moderate. Stocks moved off their lows following these remarks.

Mega cap stocks underperformed, as evidenced by the Vanguard Mega Cap Growth ETF (MGK) closing down 1.1% versus a 0.8% loss in the S&P 500. Apple (AAPL 140.42, +0.33, +0.2%) for its part started the session on a weaker note (down 1.1% at today's low) before exhibiting a turnaround in price action that helped boost the broader market off session lows.

Semiconductor stocks were a weak spot today. They continued to suffer following last week's revenue warning from Advanced Micro Devices (AMD 57.81, -0.63, -1.1%) and news of the U.S. imposing new export controls that are intended to degrade China's ability to manufacture advanced military systems, according to CNBC. The PHLX Semiconductor Index closed down 3.5%.

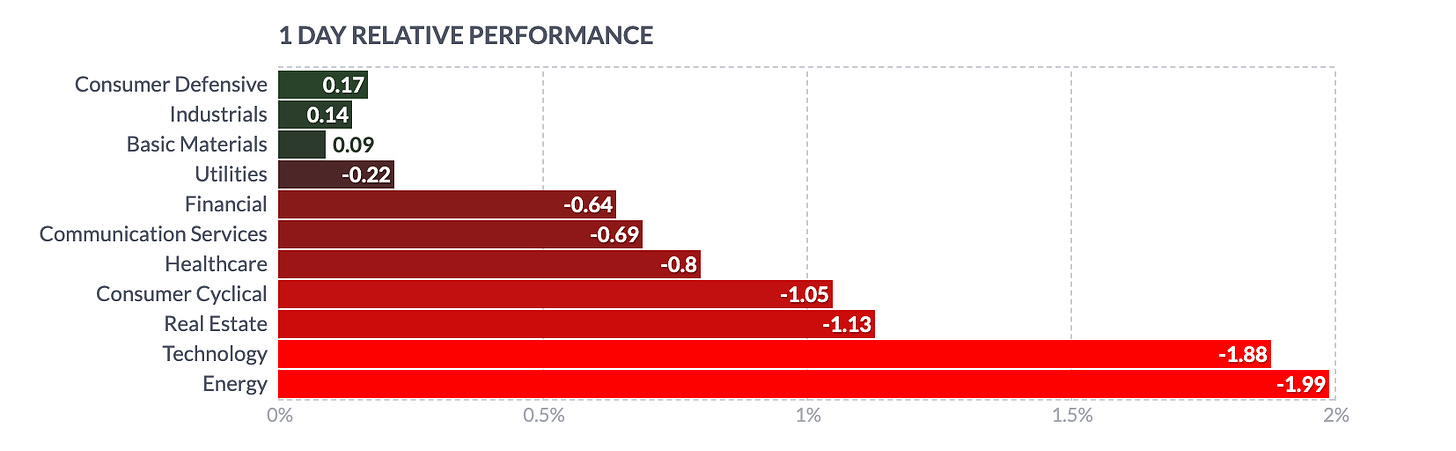

Falling oil prices weighed on the S&P 500 energy sector (-2.1%), which closed in last place on the day after surging 13.7% last week. WTI crude oil futures fell 1.7% to $90.92/bbl. Natural gas futures fell 4.3% to $6.46/mmbtu.

On the flip side, industrials (+0.3%) sat atop the leaderboard with a slim gain.

The Treasury market was closed today in observance of Columbus Day/Indigenous Peoples' Day. Still, with the 10-yr UK gilt yield spiking above 4.50% today, leaving it well above the 4.32% yield it sported when the Bank of England announced an emergency gilt purchase plan on September 28, one can make a case that interest rate jitters were a part of today's trading mix.

There was no U.S. economic data of note today. Participants are in wait-and-see mode ahead of the FOMC Minutes for the September meeting and key PPI and CPI reports later this week.

Looking ahead to Tuesday, economic data is limited to the September NFIB Small Business Optimism reading (prior 91.8) at 6:00 a.m. ET.

Dow Jones Industrial Average: -19.6% YTD

S&P Midcap 400: -20.4% YTD

S&P 500: -24.2% YTD

Russell 2000: -24.7% YTD

Nasdaq Composite: -32.6% YTD

Overseas:

Europe: DAX +0.1%, FTSE -0.5%, CAC -0.5%

Asia: Nikkei market closed, Hang Seng -3.0%, Shanghai -1.7%

Commodities:

Crude Oil -1.55 @ 90.92

Nat Gas -0.29 @ 6.46

Gold -30.80 @ 1676.60

Silver -0.59 @ 19.64

Copper +0.05 @ 3.44

source: briefing.com

Market Trader by MyntBit

Market Trader Edition No. 8