Daily Newsletter Oct 06 '22

MyntBit's Daily Plan is dedicated to providing traders with today's recap and bringing setups to watch for stocks and futures for the next trading day.

What is included in tomorrow's game plan?

Daily Recap

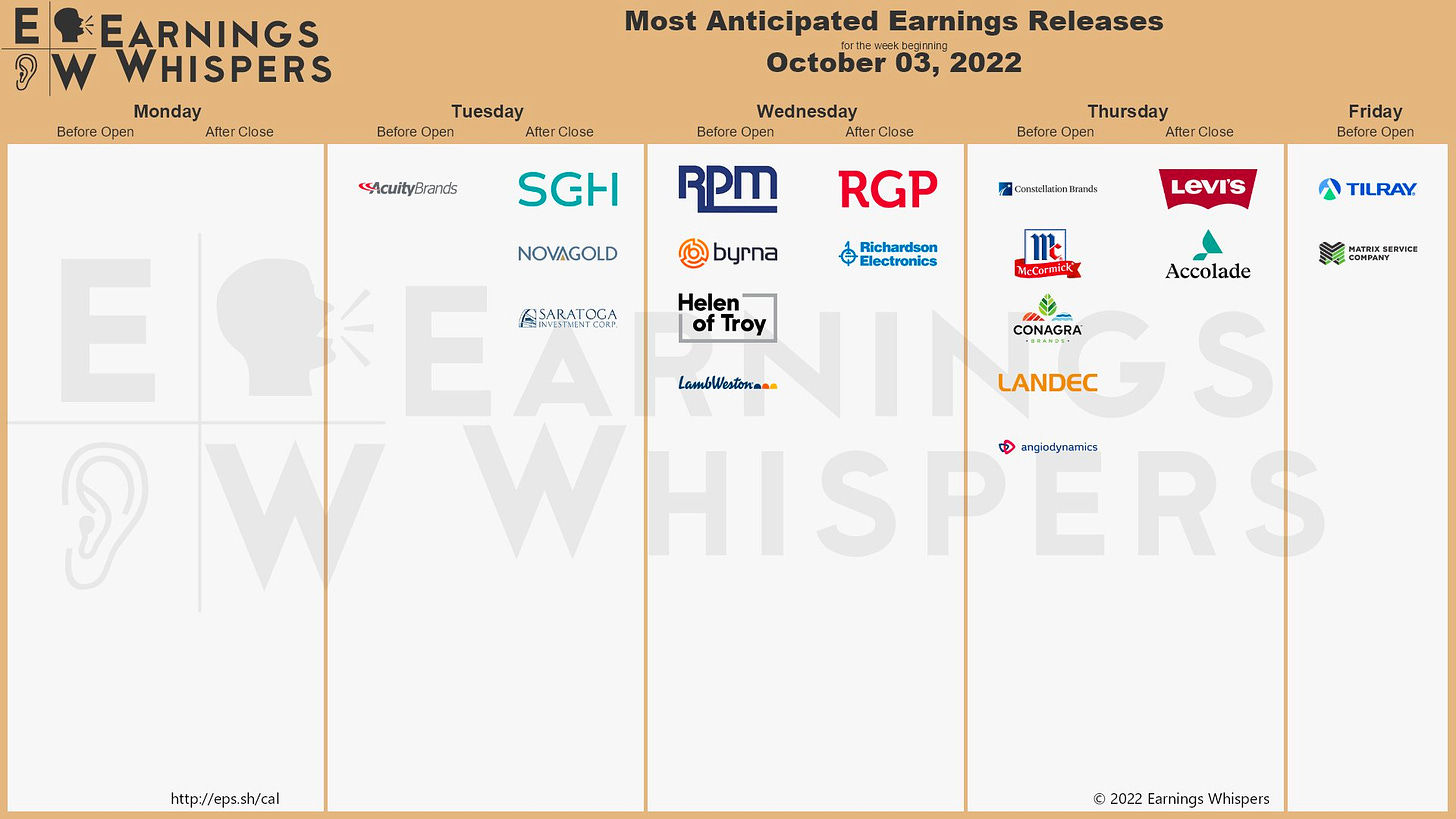

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Day Trade Stock Ideas - SNOW and AMD

Today's Recap

Market Snapshot

Market Heatmap

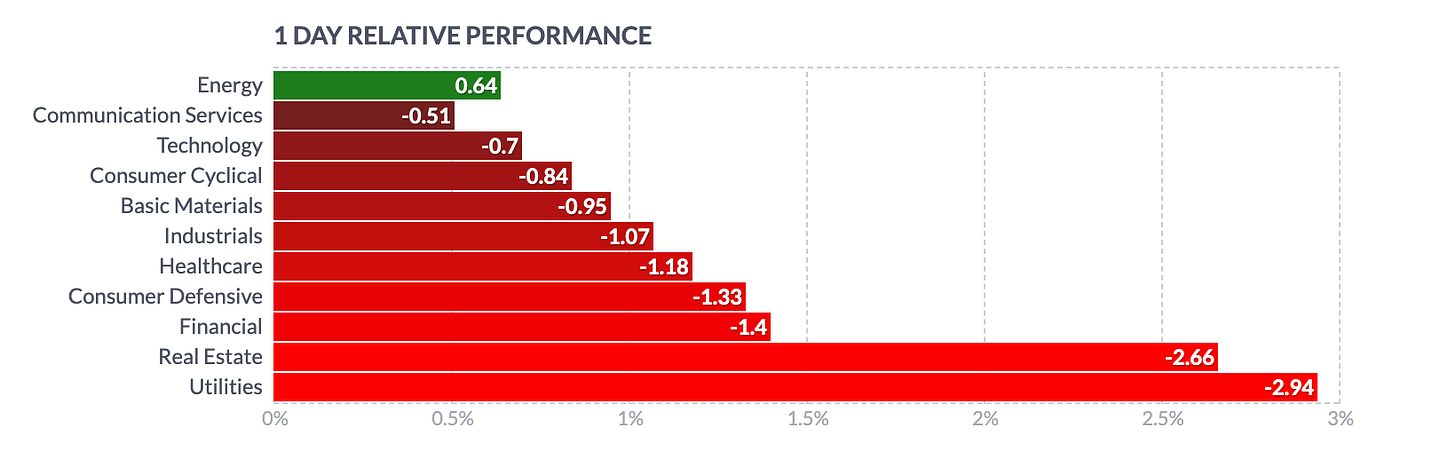

Sector Heatmap

Briefing Market Update

The stock market had a rough showing today while it continued to deal with concerns that it got carried away with expectations of a Fed policy pivot soon and amid some hesitancy in front of the September Employment Report on Friday.

The major averages were influenced by the behavior of the Treasury market today. The 2-yr note yield, which saw 4.14% earlier, traded above Friday's close and settled at 4.23%, up ten basis points for the day. The 10-yr note yield, stood at 3.74% overnight, but also traded above Friday's close and settled at 3.83%, up seven basis points for the day.

As Treasury yields moved higher, the major indices moved lower and struggled to mount a comeback effort today. They ultimately finished near their worst levels of the session.

The US Dollar Index jumped 1.0% to 112.18, acting as an additional headwind for the equity market.

There was also some hawkish Fed speak for participants to digest. Atlanta Fed President Bostic (2024 FOMC voter) said the inflation fight is still in the early days and Minneapolis Fed President Kashkari (2023 FOMC voter) said he is not comfortable pausing until there is evidence of inflation cooling.

In addition, there was heightened geopolitical uncertainty after OPEC+ agreed to cut production by 2 million barrels per day starting in November, a move that drew sharp criticism from the White House. WTI crude oil futures rose 1.0% today to $88.51/bbl.

Today's stock market losses were broad based but somewhat modest in scope relative to recent gains. The major indices fell between 0.6% and 1.1%.

The rising price of oil boosted the S&P 500 energy sector (+1.8%), which was the only sector to close with a gain. Meanwhile, utilities (-3.3%) and real estate (-3.2%) fell to the bottom of the pack.

Market breadth showed decliners outpacing advancers by a greater than 2-to-1 margin at the NYSE and a 3-to-2 margin at the Nasdaq.

Looking ahead to Friday, market participants will receive the following economic data:

8:30 ET: September Nonfarm Payrolls (Briefing.com consensus 250,000; prior 315,000), Nonfarm Private Payrolls (Briefing.com consensus 275,000; prior 308,000), Average Hourly Earnings (Briefing.com consensus 0.3%; prior 0.3%), Unemployment Rate (Briefing.com consensus 3.7%; prior 3.7%), and Average Workweek (Briefing.com consensus 34.5; prior 34.5)

10:00 ET: August Wholesale Inventories (prior 0.6%)

15:00 ET: August Consumer Credit (prior $23.30 bln)

Reviewing today's economic data:

Initial jobless claims for the week ending October 1 increased by 29,000 to 219,000 (Briefing.com consensus 203,000) while continuing jobless claims for the week ending September 24 increased by 15,000 to 1.361 million.

The key takeaway from the report is that initial claims -- a leading indicator -- have a lot more scope for deterioration before the Fed can be convinced that its rate hikes have induced a sufficient softening in the labor market to ease wage-based inflation pressures.

Weekly EIA natural gas inventories showed a build of 129 bcf versus a build of 103 bcf last week

Dow Jones Industrial Average: -17.6% YTD

S&P Midcap 400: -18.1% YTD

S&P 500: -21.4% YTD

Russell 2000: -22.0% YTD

Nasdaq Composite: -29.2% YTD

source: briefing.com

Market Trader by MyntBit

When will the FED pivot? | Market Trader Edition No. 7