Daily Newsletter Nov 04 '22

What is included in tomorrow's newsletter?

Daily Recap

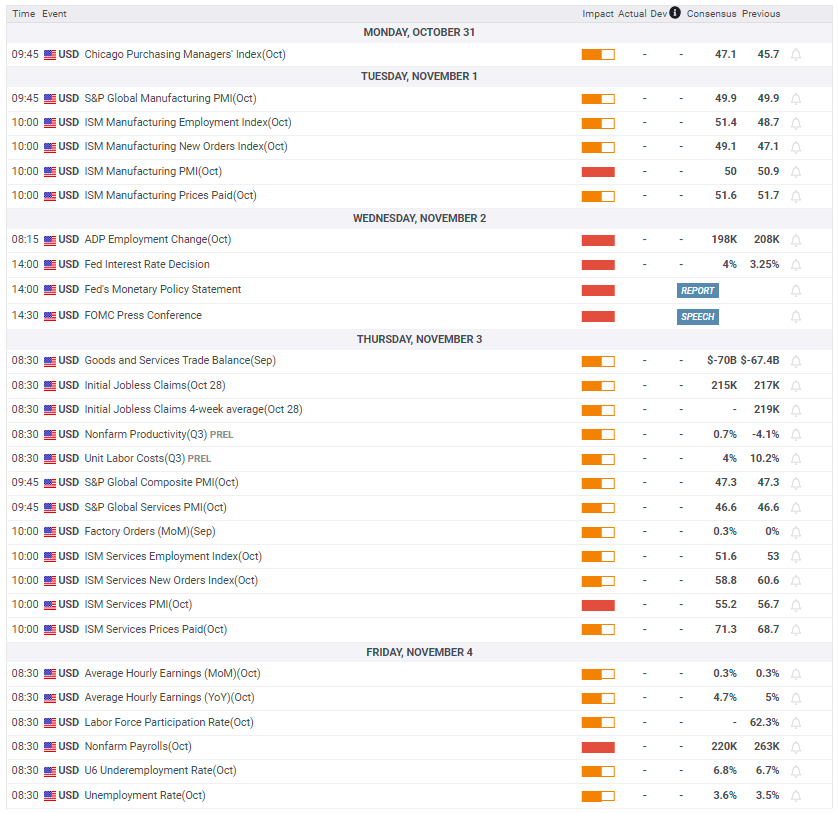

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Today's Recap

Market Snapshot

Market Heatmap

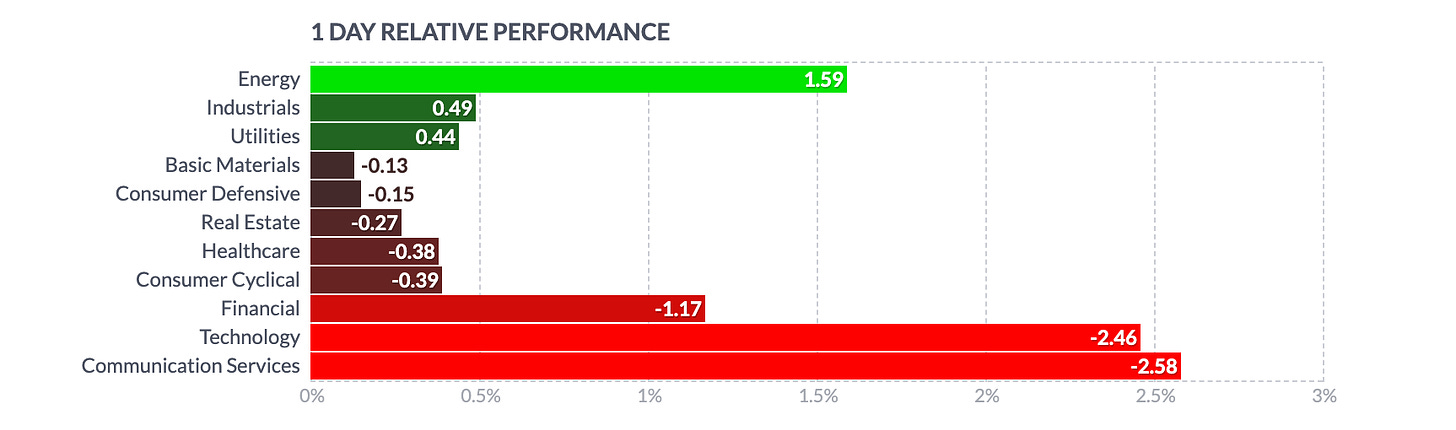

Sector Heatmap

Market Recap

U.S. stocks fell on Thursday, extending losses to a fourth straight session, as slowing growth and rising interest rates dampened investors sentiment.

The fourth straight 75-basis point interest rate hike by the Federal Reserve, and comments from the central bank Chair Jerome Powell that signaled more interest rate hikes in the coming months rendered the mood bearish.

The major averages all ended in the red despite seeing a modest recovery from early lows. The Dow ended with a loss of 146.51 points or 0.46 percent at 32,001.25

The S&P 500 settled at 3,719.89, losing 39.80 points or 1.06 percent, while the Nasdaq ended with a loss of 181.86 points or 1.73 percent at 10,342.94.

In addition to digesting the Fed's aggressive rate hike and Powell's hawkish comments, investors also digested the latest batch of economic data and looked ahead to the crucial non-farm payroll data, due on Friday.

Apple Inc (AAPL) is down more than 3 percent. Visa (V), American Express (AXP), Home Depot (HD), Walt Disney (DIS) and Cisco Systems (CSCO) are down 2 to 2.5 percent.

Amazon Inc (AMZN) ended lower by 3 percent, Alphabet (GOOGL) dropped about 4 percent, and Meta Platforms (META) drifted down 1.8 percent.

Apple Inc (AAPL) declined 4.2 percent. Visa (V), American Express (AXP), Walt Disney (DIS), Home Depot (HD) and Microsoft (MS) lost 2.5 to 3 percent.

Salesforce.com, IBM (IBM), Verizon (VZ) and Cisco Systems (CSCO) also declined sharply.

Boeing (BA) shares climbed more than 6 percent. Cateriller (CAT), Honeywell International (HON) and Chevron (CVX) gained 1.5 to 2.3 percent.

Data from the Commerce Department showed the U.S. trade gap widened to a three-month high of $73.3 billion in September, up from a downwardly revised $65.7 billion in August. Exports were down 1.1 percent at $258 million, while imports increased by 1.5 percent to $331.3 million in the month.

Data released by the Labor Department showed jobless claims fell by 1,000 to 217,000 in the week ended October 27th.

Data from Markit Economics showed the S&P Global US Composite PMI was revised higher to 48.2 in October 2022 from a preliminary estimate of 47.3, compared with September's 49.5

Data released by the Commerce Department showed new orders for US manufactured goods rose by 0.3 percent in the month of September, up from a revised 0.2 percent uptick in the prior month. Orders for durable goods rose by 0.4 percent in September, after seeing a 0.2 percent increase a month earlier.

The Institute for Supply Management's report showed the ISM non-manufacturing business activity in the U.S. fell to a reading of 55.7 points in October from 59.1 in the previous month.

Other Markets

In overseas trading, Asian stocks ended lower on Thursday, as investors reacted to hawkish comments from Fed Chair Jerome Powell on the outlook for inflation and rates, and China's affirmation that a zero-tolerance approach continues to be the overall strategy in tackling COVID-19. Weak services sector data from China weighed as well.

The major European markets too mostly ended weak. The pan European Stoxx 600 shed nearly 1 percent. Germany's DAX shed 0.95 percent, and France's CAC 40 declined 0.54 percent. The U.K.'s FTSE 100 advanced 0.62 percent, while Switzerland's SMI fell 0.89 percent.

source: rttnews.com