Daily Newsletter Nov 03 '22

What is included in tomorrow's newsletter?

Daily Recap

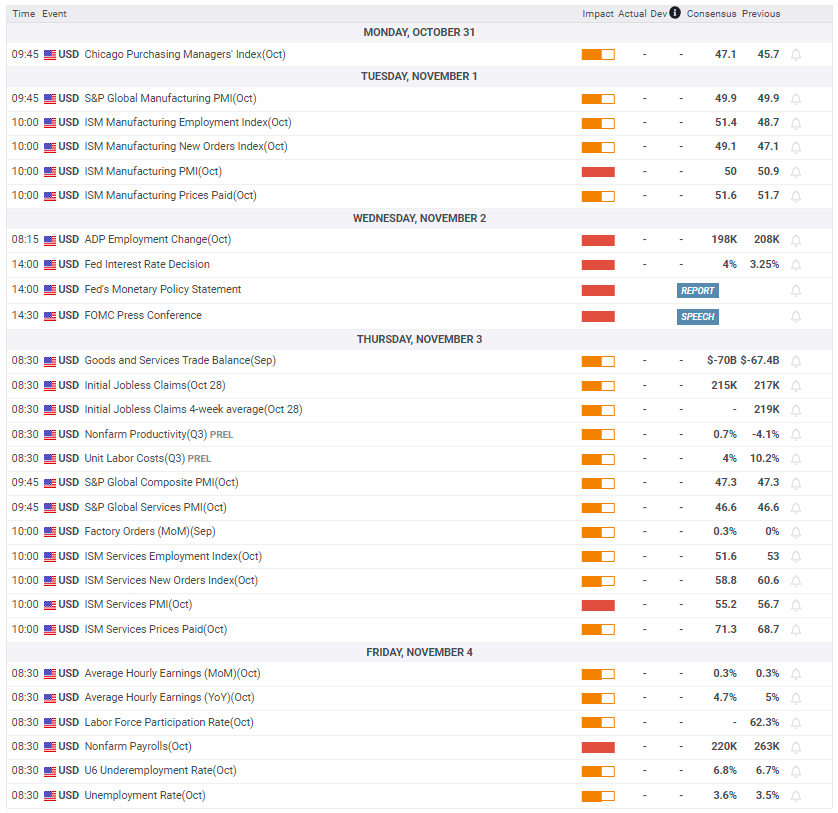

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Today's Recap

Market Snapshot

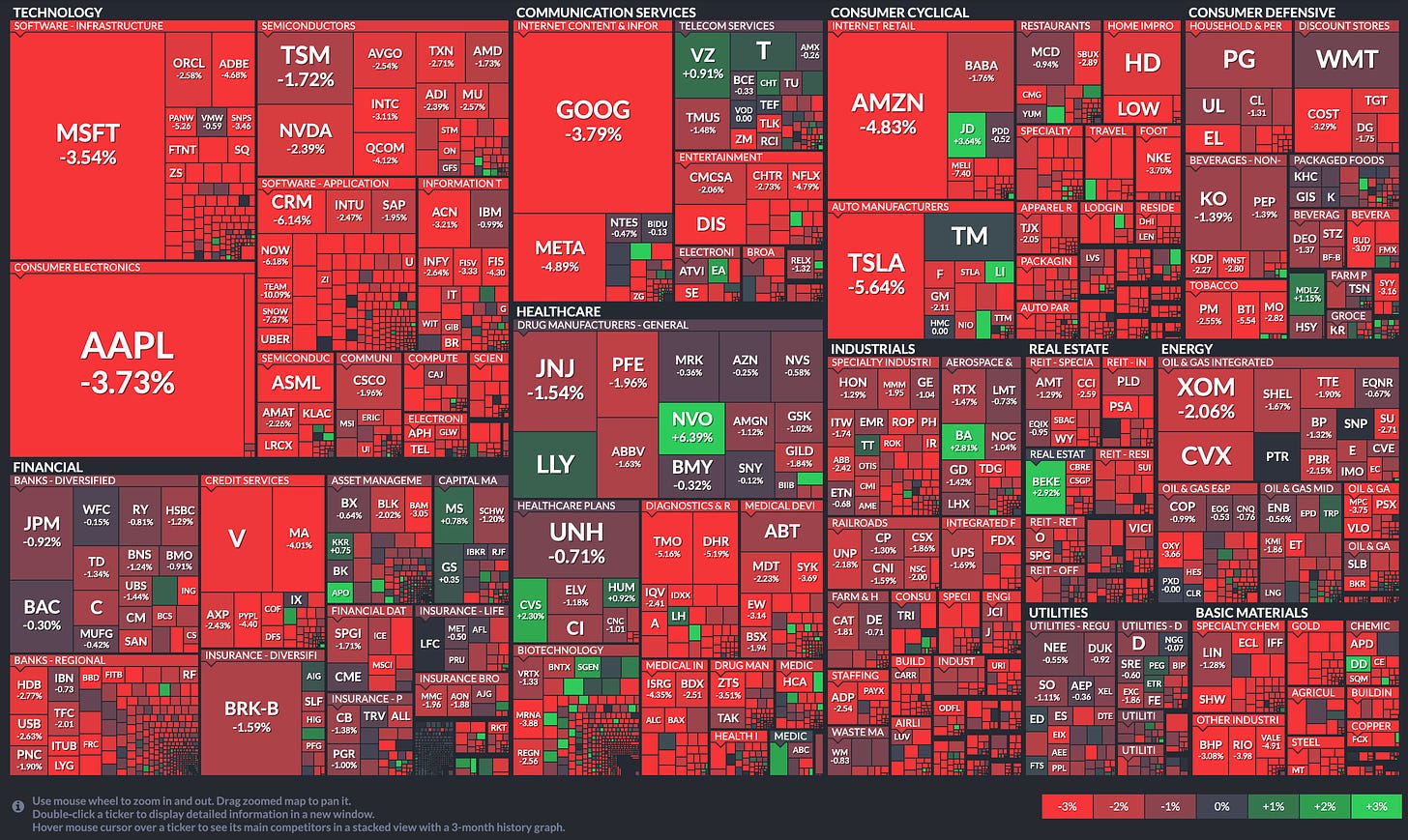

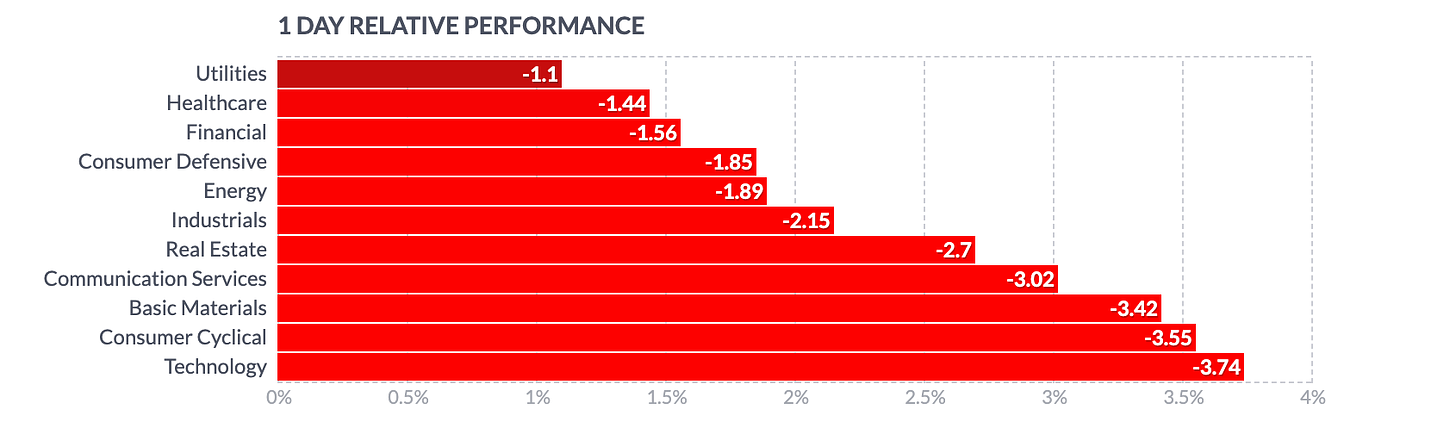

Market Heatmap

Sector Heatmap

Market Recap

Stocks saw substantial volatility late in the trading session on Wednesday, as traders reacted to the Federal Reserve's monetary policy announcement and subsequent comments by Fed Chair Jerome Powell.

The major averages initially reacted positively to the Fed's statement but pulled back sharply going into the close of trading.

The Dow slumped 505.44 points or 1.6 percent to 32,147.76, the Nasdaq plunged 366.05 points or 3.4 percent to 10,524.80 and the S&P 500 tumbled 96.41 points or 2.5 percent to 3,759.69.

The late-day volatility came after the Fed announced its widely expected decision to raise interest rates by another 75 basis points.

Citing efforts to achieve maximum employment and inflation at the rate of 2 percent over the longer run, the Fed announced its decision to raise the target range for the federal funds rate to 3.75 to 4 percent.

The Fed also said that ongoing increases in rates will be "appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."

However, the central bank noted that future rate hikes will "take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments."

The change in the language from the Fed comes following recent reports some officials are becoming increasingly uneasy about the pace of interest rate increases and the impact on the economy.

Nonetheless, comments from Fed Chair Jerome Powell tamped down optimism about the outlook for interest rates.

"It is very premature to be thinking about pausing," Powell said in his post-meeting press conference. "People when they hear 'lags' think about a pause."

"It is very premature, in my view, to think about or be talking about pausing our rate hikes. We have a ways to go," he added.

Gold stocks showed a substantial move to the downside on the day, resulting in a 5.9 percent nosedive by the NYSE Arca Gold Bugs Index.

The sell-off by gold stocks came as the price of the precious moved lower in after-hours trading after ending the regular session little changed.

Significant weakness also emerged among steel stocks, as reflected by the 4.8 percent plunge by the NYSE Arca Steel Index.

Retail stocks also saw considerable weakness on the day, dragging the Dow Jones U.S. Retail Index down by 3.3 percent.

Networking, transportation and semiconductor stocks also showed notable moves to the downside, moving lower along with most of the other major sectors.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance during trading on Wednesday. Japan's Nikkei 225 Index edged down by 0.1 percent, while China's Shanghai Composite Index jumped by 1.2 percent.

Meanwhile, the major European markets all moved to the downside on the day. While the French CAC 40 Index slid by 0.8 percent, the German DAX Index and the U.K.'s FTSE 100 Index both fell by 0.6 percent.

In the bond market, treasuries fluctuated following the Fed announcement before closing roughly flat. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, inched up by less than a basis point to 4.059 percent.

Looking Ahead

Trading on Thursday may continue to be impacted by reaction to the Fed announcement, while traders are also likely to keep an eye on reports on weekly jobless claims, service sector activity, labor productivity and factory orders.

source: rttnews.com