Daily Market Update 08.02 | Stocks on Edge due to Speaker Pelosi

MyntBit's Daily Market Update is dedicated to provide traders with recap and bring setups to watch for the next trading day.

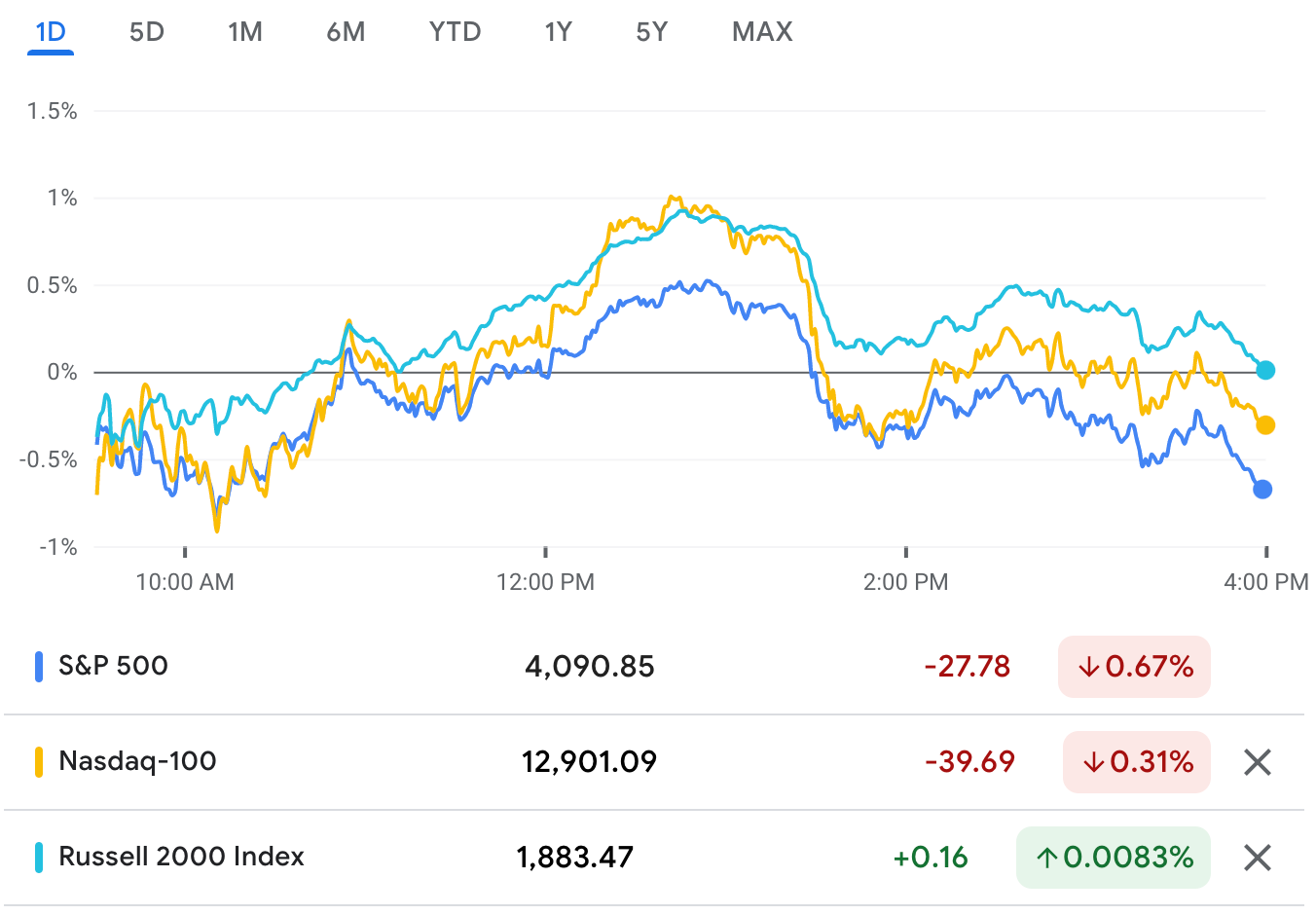

Market Snapshot

RTTNews Market Update

U.S. stocks closed on a weak note on Tuesday as rising tensions between the U.S. and China, and signs of slowing global growth weighed on sentiment.

Hawkish comments from a couple of Federal Reserve officials weighed as well.

The major averages all ended in negative territory although the S&P 500 and the Nasdaq managed to spend some time above the flat line.

In addition to digesting the latest batch of earnings updates and economic data, investors looked ahead to the non-farm payroll data for the month of July, due later in the week.

The Dow ended with a loss of 402.23 points or 1.23 percent at 32,396.17, slightly off the session's low. The S&P 500, which advanced to 4,140.47, settled with a loss of 27.44 points or 0.67 percent at 4,091.19, while the Nasdaq, which rebounded to 12,503.34, rising nearly 250 points from an early lower, ended with a loss of 20.22 points or 0.16 percent at 12,348.76.

Tensions between the U.S. and China have risen due to U.S. House Speaker Nancy Pelosi's visit to Taiwan.

It is feared that Pelosi's trip to Taiwan would raise tensions between the two economic superpowers. Chinese foreign ministry spokesman Zhao Lijian said that Pelosi's visit would lead to "very serious developments and consequences". The White House has warned China against turning her visit into a crisis.

Caterpillar ended nearly 6 percent down, after reporting lower than expected revenues in the latest quarter. The company reported second-quarter earnings of $1.67 billion, or $3.13 per share compared to $1.41 billion, or $2.56 per share a year ago. Revenue for the quarter rose 10.6 percent to $14.25 billion from $12.89 billion last year.

Dupont drifted down 2.7 percent, weighed down by a downward revision in the company's full-year outlook.

Uber Technologies shares soared nearly 19 percent after the company said that gross bookings reached an all-time high of $29.1 billion in the second quarter this year, up 33 percent over the corresponding quarter last year. The company reported a net loss of $2.6 billion for the second quarter. For the third quarter of this financial year, Uber expects gross bookings of $29 billion to $30 billion.

Pinterest zoomed 12.25 percent, buoyed by news about Elliott Investment Management becoming the largest shareholder of the company.

Boeing, Visa, Intel, Nike, Walgreens Boots Alliance, Verizon, JP Morgan, Home Depot, Coca-Cola, Goldman Sachs and Microsoft all ended notably lower.

Data from the Labor Department showed the number of job openings in the US fell by 605,000 from a month earlier to 10.7 million in June of 2022, the lowest in nine months and below market expectations of 11 million.

Other Markets

In overseas trading, Asian stocks fell on Tuesday as worrying manufacturing data from across the globe raised concerns over a potential recession. Chinese, Hong Kong and Taiwanese stocks led losses ahead of a possible trip by U.S. House Speaker Nancy Pelosi to Taipei as part of her Asian tour.

European stocks closed on a weak note on Tuesday as traders weighed near term prospects for the market amid concerns about slowing growth and rising rates, and largely refrained from creating fresh positions.

Market Heatmap

Futures Markets

The markets were shaky today due to Speaker Pelosi landing in Taiwan which increases tension between US and China. On /ES our 4120 level from yesterday’s newsletter held fairly well, as suggested we visited lows of 4080, but we also did manage to go up 4143 before finding resistance. But, as of now, nothing has changed from our weekly perspective.

On the earnings front, AMD 0.00%↑ is down over 4 percent after strong earnings but a weaker forecast for the upcoming quarter. While PYPL 0.00%↑ is up over 11 percent after beating earnings and revealing that Elliott Management has a $2 Billion dollar stake in the company.

Something else to monitor is Speaker Pelosi's trip and stay in Taiwan. Now, we wait for China to respond to Pelosi’s action. Plus the hawkish comments from a couple of FED officials.

/ES - Emini S&P 500

Bullish Scenario

If we OPEN above 4100, the next resistance will be around 4120, this level has held well today. But if that key level is broken, next up is 4150 which has been a strong resistance thus far.

Bearish Scenario

If we OPEN below 4100, the next stop is 4075 where buyers did come in today but if that is broken then the next level down is 4050 where we might see buyers step in then again 4030 is the next area that needs to be tested.

POC: 4108 | Range: 3723 - 4300

/NQ - Emini Nasdaq 100

Bullish Scenario

Similar to today. If we OPEN above 12900, we might see the test of 13000 which has seen the sellers defend for the last couple of sessions but if that is broken then a move up to 13200 is possible.

Bearish Scenario

Similar to today. If we OPEN below 12900, we open the possibility of a test of 12750 might which opens the possibility of breaking down to the 12500 area before buyers step in.

POC: 12949 | Range: 11390 - 13583

For the stock watchlist from the weekend and daily updates, please watch the below videos…

Earnings Calendar (Wed. 08/03)

Economic Calendar (Wed. 08/03)

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of IBKR, Unusual whales, RTTnews, FXstreet, and/or Tradingview. We are just an end-user with no affiliations with them.