Daily Market Update 08.01 | Choppy Day With No Direction

MyntBit's Daily Market Update is dedicated to provide traders with recap and bring setups to watch for the next trading day.

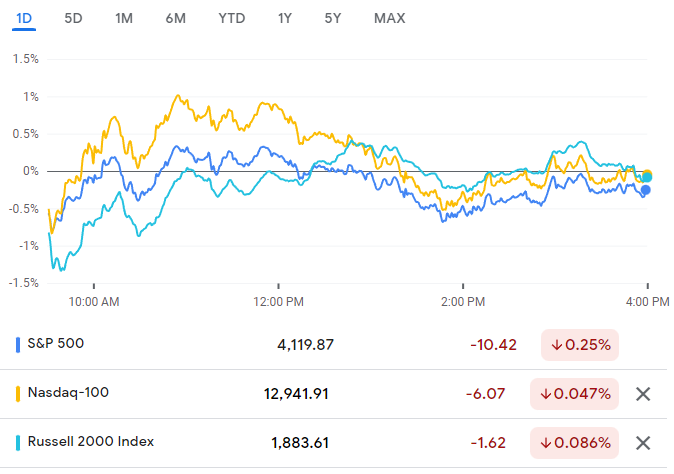

Market Snapshot

RTTNews Market Update

After recording their best month in the Year in July, U.S. stocks turned in a sluggish performance on Monday, the first trading session of August, and ended slightly weak.

The mood in the market was quite cautious due to worries about a possible recession after data showed weakening factory activity in Asia and Europe. Data showing manufacturing activity in the U.S. rose at the weakest rate in nearly two years hurt as well.

Fairly encouraging corporate earnings updates helped limit market's downside.

In addition to digesting the latest batch of economic data, investors looked ahead to upcoming economic reports, including the crucial non-farm payroll data, due later in the week.

The major averages all ended in negative territory despite seeing a brief spell in positive territory. The Dow ended with a loss of 46.73 points or 0.14 percent at 32,798.40, after moving between 32,640.79 and 32,972.03.

The S&P 500 ended lower by 11.66 points or 0.28 percent at 4,118.63, while the Nasdaq settled at 12,368.98, down 21.71 points or 0.18 percent from the previous close.

Shares of energy firms drifted down after oil prices tumbled amid concerns about outlook for energy demand due to global economic slowdown. Bank stocks were weak as well.

Boeing shares climbed more than 6 percent on reports that the Federal Aviation Administration had approved the jet maker to restart deliveries of its 787 Dreamliner.

Procter & Gamble surged 2.25 percent, riding on fairly strong earnings updates. Intel ended stronger by about 1.8 percent. Home Depot and IBM were among the other notable gainers.

Chevron, Caterpillar, Travelers Companies, United Health and Merck drifted lower. Microsoft, JP Morgan, J&J, Nike and Goldman Sachs also closed weak.

In economic news, the S&P Global US Manufacturing PMI was revised slightly lower to 52.2 in July of 2022 from a preliminary of 52.3, pointing to the lowest factory growth since July of 2020.

The Institute for Supply Management said the ISM Manufacturing PMI edged lower to 52.8 in July of 2022 from 53 in June, beating market forecasts for a reading of 52. The reading pointed to a 26th straight month of rising factory activity but the weakest rate since June of 2020.

The ISM Manufacturing Employment sub index in the United States increased to 49.90 points in July from 47.30 points in June, compared with expectations for a reading 47.4.

The ISM Manufacturing New Orders sub index in the United States decreased to 48 points in July from 49.20 points in June of 2022.

Data from the Commerce Department showed construction spending in the US fell by 1.1 percent from the previous month to a seasonally adjusted annual rate of $1.76 trillion in June, compared to the revised 0.1 percent increase in May and market expectations of a 0.1 percent rise.

Other Markets

In overseas trading, Asian stocks ended broadly higher on Monday after key U.S. benchmark indexes finished July 2022 with the largest gains since 2020 on the back of better-than-expected earnings and easing concerns over the need for continued aggressive interest rate hikes by the U.S. Federal Reserve.

Chinese stocks fluctuated before ending slightly higher for the day. China's factory activity contracted unexpectedly in July, the National Bureau of Statistics said Sunday, with the corresponding PMI falling to 49 from 50.2 in June as a result of fresh COVID-19 outbreaks.

The non-manufacturing gauge, which measures activity in the construction and services sectors, dropped to 53.8 from 54.7, and overall property loans rose at the slowest rate on record as of the end of June -underlining the economic challenges facing the country.

Meanwhile, the Caixin/Markit manufacturing PMI eased to 50.4 from 51.7 in the previous month, adding to calls for more policy stimulus to fuel growth.

European stocks, which had their best month of the year in July, ended the first session of the new month on a weak note as weak data from China and the Euro area weighed on sentiment.

The pan European Stoxx 600 drifted down 0.19%. The U.K.'s FTSE 100 ended 0.13% down, France's CAC 40 ended lower by 0.18% and Germany's DAX edged down 0.03%.

Market Heatmap

Futures Markets

With massive events under our belts from last week, we started the week with no sense of direction in the market. /ES and /NQ were both consolidating all day after the massive moves last week. On /ES we did find sellers at 4150 (our key level mentioned in the weekly newsletter) with HOD at 4147 then drop to test 4100.

On the earnings front, PINS 0.00%↑ is up over 20 percent after their Q2 earnings results. Now the move by Eillot Management makes sense…

Something to monitor is Speaker Pelosi's trip to Asia. If she decides to go to Taiwan then that could escalate things with China-US which could volatility and impact the markets. But, as of now, nothing has changed from our weekly perspective.

/ES - Emini S&P 500

Bullish Scenario

If we OPEN above 4120, the next resistance will be around 4150, this level has held well for the last couple of days. If that key level is broken, next up is 4180-4200 where sellers will step in further.

Bearish Scenario

If we OPEN below 4120, the next stop is 4100 where buyers have been buying the dip but if that is broken then the next level down is 4075 then 4030 is the next area that needs to be tested.

POC: 4121 | Range: 3723 - 4300

/NQ - Emini Nasdaq 100

Bullish Scenario

If we OPEN above 12950, we might see the test of 13000 which has seen the sellers defend for the last couple of sessions but if that is broken then a move up to 13200 is possible.

Bearish Scenario

If we OPEN below 12950, we open the possibility of a test of 12750 might which opens the possibility of breaking down to the 12500 area before buyers step in.

POC: 12942 | Range: 11390 - 13583

For the stock watchlist from the weekend and daily updates, please watch the below videos…

Earnings Calendar (Tue. 08/02)

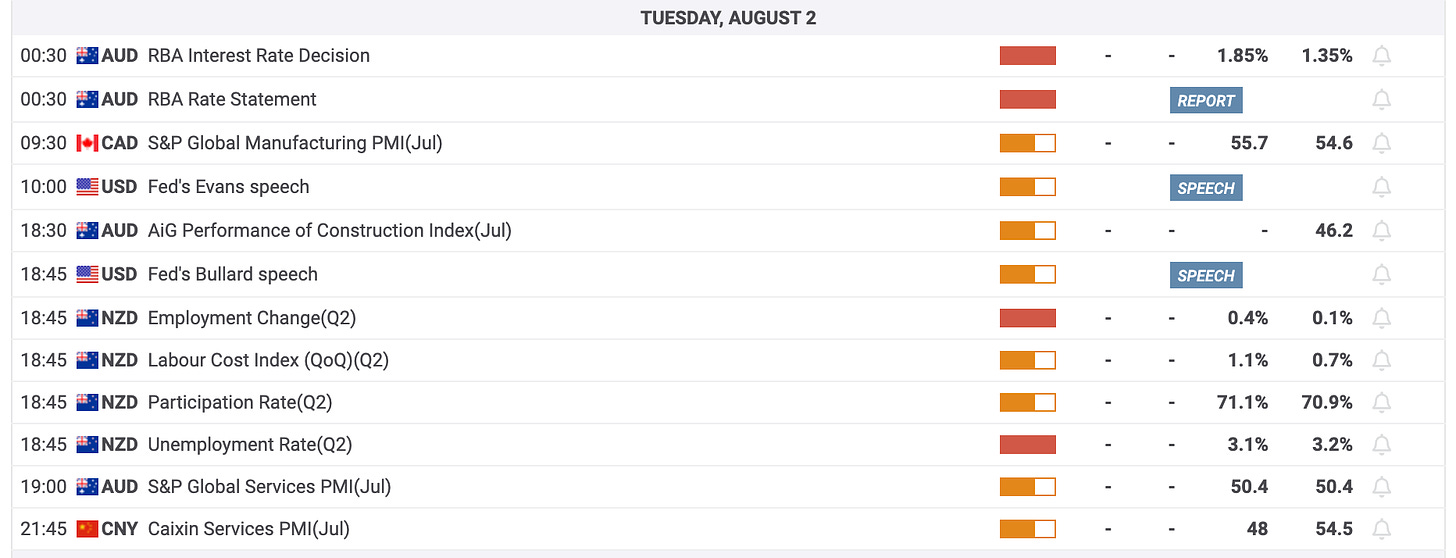

Economic Calendar (Tue. 08/02)

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of IBKR, Unusual whales, RTTnews, FXstreet, and/or Tradingview. We are just an end-user with no affiliations with them.