Daily Market Update 08.09 | Stocks Weak after Micron Warning plus CPI is Tomorrow!

MyntBit's Daily Market Update is dedicated to providing traders with a recap and bringing setups to watch for the next trading day.

Today's Recap

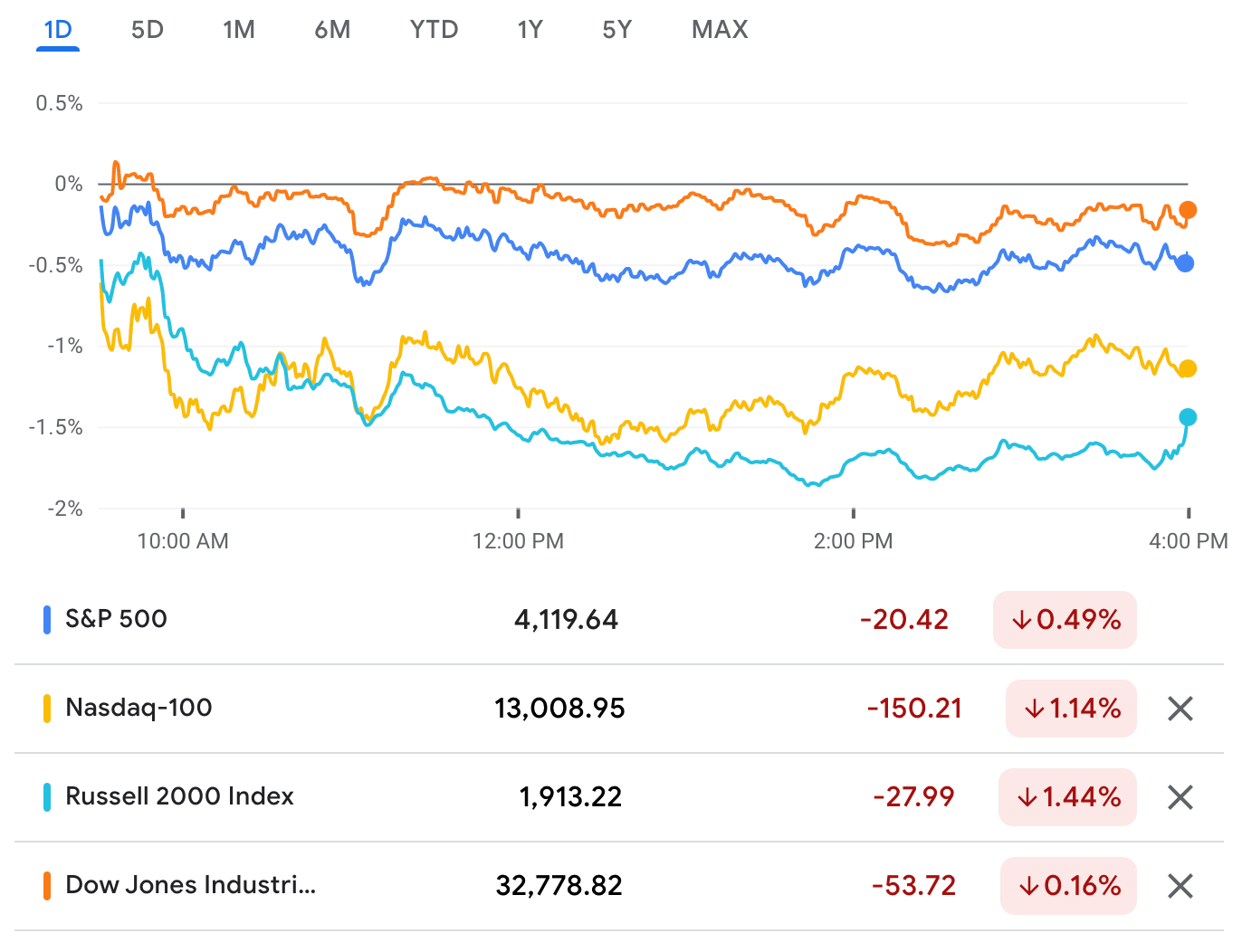

Market Snapshot

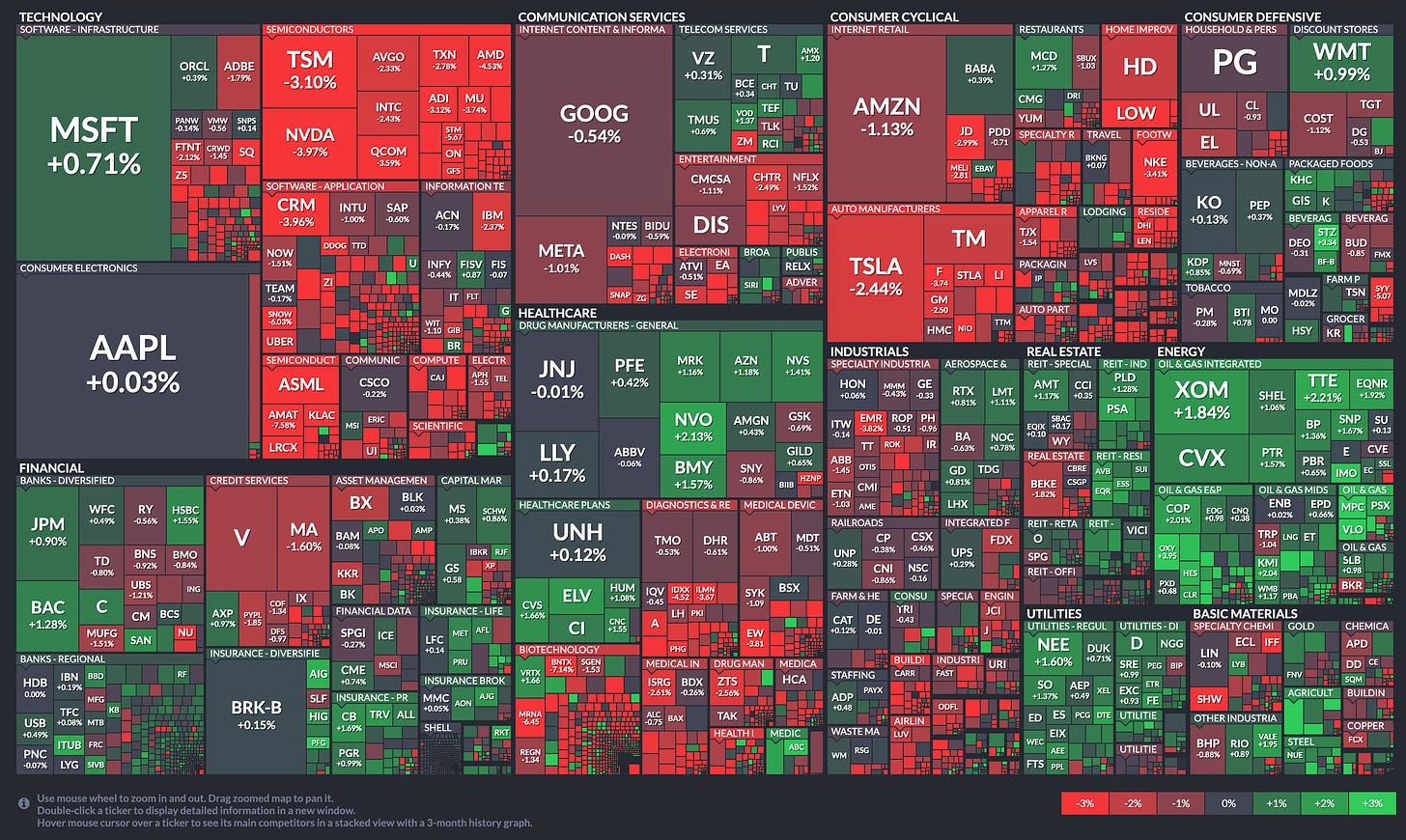

Market Heatmap

RTTNews Market Update

After ending Monday's trading little changed, stocks moved mostly lower over the course of the trading session on Tuesday. The major averages all moved to the downside, with the tech-heavy Nasdaq showing a particularly steep drop.

The Nasdaq tumbled 150.53 points or 1.2 percent to 12,493.93 and the S&P 500 fell 17.59 points or 0.4 percent to 4,122.47. Meanwhile, the Dow posted a more modest loss, edging down 58.13 points or 0.2 percent to 32,774.41.

Technology stocks helped to lead Wall Street lower, as reflected by the sharp decline by the Nasdaq, which continued to give back ground after reaching a three-month intraday high in early trading on Monday.

Within the tech sector, semiconductor stocks turned in some of the worst performances, resulting in a 4.6 percent nosedive by the Philadelphia Semiconductor Index.

The sell-off by semiconductor came following a warning from Micron Technology (MU), with the memory chip maker tumbling by 3.7 percent.

Micron warned revenue for the current quarter may come in at or below the low end of its previous guidance, citing "macroeconomic factors and supply chain constraints."

The news from Micron came after a warning from graphics chip maker Nvidia (NVDA) contributed to the pullback by the markets on Monday.

Micron’s warning of weak demand rattles chip stocks

Computer hardware stocks also saw considerable weakness on the day, with the NYSE Arca Computer Hardware Index slumping by 2.2 percent after ending the previous session at a two-month closing high.

Outside of the tech sector, airline stocks moved sharply lower, dragging the NYSE Arca Airline Index down by 3.6 percent. The index also ended the previous session at its best closing level in two months.

Housing, biotechnology, and retail stocks are moved, while energy stocks bucked the downtrend despite a decrease by the price of crude oil.

The weakness on Wall Street also came as traders looked ahead to the release of a highly anticipated reading on U.S. consumer price inflation on Wednesday.

The report is expected to show consumer prices edged up by 0.2 percent in July after jumping by 1.3 percent in June. The annual rate of growth is expected to slow to 8.7 percent from a four-decade high of 9.1 percent.

Core consumer prices, which exclude food and energy prices, are expected to rise by 0.5 percent in July after climbing by 0.7 percent in June. Annual core consumer price growth is expected to accelerate to 6.1 percent from 5.9 percent.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in another mixed performance during trading on Tuesday. Japan's Nikkei 225 Index slid by 0.9 percent, while China's Shanghai Composite Index rose by 0.3 percent.

The major European markets also ended the day mixed. While the U.K.'s FTSE 100 Index inched up by 0.1 percent, the French CAC 40 Index fell by 0.5 percent and the German DAX Index slumped by 1.1 percent.

In the bond market, treasuries moved back to the downside following the rebound seen in the previous session. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, rose by 3.2 basis points to 2.797 percent.

Looking Ahead

Trading on Wednesday is likely to be driven by a reaction to the report on consumer price inflation, which could impact the outlook for interest rates.

But, as of now, nothing has changed from our weekly perspective.

CPI Coming Up NEXT Week! Could It CRASH The Market? | Weekly Market Update

Tomorrow's Plan

/ES - Emini S&P 500

On ES, we opened around the 4150 level and bleed the rest of the day to the 4110 area after MU warned about their future earnings. Tomorrow is all about CPI, which we get at 8.30 AM EST. So we might gap up or down.

☎️ Keeping it simple, moves to the range top or bottom can happen based on the CPI data. Now, 4100 remains a key area for tomorrow.

Bullish Scenario

If we OPEN above again 4100, to see any upside we need to break above the 4150 level then the next target is that 4175-4185 zone. Once broken, the next level up is 4200.

Bearish Scenario

If we OPEN below 4100, the next level down is 4070-4080 but if that area is broken the next area down is 4030.

POC: 4122 | Range: 3723 - 4300

/NQ - Emini Nasdaq 100

After MU news, the tech sector took a hit and NQ led the decline dipping under 13000 at one point.

☎️ Again, for tomorrow a big move is coming in either direction depending on the CPI data. 13000 is the key level.

Bullish Scenario

If we OPEN above 13000, we might see the test of the 13300-13400 area but if that is broken then a move up to our range top at 13500.

Bearish Scenario

If we OPEN below 13000, we might see a move to the 12750 area and if we break further down to the next level down is around the 12500 area.

POC: 13038 | Range: 11390 - 13583

For the stock watchlist from the weekend and daily updates, please watch the below videos…

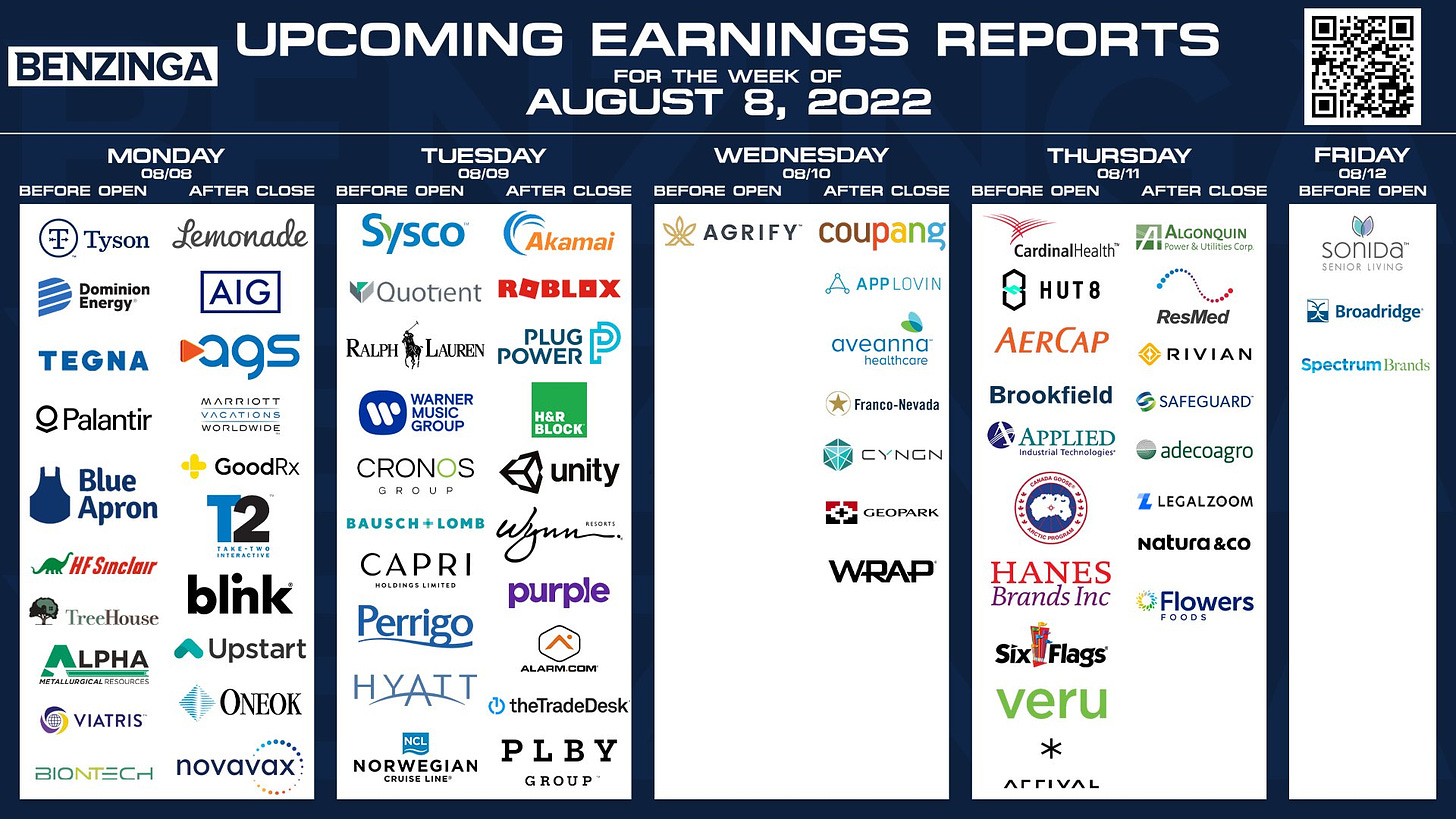

Earnings Calendar

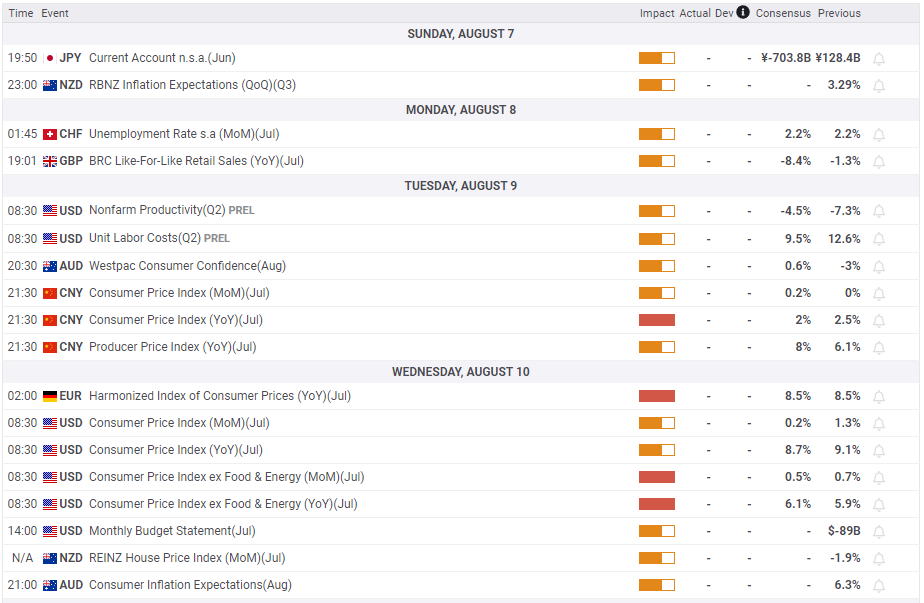

Economic Calendar

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of IBKR, Unusual whales, RTTnews, FXstreet, and/or Tradingview. We are just an end-user with no affiliations with them.