Daily Market Update 08.08 | Market losing Momentum!

MyntBit's Daily Market Update is dedicated to providing traders with a recap and bringing setups to watch for the next trading day.

Today's Recap

Market Snapshot

Market Heatmap

RTTNews Market Update

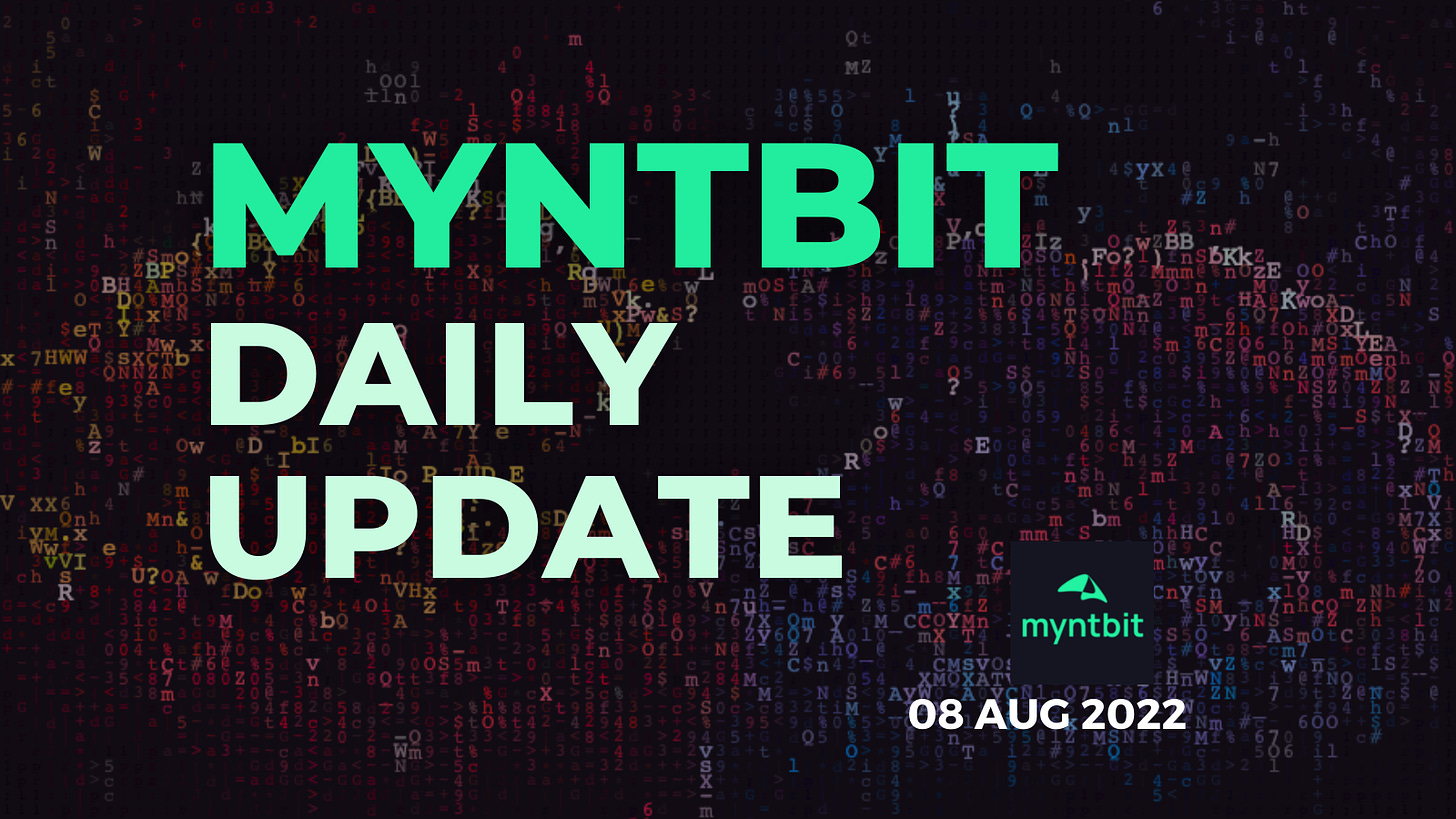

After failing to sustain an early move to the upside, stocks gave back ground over the course of the trading session on Monday. The major averages pulled back off their highs of the session and spent the remainder of the day lingering near the unchanged line.

The major averages eventually ended the session narrowly mixed. While the Dow inched up 29.07 points or 0.1 percent to 32,832.54, the Nasdaq slipped 13.10 points or 0.1 percent to 12,644.46 and the S&P 500 edged down 5.13 points or 0.1 percent to 4,140.06.

The early strength on Wall Street extended a recent upward trend on Wall Street, with the major averages continuing to recover from their June lows. The Nasdaq and S&P 500 reached three-month intraday highs before pulling back.

Easing concerns about a potential recession may have contributed to the continued upward move following last week's much stronger than expected jobs data.

Buying interest waned over the course of the session, however, as the strong jobs data has increased the likelihood of another 75 basis point interest rate hike by the Federal Reserve next month.

Traders may also have been reluctant to make significant bets ahead of the release of closely watched U.S. inflation data in the coming days.

Economists have suggested that the inflation data could have an even greater impact on Fed officials' thinking than the jobs data.

The pullback on Wall Street also came following a warning from graphics chip maker Nvidia (NVDA), which has tumbled by 6.3 percent following the news.

Nvidia reported preliminary second quarter revenue of $6.70 billion versus its outlook for $8.10 billion, with weaker gaming revenue blamed for the shortfall.

Sector News

Despite the pullback by the broader markets, gold stocks held on to strong gains amid an increase by the price of the precious metal.

With gold for December delivery climbing $14 to $1,805.20 an ounce, the NYSE Arca Gold Bugs Index jumped by 2.6 percent to its best closing level in almost a month.

Airline stocks also turned in a strong performance on the day, driving the NYSE Arca Airline Index up by 2.2 percent to a two-month closing high.

Housing and tobacco stocks also saw notable strength, while the warning from Nvidia weighed on semiconductor stocks, dragging the Philadelphia Semiconductor Index down by 1.6 percent.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance during trading on Monday. Japan's Nikkei 225 Index rose by 0.3 percent, while Hong Kong's Hang Seng Index slid by 0.8 percent.

Meanwhile, the major European markets all moved to the upside on the day. While the U.K.'s FTSE 100 Index climbed by 0.6 percent, the French CAC 40 Index and the German DAX Index both advanced by 0.8 percent.

In the bond market, treasuries regained ground after moving sharply lower last Friday. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, slid 7.5 basis points to 2.765 percent.

Looking Ahead

A report on labor productivity and costs in the second quarter may attract some attention on Tuesday, although trading activity may remain somewhat subdued ahead of the release of consumer price inflation data on Wednesday.

But, as of now, nothing has changed from our weekly perspective.

CPI Coming Up NEXT Week! Could It CRASH The Market? | Weekly Market Update

Tomorrow's Plan

/ES - Emini S&P 500

On /ES, we opened above our key level of 4150 from this week's newsletter and went up to the 4185 area where the sellers stepped into the market as mentioned in the weekly newsletter. Then we dropped all the way down to 4130 levels where the buyers stepped into the market to buy the dip. Again, 4150 remains a key area for tomorrow and the foreseeable future.

Bullish Scenario

If we OPEN above again 4150, we need to break above the 4175-4185 area to see any upside potential which has been a key resistance for last week. Once broken, the next level up is 4200 which is also a critical resistance where sellers will step in.

Bearish Scenario

If we OPEN below 4150, the next level down is 4130-4120 which has been an area where buyers have entered to buy dips but if that area is broken the next area down is 4100.

POC: 4142 | Range: 3723 - 4300

/NQ - Emini Nasdaq 100

Similar to ES, NQ has been tightly bound around the 13400-13100 area as mentioned in the weekly newsletter. We did see a move up to the top of that range at 13400 before we sold off to 13100. Again, a big move is coming in either direction, could CPI be the reason?

Bullish Scenario

If we OPEN above 13200, we might see the test of the 13300-13400 area which has been key resistance for a few sessions but if that is broken then a move up to 13500 is possible which is out range top.

Bearish Scenario

If we OPEN below 13200, we might see a move to the 13100-13000 area before buying stepping in to buy the dip, and if we break further down to the next level down is around the 12750 area.

POC: 13188 | Range: 11390 - 13583

For the stock watchlist from the weekend and daily updates, please watch the below videos…

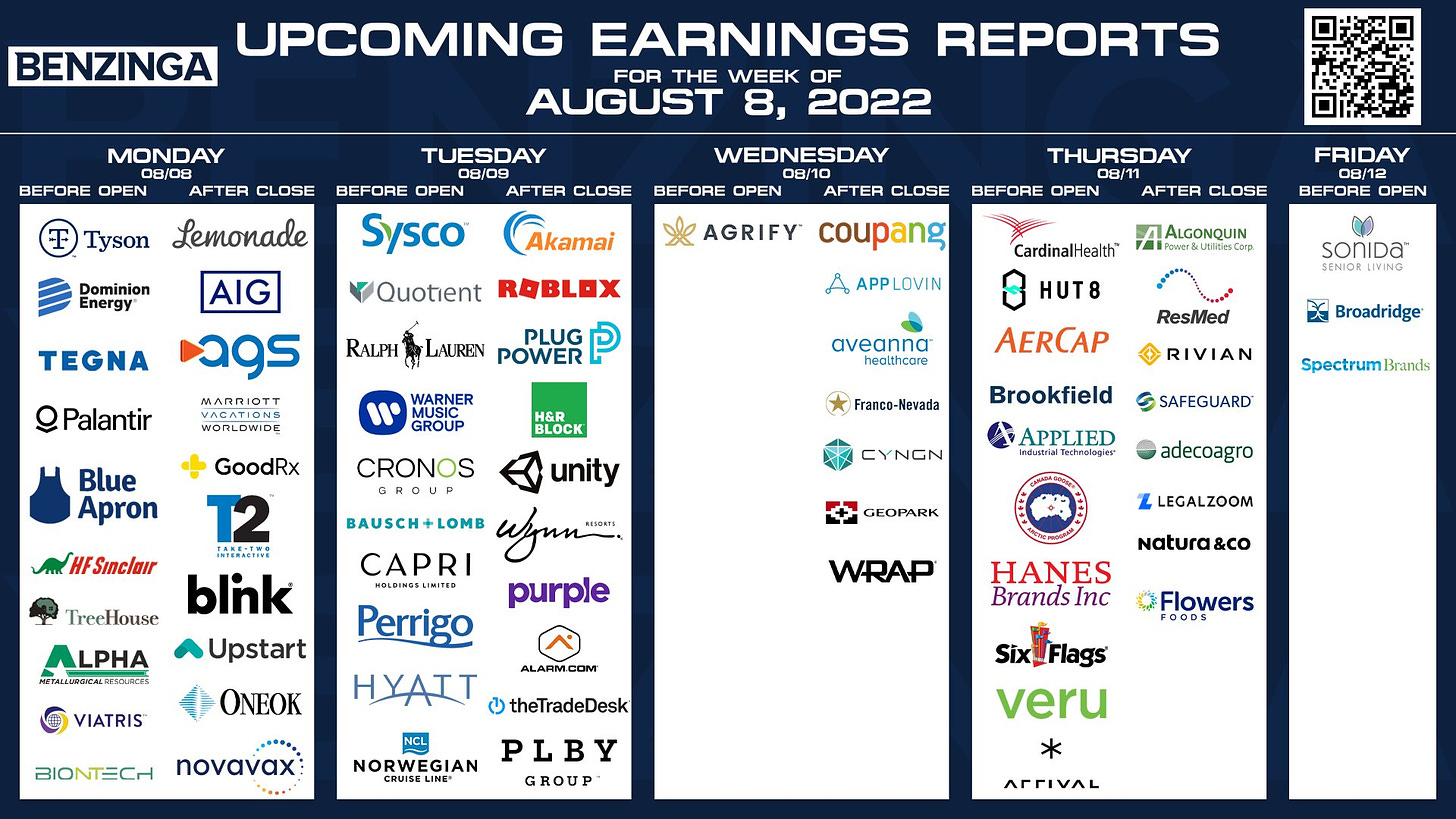

Earnings Calendar

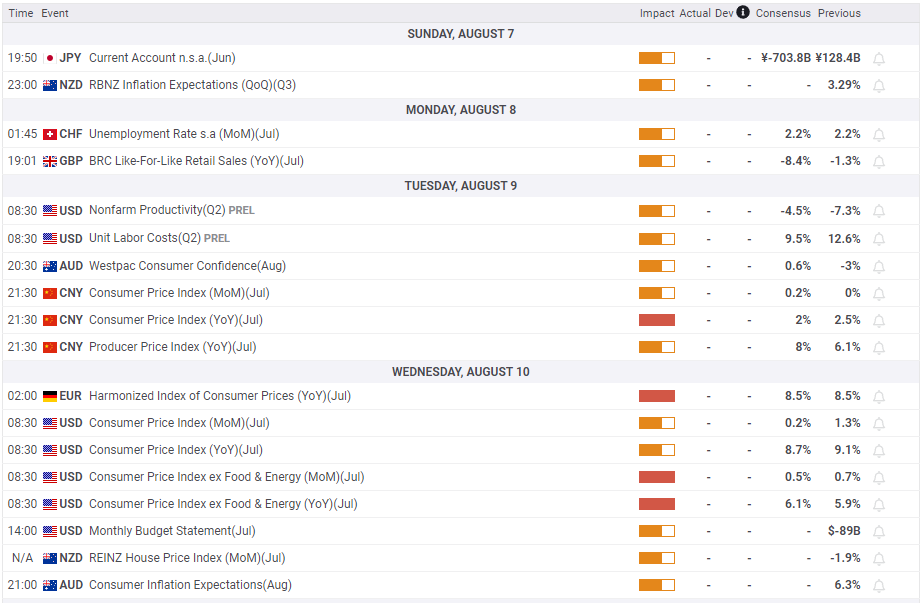

Economic Calendar

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of IBKR, Unusual whales, RTTnews, FXstreet, and/or Tradingview. We are just an end-user with no affiliations with them.