Daily Gameplan Oct.04.22

MyntBit's Daily Plan is dedicated to providing traders with today's recap and bringing setups to watch for stocks and futures for the next trading day.

What is included in tomorrow's game plan?

Daily Recap

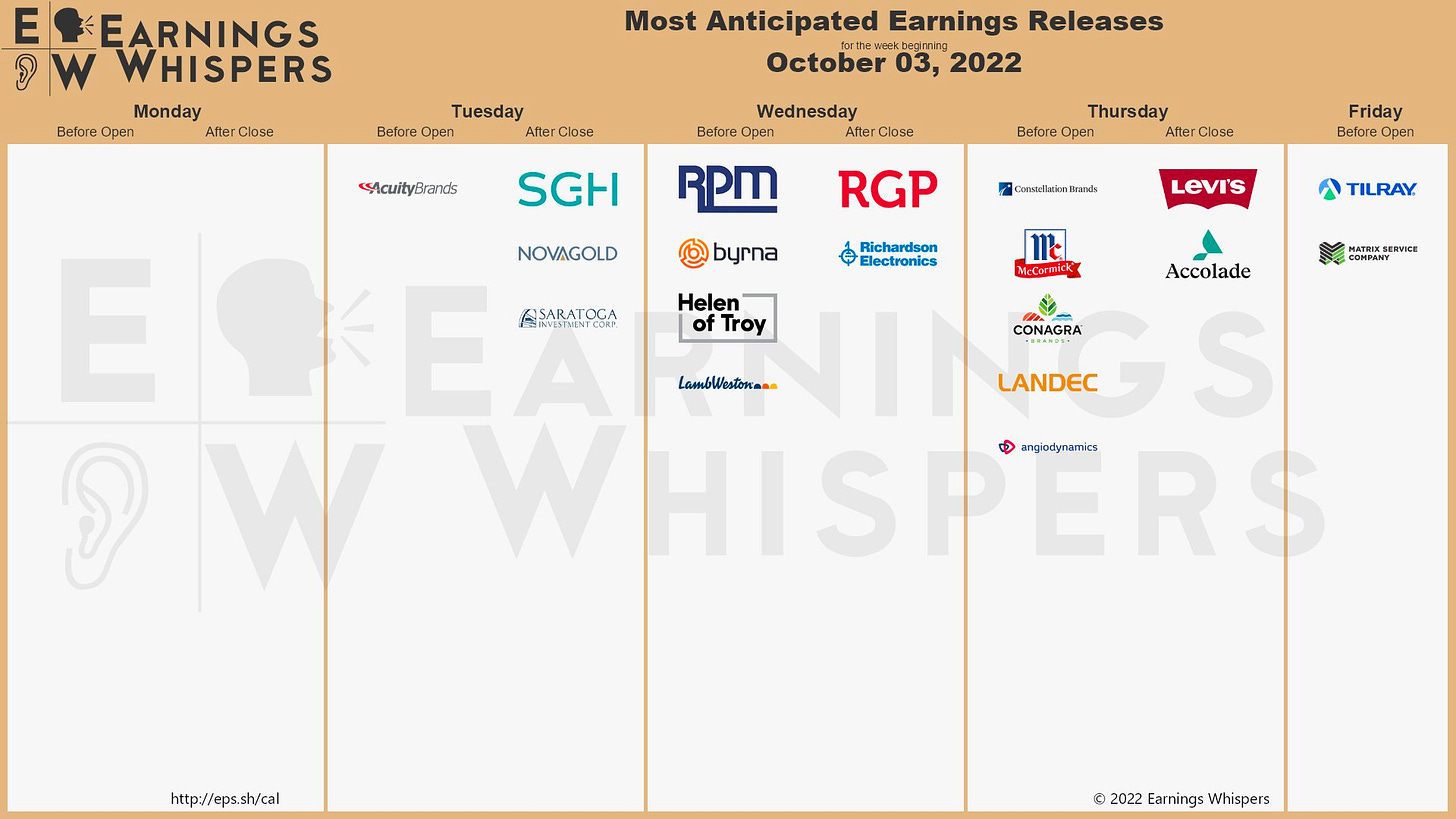

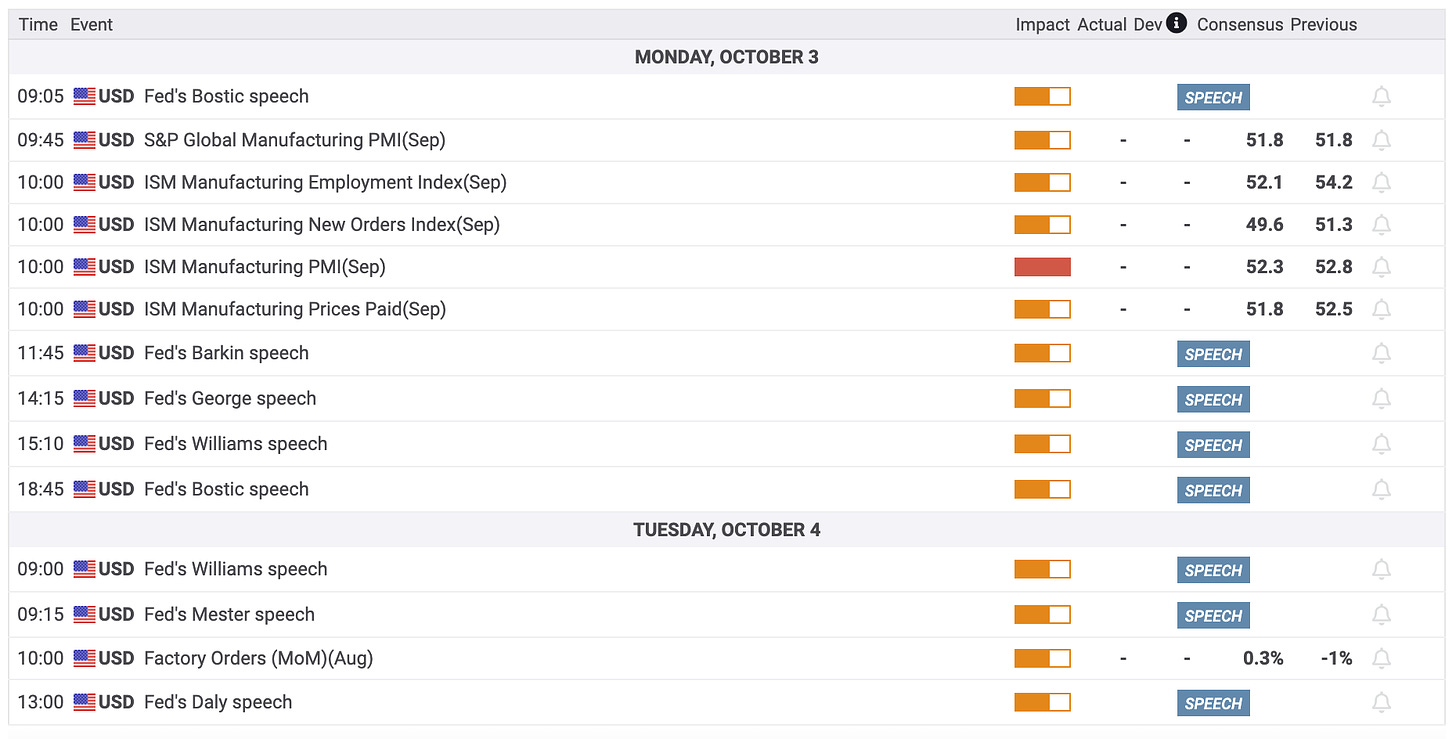

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Day Trade Stock Ideas - AMD

Today's Recap

Market Snapshot

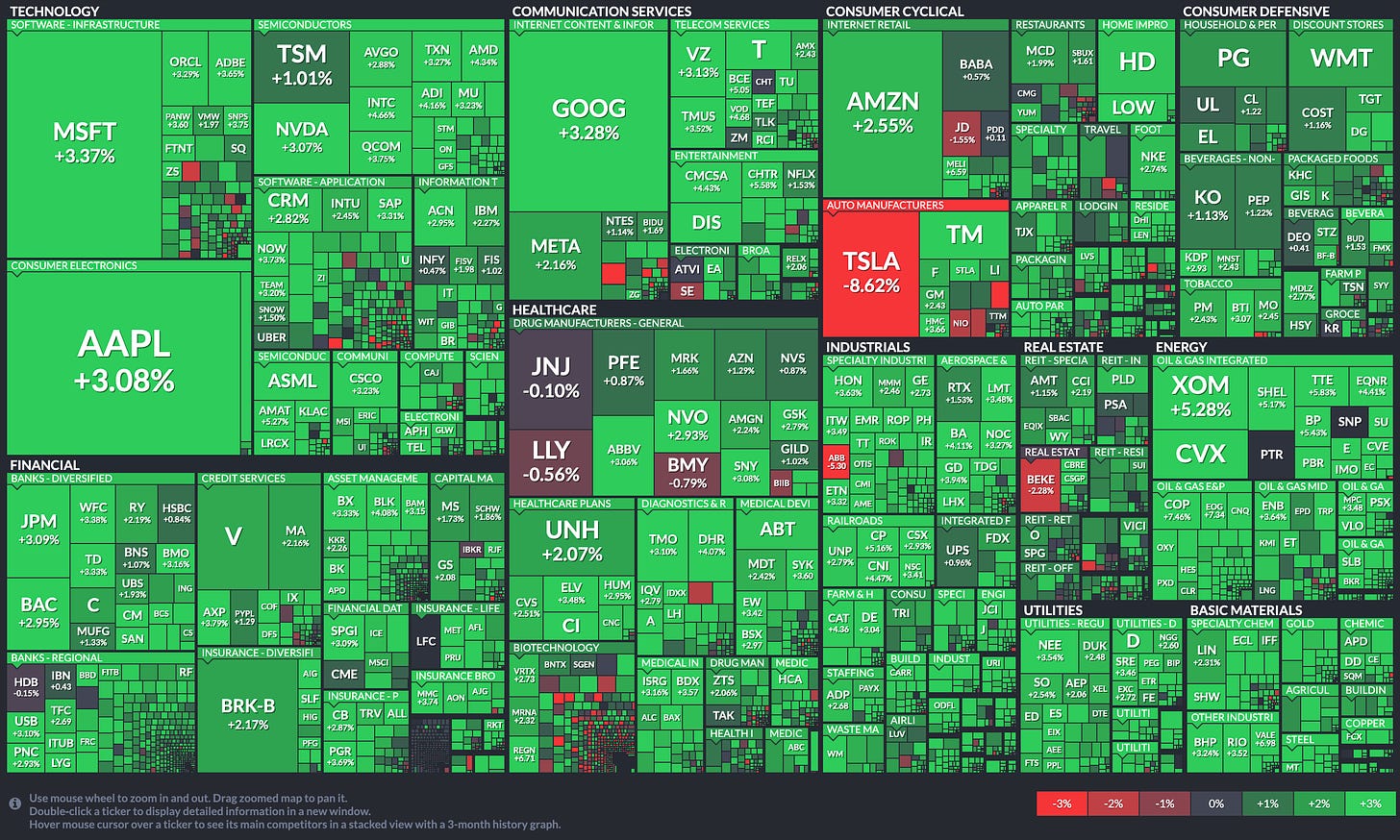

Market Heatmap

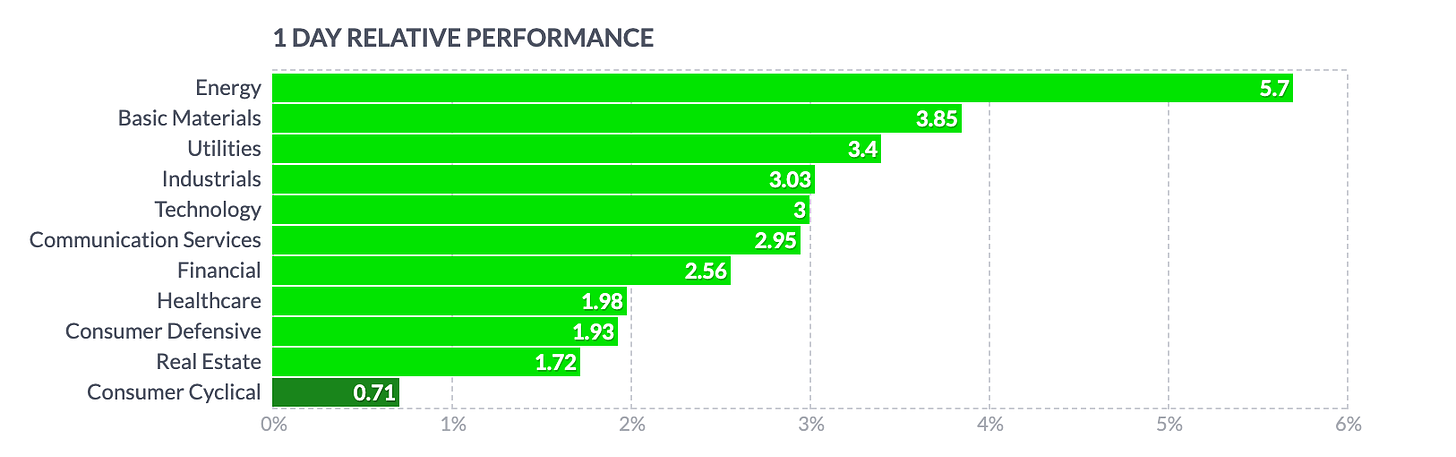

Sector Heatmap

Briefing Market Update

The equity market had a strong start to the week, month, and fourth quarter. The major averages all closed with sizable gains. The S&P 500 was flirting with the 3,700 level at today's highs, after closing below 3,600 on Friday. There were several catalysts in play fueling the upside momentum, but one of the biggest drivers was offsides positioning.

There has been a lot of hedging with put options for further downside, a pickup in short-selling activity, and certainly some extreme bearish sentiment readings. Today's market, though, went against the grain in all respects, which is why there were outsized gains hot on the heels of an outsized loss last month.

Another support factor was the big drop in Treasury yields. That move came in response to the UK abandoning its plan to cut taxes for higher earners and to weaker-than-expected ISM Manufacturing and Construction Spending data out of the U.S. The 2-yr note yield, which reached 4.22% overnight, fell nine basis points on the day to 4.11%. The 10-yr note yield, which reached 3.80% overnight, fell 14 basis points to 3.65%.

There was also growing speculation among market participants that today's weak economic data and concerns about financial instability will compel the Fed to take a softer angle with its rate-hike approach. That narrative, however, was not supported by the fed funds futures market. There was little change, versus Friday, in the expectation that the terminal fed funds rate will be 4.25-4.50%.

Nonetheless, the stock market can sometimes have a mind of its own and will trade off a predilection in an oversold market that will create the most bang for the buck. October, therefore, started with a bang as new money got put to work in a vast array of beaten-up stocks. Apple (AAPL 142.45, +4.25, +3.1%) was a case in point. It fell 8.1% last week on earnings concerns, but jumped 3.1% today on heavy volume and no good news of note.

Market breadth figures reflected the broad based buying today. Advancers led decliners by a 5-to-1 margin at the NYSE and a greater than 2-to-1 margin at the Nasdaq.

All 11 S&P 500 sectors closed in the green led by energy (+4.8%), today's top performer by a wide margin thanks to rising oil prices. WTI crude oil futures rose 5.0% to $83.50/bbl in response to reports that OPEC+ will be considering a production cut of more than one million barrels per day at Wednesday's meeting.

Meanwhile, the consumer discretionary sector (+0.2%) brought up the rear thanks to a huge loss for Tesla (TSLA 242.40, -22.85, -8.6%) after the company reported lower-than-expected deliveries for the third quarter.

Another piece of corporate news in play today was Credit Suisse (CS 4.01, +0.09, +2.3%) being confronted with concerns about its financial condition. Credit Suisse executive, however, rebutted such concerns, saying the bank has a strong capital base and liquidity position. That view seemed to placate investors for the time being, as the stock rebounded from a 5.6% loss to close the session up 2.3%.

Looking ahead to Tuesday, market participants will receive the August Factory Orders report (Briefing.com consensus +0.4%; prior -1.0%) and the August JOLTS Job Openings report (prior 11.239 million) at 10:00 a.m. ET.

Reviewing today's economic data:

Final IHS Markit Manufacturing PMI September reading came in at 52.0 after the prior reading of 51.8

ISM Manufacturing Index for September was 50.9% (Briefing.com consensus 52.0%) after the prior reading of 52.8%

The key takeaway from the report is that it connotes a moderation in manufacturing activity that coincides with rapidly rising interest rates, and it will contribute to slowdown concerns that could, in turn, offer the market reason to think the Fed won't be as aggressive with its rate hikes as it is suggesting it could be.

Construction spending fell 0.7% in August (Briefing.com consensus -0.2%) after a revised 0.6% decline in July (from 0.4%)

The key takeaway from the report is the continued downturn in residential spending. That is an offshoot of rising interest rates that have weakened homebuilder sentiment, as higher mortgage rates have also worsened affordability for prospective buyers.

Dow Jones Industrial Average: -18.8% YTD

S&P Midcap 400: -20.2% YTD

S&P 500: -22.8% YTD

Russell 2000: -23.9% YTD

Nasdaq Composite: -30.9% YTD

source: briefing.com

Market Trader by MyntBit

When will the FED pivot? | Market Trader Edition No. 7