Daily Bit | 22 July 2022

MyntBit Daily Report is dedicated to provide traders with recap and bring setups to watch for the next trading day.

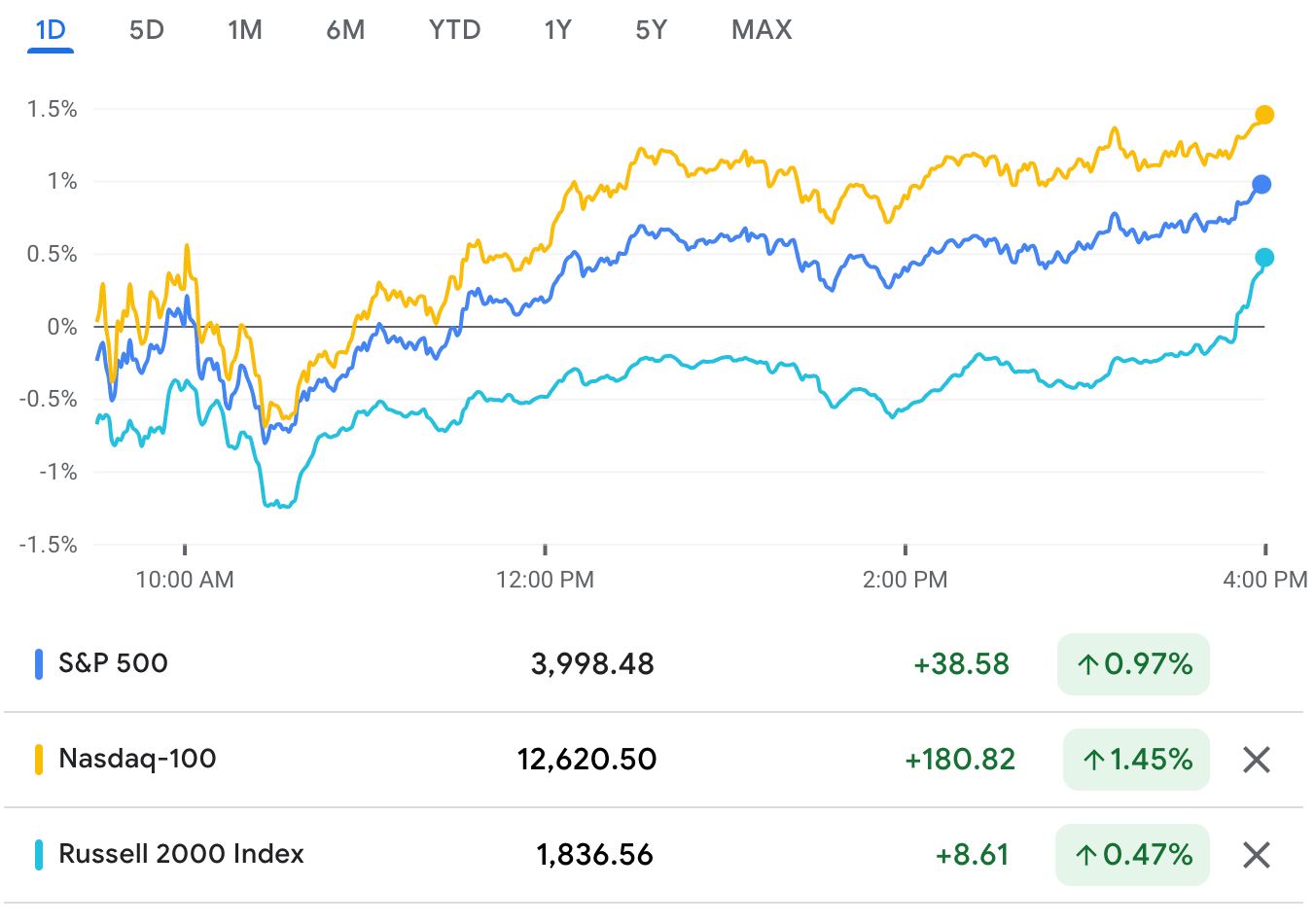

Market Snapshot

RTTNews Market Update

Stocks saw significant volatility over the course of the trading session on Thursday but managed to end the day notably higher. The major averages extended a recent upward trend, reaching their best closing levels in over a month.

The major averages saw further upside going into the close, reaching new highs for the session. The Dow climbed 162.06 points or 0.5 percent to 32,036.90, the Nasdaq surged 161.96 points or 1.4 percent to 12,059.61 and the S&P 500 jumped 39.05 points or 1 percent to 3,998.95.

The volatility on Wall Street came as traders expressed some uncertainty about the outlook for the markets following the recent upward move.

The Nasdaq benefitted from a significant advance by shares of Tesla (TSLA), with the electric vehicle marker spiking by 9.8 percent after reporting second quarter earnings that beat expectations.

The latest U.S. economic data may have also helped ease concerns about the outlook for interest rates, with a report from the Labor Department showing initial jobless claims unexpectedly rose to an eight-month high in the week ended July 16th.

The report showed initial jobless claims crept up to 251,000, an increase of 7,000 from the previous week's unrevised level of 244,000. The uptick surprised economists, who had expected jobless claims to edge down to 240,000.

Jobless claims inched higher for the third straight week, reaching their highest level since hitting 265,000 in the week ended November 13, 2021.

A separate report released by the Federal Reserve Bank of Philadelphia showed regional manufacturing activity unexpectedly contracted at a faster rate in the month of July.

The Philly Fed said its current general activity index slumped to a negative 12.3 in July from a negative 3.3 in June, with a negative reading indicating a contraction in regional manufacturing activity. Economists had expected the index to rebound to a positive 0.4.

The Conference Board also released a report showing its index of leading economic indicators decreased for the fourth straight month in June.

The Conference Board said its leading economic index slumped by 0.8 percent in June after falling by a revised 0.6 percent in May.

Economists had expected the leading economic index to decline by 0.5 percent compared to the 0.4 percent drop originally reported for the previous month.

Meanwhile, the European Central Bank announced its decision to raise interest rates by a larger-than-expected 50 basis points, marking the first rate hike in over a decade.

"The Governing Council judged that it is appropriate to take a larger first step on its policy rate normalisation path than signalled at its previous meeting," the ECB said.

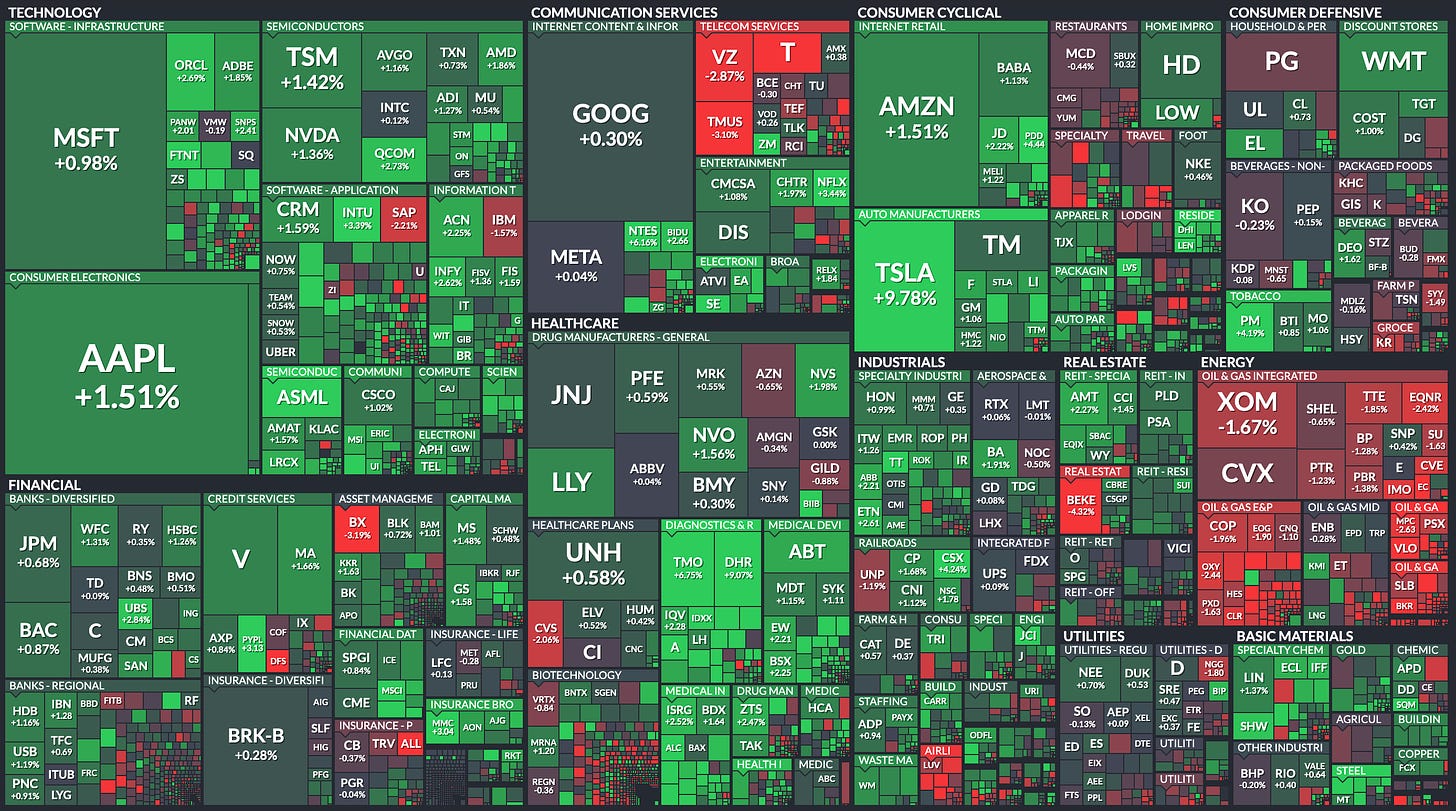

Sector News

Computer hardware stocks moved sharply higher over the course of the session, with the NYSE Arca Computer Hardware Index surging by 2.3 percent to its best closing level in well over a month.

Substantial strength also emerged among housing stocks, as reflected by the 2.3 percent spike by the Philadelphia Housing Sector Index. The index also reached a well over one-month closing high.

Homebuilder D.R. Horton (DHI) has helped to lead the housing sector higher after reporting better than expected fiscal third quarter earnings.

Tobacco, networking and semiconductor stocks also saw considerable strength on the day, while energy stocks moved sharply lower along with the price of crude oil. Crude for September delivery tumbled $3.53 to $96.35 a barrel.

Reflecting the weakness in the energy sector, the Philadelphia Oil Service Index plunged by 3.6 percent and the NYSE Arca Oil Index slumped by 2 percent.

Airline stocks also showed a significant move to the downside, resulting in a 2.5 percent nosedive by the NYSE Arca Airline Index.

United Airlines (UAL) and American Airlines (AAL) posted steep losses after reporting weaker than expected second quarter earnings.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance during trading on Thursday. Japan's Nikkei 225 Index climbed by 0.4 percent, while China's Shanghai Composite Index slumped by 1 percent.

The major European markets also finished the day mixed. While the German DAX Index dipped by 0.3 percent, the U.K.'s FTSE 100 Index inched up by 0.1 percent and the French CAC 40 Index rose by 0.3 percent.

In the bond market, treasuries moved sharply higher over the course of the session after seeing initial weakness. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, tumbled by 12.6 basis points to 2.910 percent after reaching a high of 3.081 percent.

Looking Ahead

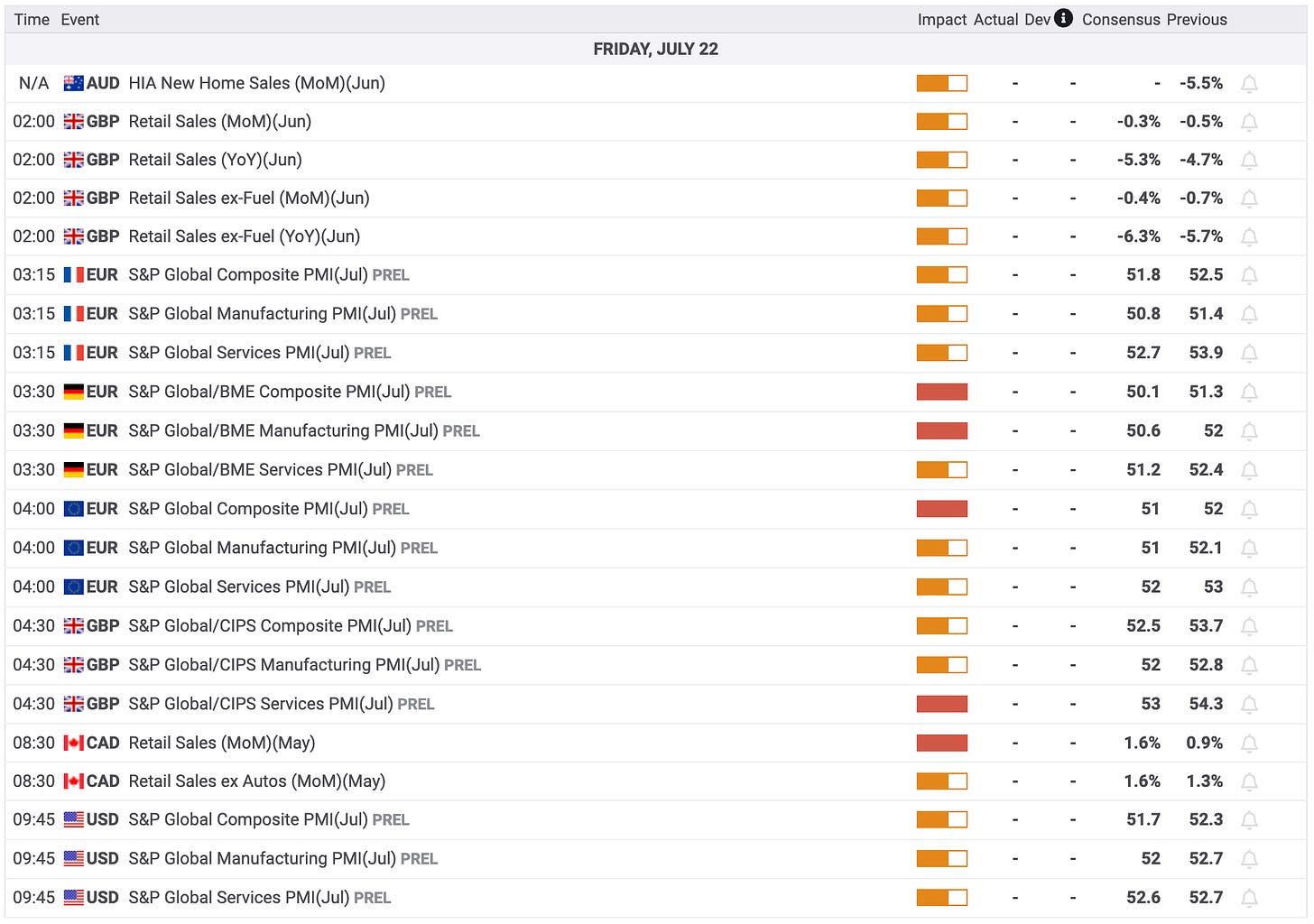

Amid a quiet day on the U.S. economic front, trading on Friday is likely to be driven by reaction to the latest earnings news.

Capital One (COF), Mattel (MAT), Snap (SNAP) and Tenet Healthcare (THC) are among the companies releasing their quarterly results after the close of today's trading.

American Express (AXP), Twitter (TWTR) and Verizon (VZ) are also among the companies due to report their results before the start of trading on Friday.

Market Heatmap

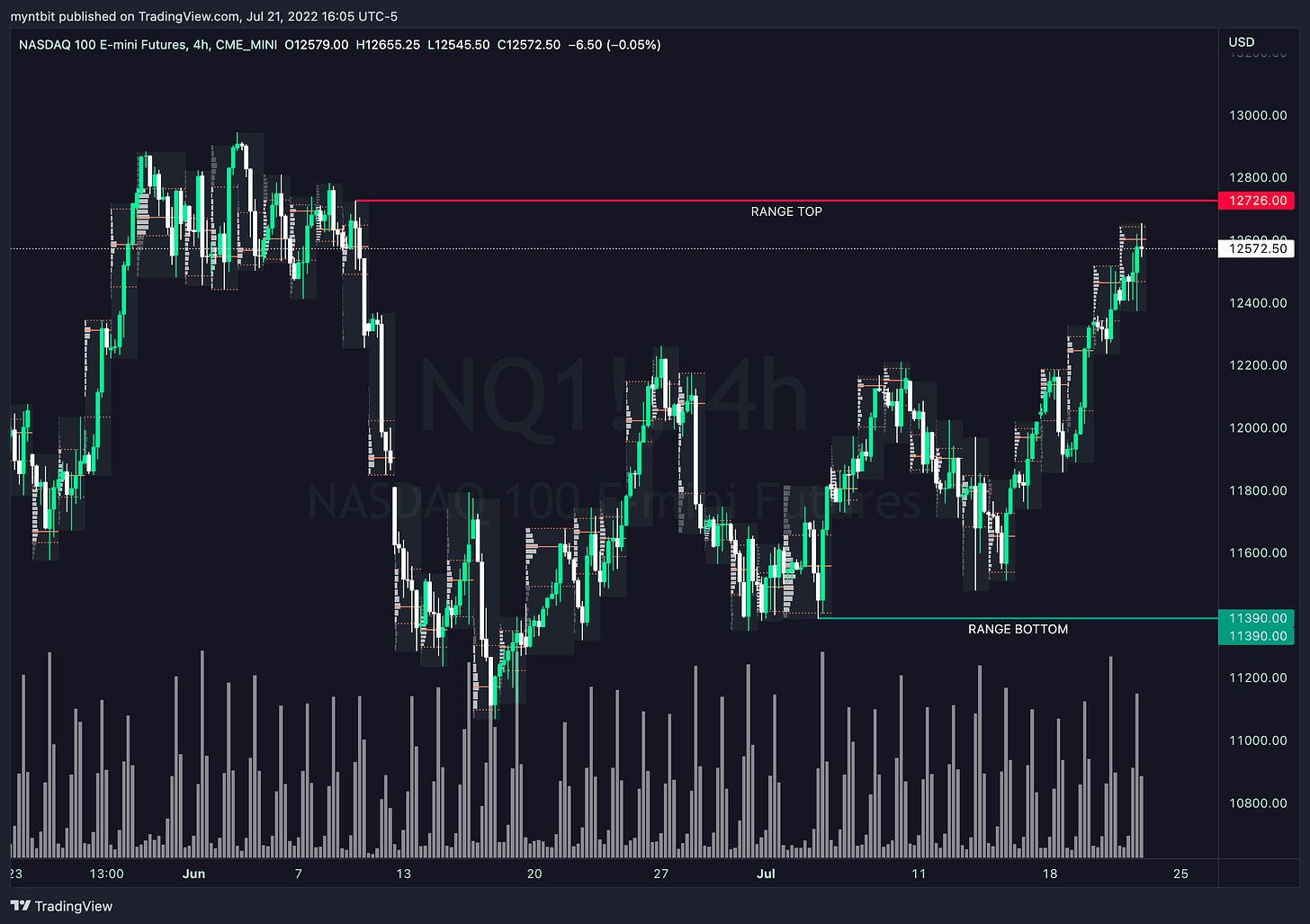

Futures Markets

There it is folks, called in the discord numerous times 4000 on /ES. The weekly perspective HAS now changed /ES and /NQ as the range top has now been moved higher due to the follow-through after the breakout. /ES futures are currently sitting at 3985 under the well under the high of day at 4004. /ES resistance at 3980 and 4000 were held on throughout the day but power-hour breakout helped /ES take out the important key area. On a similar note, /NQ continued its strength by leading the indices with over a 1.4 percent move up. Couple of key events that occurred throughout the day, the ECB announced its decision to raise interest rates by a larger-than-expected 50 basis points and Presdident Biden testing positive for Covid-19 neither has any impact on the market overall. Lastly, SNAP is currently down over 26 percent after reporting their earnings.

☎️ Snap (NYSE: SNAP) reported quarterly losses of $(0.02) per share which missed the analyst consensus estimate of $(0.01) by 100 percent. This is a 120 percent decrease over earnings of $0.10 per share from last year. The company reported quarterly sales of $1.11 billion which missed the analyst consensus estimate of $1.14 billion by 2.54 percent. This is a 13.12 percent increase over sales of $982.11 million last year.

Next up, again earnings (VZ, TWTR, AXP etc.) while not much on the data front.

/ES - Emini S&P 500

Bullish Scenario

If we OPEN above 3980, we need to overcome 4000 levels again which has been a key resistance but if there is a follow-through the price see a move towards 4030 where we could see sellers step in.

Bearish Scenario

If we OPEN below 3980, we might see the 3950 range where we found buyers step in to buy the dip. Further downside will be limited unless some there is some catalyst which could see us test 3910.

POC: 3962 | VAH: 3983 | VAL: 3946 | Range: 3723 - 4030

/NQ - Emini Nasdaq 100

Bullish Scenario

If we OPEN above 12510, we might see the test of 12642 before any sort of resistance with a move up to 12720 possible before buyers step in.

Bearish Scenario

If we OPEN below 12510, we might see a move down to 12400 before we find any buyers to buy the dip. But further breakdown might be limited.

POC: 12602 | VAH: 12642 | VAL: 12467 | Range: 11390 - 12726

Earnings Calendar (Fri. July 22)

Economic Calendar (Fri. July 22)

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of IBKR, Unusual whales, RTTnews, FXstreet, and/or Tradingview. We are just an end-user with no affiliations with them.