Daily Bit | 21 July 2022

MyntBit Daily Report is dedicated to provide traders with recap and bring setups to watch for the next trading day.

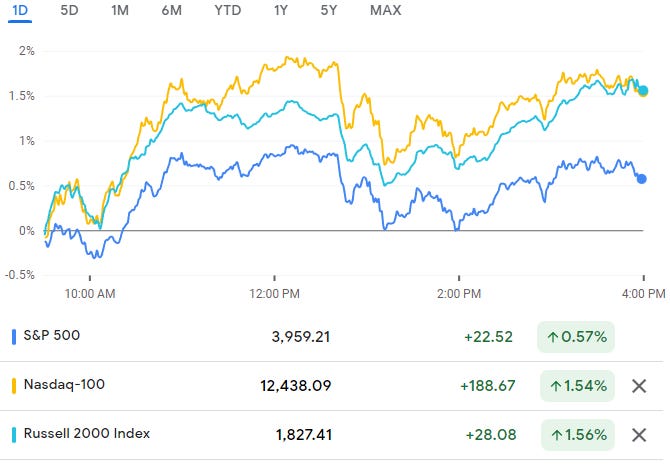

Market Snapshot

RTTNews Market Update

Stocks fluctuated over the course of the trading session on Wednesday but maintained a positive bias throughout the session before closing mostly higher. The major averages extended the rally seen in the previous session, reaching their best closing levels in over a month.

The major averages all finished the day in positive territory, although the tech-heavy Nasdaq outperformed its counterparts by a wide margin.

While the Nasdaq surged 184.50 points or 1.6 percent to 11,897.65, the S&P 500 climbed 23.21 points or 0.6 percent to 3,959.90 and the narrower Dow edged up by 47.79 points or 0.2 percent to 31,874.84.

The jump by the Nasdaq reflected strong among tech stocks, which came amid a positive reaction to earnings news from Netflix (NFLX).

Shares of Netflix surged by 7.4 percent to a three-month closing high after the streaming giant reported better than expected second quarter earnings and a smaller than expected subscriber loss.

Semiconductor stocks also turned in a strong performance on the day, with the Philadelphia Semiconductor Index spiking by 2.5 percent.

Significant strength was also visible among computer hardware stocks, as reflected by the 1.7 percent advance by the NYSE Arca Computer Hardware Index.

Outside the tech sector, retail stocks moved sharply higher, driving the Dow Jones U.S. Retail Index up by 2.2 percent to its best closing level in well over a month.

On the other hand, gold stocks came under pressure over the course of the session, dragging the NYSE Arca Gold Bugs Index down by 3.1 percent.

The weakness among gold stocks came as the price of gold for August delivery fell $10.50 to $1,700.20 an ounce.

A notable drop by shares of Merck (MRK) limited the upside for the Dow after a late-stage trial of the drug maker's Keytruda cancer drug did not meet its primary endpoint of event-free survival in head and neck cancer patients.

In U.S. economic news, a report released by the National Association of Realtors showed existing home sales tumbled by much more than expected in the month of June.

NAR said existing home sales plunged by 5.4 percent to an annual rate of 5.12 million in June after slumping by 3.4 percent to an annual rate of 5.41 million in May. Economists had expected existing home sales to decrease by 0.6 percent to a rate of 5.38 million.

Existing home sales declined for the fifth consecutive month, falling to their lowest level since June of 2020.

"Falling housing affordability continues to take a toll on potential home buyers," said NAR Chief Economist Lawrence Yun. "Both mortgage rates and home prices have risen too sharply in a short span of time."

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly higher during trading on Wednesday. Japan's Nikkei 225 Index shot up by 2.7 percent, while China's Shanghai Composite Index advanced by 0.8 percent.

Meanwhile, European stocks fluctuated over the course of the session before closing modestly lower. While the U.K.'s FTSE 100 Index fell by 0.4 percent, the French CAC 40 Index dipped by 0.3 percent and the German DAX Index edged down by 0.2 percent.

In the bond market, treasuries moved to the downside after seeing early strength. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, crept up by 1.7 basis points at 3.036 percent after hitting a low of 2.943 percent.

Looking Ahead

Trading on Thursday may be impacted by reaction to reports on weekly jobless claims, Philadelphia-area manufacturing activity and leading U.S. economic indicators.

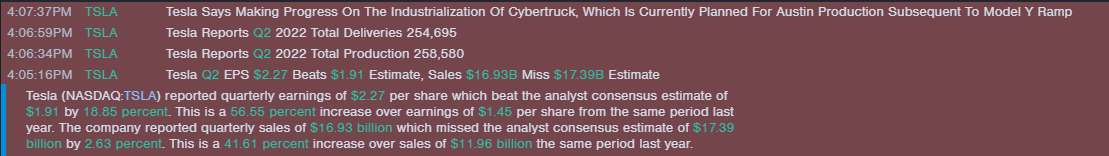

On the earnings front, Alcoa (AA), CSX Corp. (CSX), Las Vegas Sands (LVS), Tesla (TSLA) and United Airlines (UAL) are among the companies releasing their quarterly results after the close of today's trading.

American Airlines (AAL), AT&T (T), Dow (DOW), Nokia (NOK), and Travelers (TRV) are also among the companies due to report their results before the start of trading on Thursday.

Market Heatmap

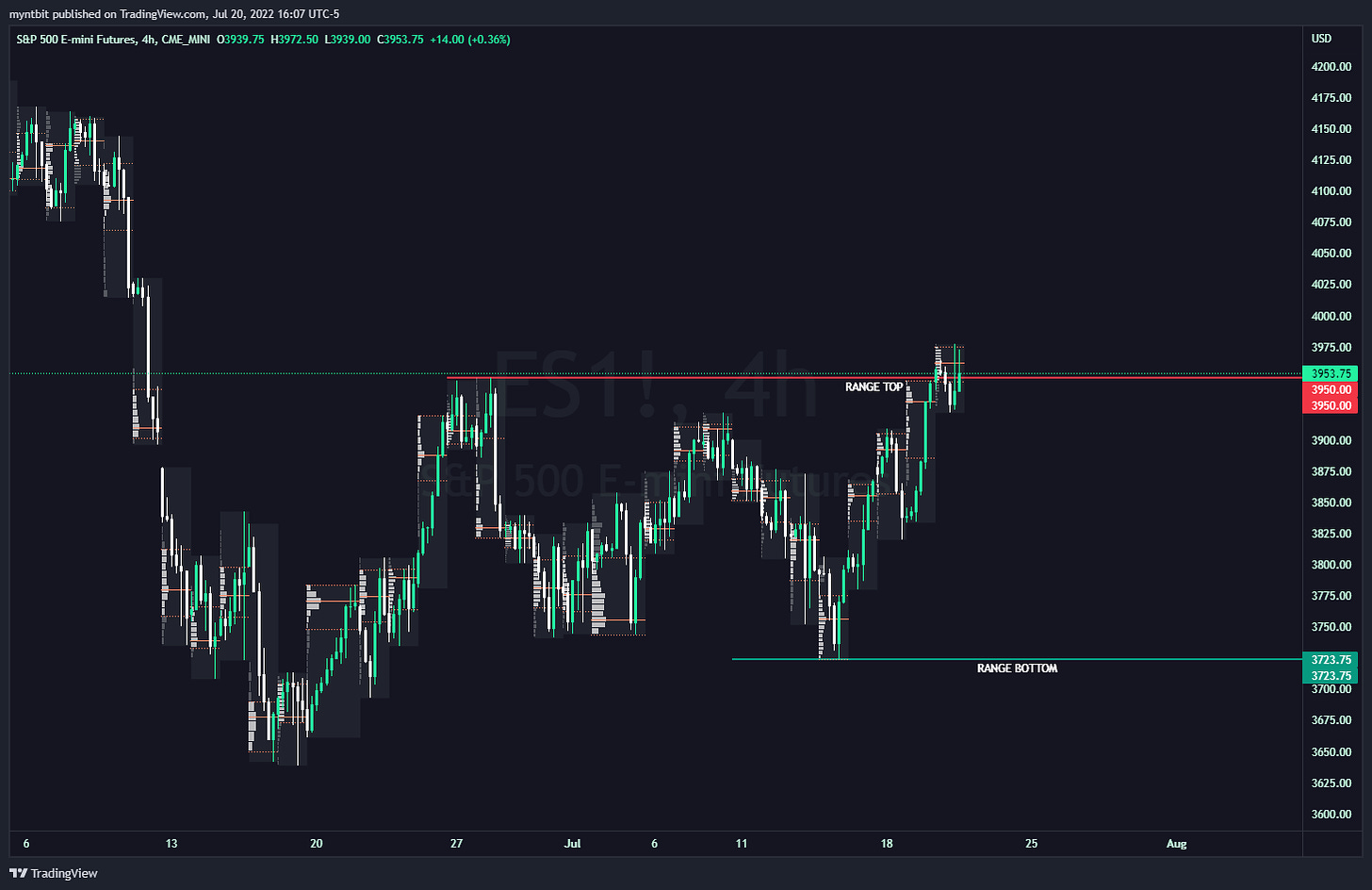

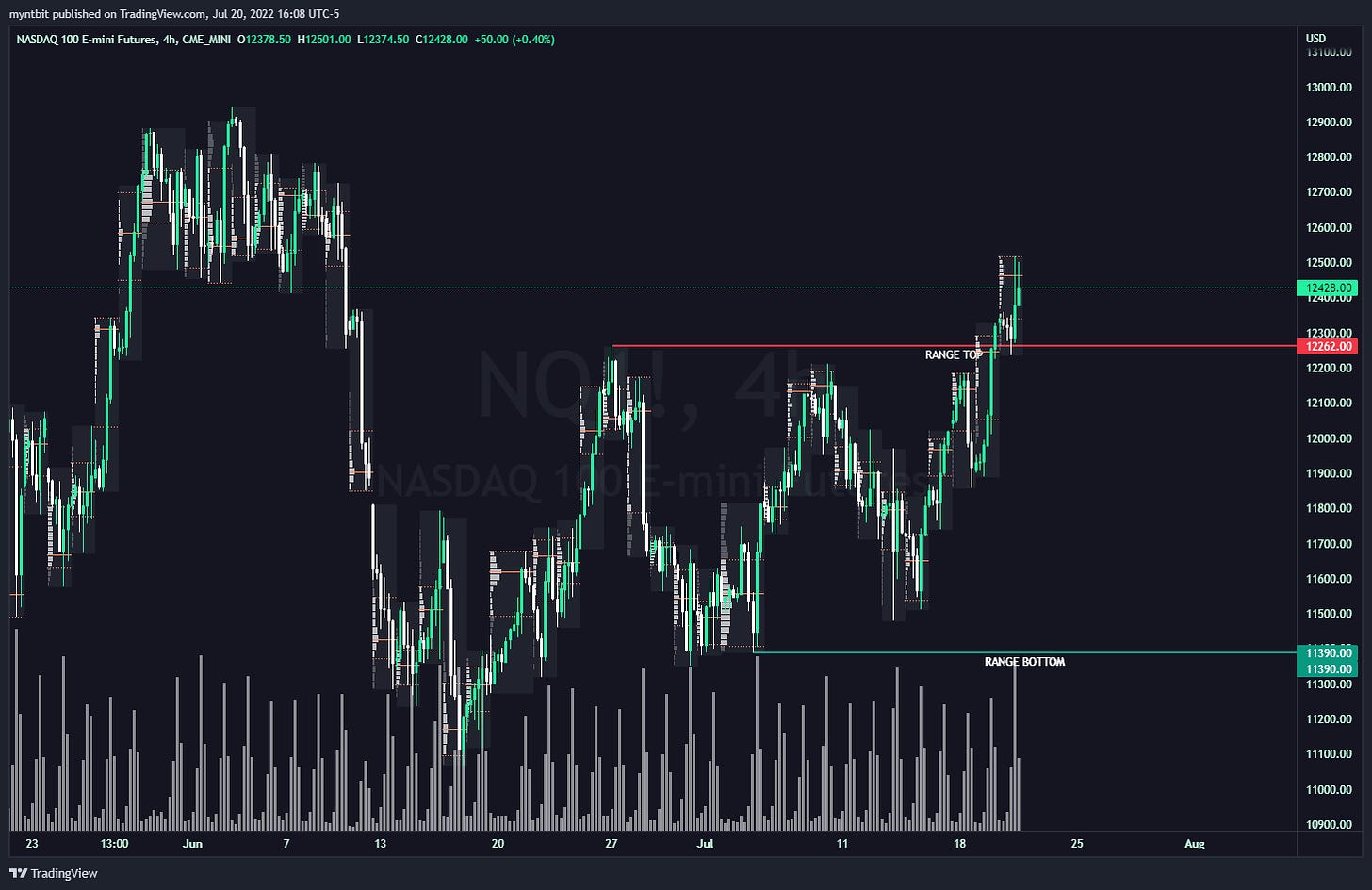

Futures Markets

What a day! The continued across the board with /NQ leading the way. The weekly perspective for /ES & /NQ has not changed even with the recent breakout of the range top. /ES futures are currently sitting at 3953.75 above its range top while writing this post. /ES target at 3970 was suggested in yesterday’s newsletter but it came with a lack of followthrough in volume. /NQ, on the other hand, was flying reaching 12500 above its range top. There was a GOOGL news about freezing hiring for the rest of the year that brought some pain to the markets but the markets recovered in anticipation of TSLA earnings. TSLA is currently sitting about 0/40 percent up after reporting their earnings, as shown below.

Something to note, Tesla Reveals It Sold 75% Of Bitcoin Holdings which cause a ripple effect in the crypto space with BTC and ETH falling after the report came out. Tomorrow, we have key data from ECB and Job data that can impact the markets.

/ES - Emini S&P 500

Bullish Scenario

If we OPEN above 3950, we need to overcome 3970-80 levels which held fairly well today but then the next resistance will be at 4000 (this will fill the gap).

Bearish Scenario

If we OPEN below 3950, we might see the 3925-10 range where we found buyers today but the key area would be 3900. If that 3900 area is broken then we open the door for a move to the 3850-30 area.

POC: 3957 | VAH: 3975 | VAL: 3947.75 | Range: 3723 - 3950

/NQ - Emini Nasdaq 100

Bullish Scenario

If we OPEN above 12510, we might see the test of 12440 with a move up to today’s high at 12600 possible.

Bearish Scenario

If we OPEN below 12420, we might see a move down to 12332 before we find any buyers to buy the dip. But further breakdown will open the possibility of a 12140 - 12100 test.

POC: 12464 | VAH: 12517 | VAL: 12 | Range: 11390 - 12262

Earnings Calendar (Thurs. July 21)

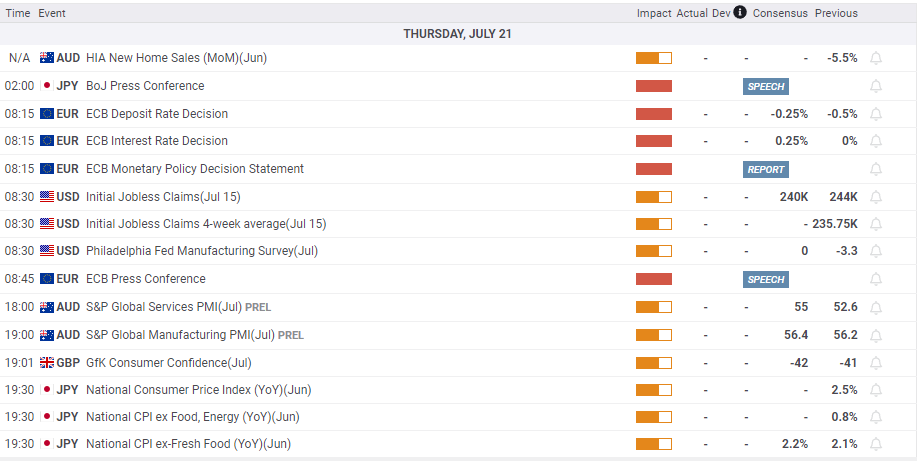

Economic Calendar (Thurs. July 21)

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of IBKR, Unusual whales, RTTnews, FXstreet, and/or Tradingview. We are just an end-user with no affiliations with them.