CPI Coming Up NEXT Week! Could It CRASH The Market? | Weekly Market Update

MyntBit Weekly Report is dedicated to helping traders prepare for the upcoming week.

Recap

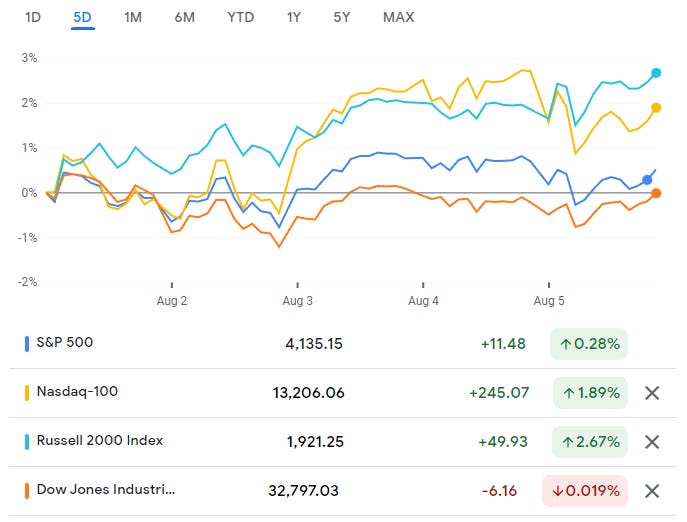

Market Snapshot

Weekly Wrap by Breifing.com

The first week of August ended up being another winning week for the stock market. It wasn't an easy ordeal, yet market participants largely retained the positive mindset that prevailed throughout July.

Things started on a somewhat weak note. There were some assumptions that the market would face selling pressure after the huge move it made in July. That rang true in the first part of the week but not so much in the latter part of the week. Fittingly, market participants got over the selling hump on Wednesday (hump day), which proved to be the big difference in making this another winning week.

The cautious start to the week coincided with a relatively weak ISM Manufacturing Index for July, a sizable drop in oil prices on demand concerns, and saber-rattling by China in front of an expected visit to Taiwan by House Speaker Pelosi.

The latter visit happened on Tuesday, but China's initial response wasn't deemed proportional to the bluster it was expressing in front of the visit. China ultimately announced that it would hold live-fire military exercises near Taiwan. On Friday, China announced that it will be sanctioning Ms. Pelosi and her family, and cutting back on cooperation with the U.S. on certain matters like climate change initiatives.

The lack of a more consequential response was a catalyst for a broad-based rally on Wednesday, which also featured strong leadership from the mega-cap stocks and another sizable drop in oil prices even though OPEC+ said it was going to raise output in September by 100,000 barrels per day versus July and August when it increased its production quota by 600,000 barrels per day.

WTI crude prices slumped below $90.00 per barrel this week, settling Friday at $88.73 per barrel. That move undercut the energy sector, which was the worst-performing sector this week with a 6.8% decline (including a 2.0% gain on Friday). The best-performing sectors were the information technology (+2.0%), consumer discretionary (+1.2%), and communication services (+1.2%) sectors.

The mega-cap stocks were influential sources of support at the index level most of the week. That was evident in the standing of the vanguard Mega-Cap Growth ETF (MGK). It gained 1.8% for the week versus a more modest 0.4% gain for the S&P 500 and an even smaller 0.1% gain for the Invesco S&P 500 Equal Weight ETF (RSP).

That performance made an important difference in the continued outperformance of the growth indexes, as did the relative strength in many smaller-sized companies. The Russell 3000 Growth Index jumped 1.6% this week versus a 0.2% decline for the Russell 3000 Value Index.

This week was not without its speculative flair either. There were some major short squeezes in a number of stocks and AMTD Digital (HKD), which opened for trading at $13.00 per share on July 15, went as high as $2555.30 on Tuesday, August 2, on no news. Its price action became the news.

Switching gears, there was a ton of earnings news this week. The companies reporting didn't have the cachet of last week's reporters. Nonetheless, they generally carried the mantle of providing better-than-feared results, which was still good enough to keep buyers interested.

The earnings news took a backseat to the July employment report as the week progressed. There was some skittishness ahead of that report given the manner in which it could shape the market's perspective on the path of Fed policy.

The report ended up being much stronger than expected. Nonfarm payrolls increased by 528,000, the unemployment rate fell to 3.5%, and average hourly earnings were up 5.2% year-over-year. The key takeaway was that it squashed the friendly notion that the Fed can turn friendly with its monetary policy decisions sooner rather than later.

The Treasury market took that view to heart. The 2-yr note yield, which hit 2.80% earlier in the week and stood at 3.05% right in front of the report, settled Friday's session at 3.23% (up 33 basis points for the week). The 10-yr note yield, which hit 2.53% earlier in the week and stood at 2.70% right in front of the report, settled Friday's session at 2.84% (up 20 basis points for the week).

Initially, the stock market was rattled by the report and the move in market rates, but it eventually found its nerve and put together a nice rebound effort. Friday's session did not culminate in gains for each of the major indices, but the overall performance was better than what many feared it would be based on the shifting rate-hike expectations.

Prior to the report, the fed funds futures market was assigning a 34% probability to a 75-basis point rate hike at the September FOMC meeting. That probability shot up to 68.5%, according to the CME's FedWatch Tool, in the wake of the report.

The relative resilience of the stock market after the employment report squashed its seemingly preferred outcome (i.e. weak data that suggested the Fed will be lowering rates in the first half of 2023) likely revolved around two, alternative takes on the data:

The continued strength of the labor market shows that the economy can handle the Fed's rate hikes without devolving into a hard-landing scenario, or

Employment is a lagging indicator, and given the lag effect of the Fed's rate increases, there will be much weaker numbers in coming months that will invite a friendlier shift in monetary policy sooner rather than later

It is hard to say what the ultimate driver of sentiment was, but because the market stood its ground for the most part after the report, the S&P 500 scored its third straight winning week.

Market Heatmap

Looking Ahead

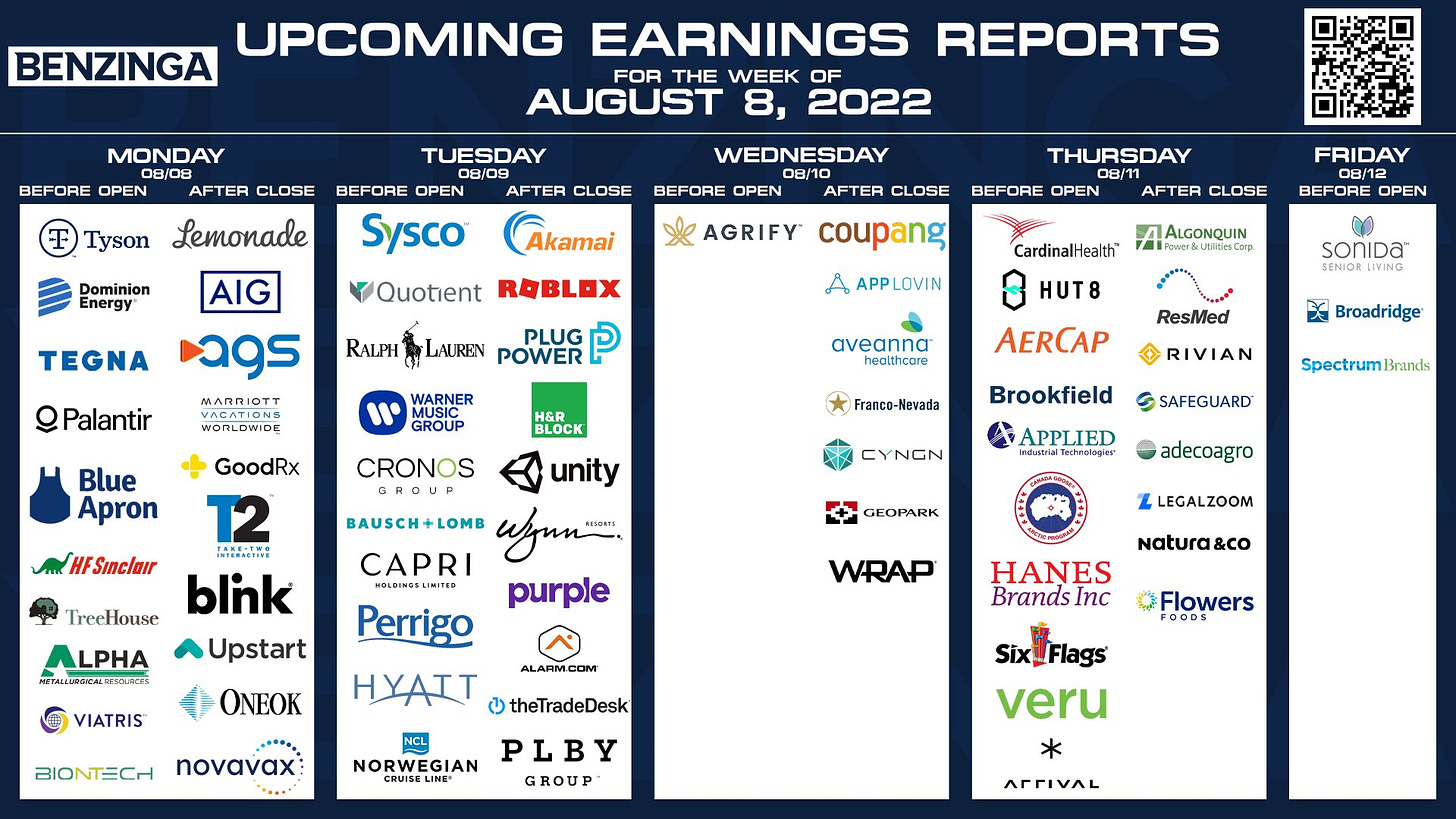

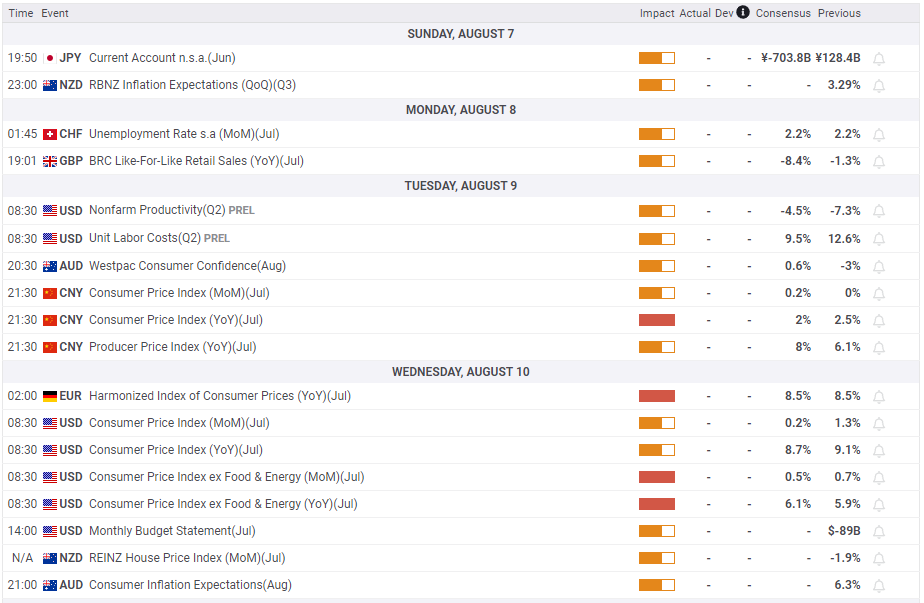

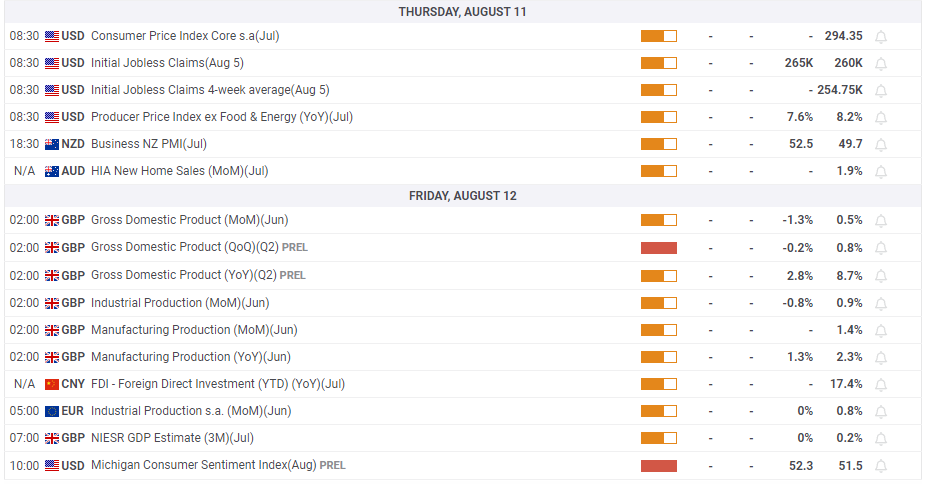

Next week, the latest update on inflation will take center stage, as it will no doubt impact the path of Federal Reserve (Fed) rate hikes. The closely watched Consumer Price Index (CPI)is forecasted to have climbed8.8% year-over-year in July, easing slightly from the prior month's 9.1% annual increase that had marked a fresh four-decade high. Still, core CPI(excluding the more volatile food and energy components) likely jumped 6.1%on an annual basis, accelerating from the previous 5.9%year-over-year advance. Other readings on inflation include import prices, the Producer Price Index(PPI), unit labor costs, and CPI figures out of China, Germany, and France. Across the pond, the U.K.’s preliminary second-quarter GDP (Gross Domestic Product) print could garner attention after the Bank of England (BOE)forecasted their economy could slide into recession by year-end. Also in focus, a preliminary August update from the University of Michigan is expected to show U.S.consumer sentiment improving to 52 from July's 51.5 print. Rounding out the docket will be updates on small business optimism, first-time unemployment claims, and mortgage applications. In central bank news, a few regional Fed presidents have public appearances scheduled throughout the week. In the auction space, the U.S.Treasury Department is slated to sell 10-year notes and 30-year bonds. Meanwhile, WallStreet has a lighter load of earnings to digest. In the Communications Services space, results from Walt Disney Co. and Fox Corp. will hit the tape. Consumer Staples companies Tyson FoodsInc. and Sysco Corp. are set to report, while the travel industry is represented by NorwegianCruise Line HoldingsLtd. and Wynn Resorts Ltd.

Earnings Calendar

Economic Calendar

Futures Markets

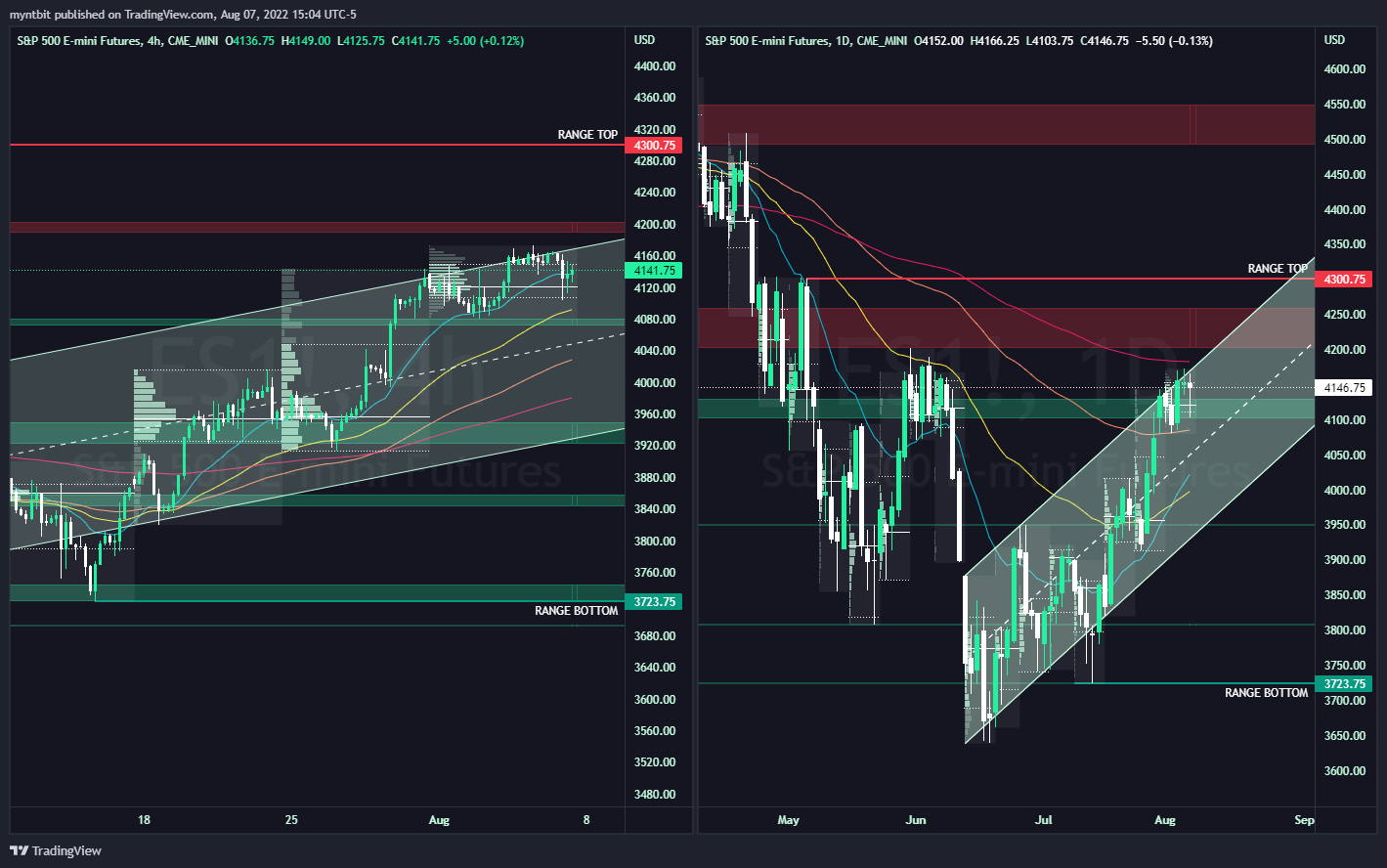

/ES - Emini S&P 500

Last Week, ES was in a very tight bound range between 4080 to 4175 as suggested by our last week's newsletter. With all the events from last week, ES stayed firm and above our key 4100 level. On a daily timeframe, ES is still under the 200 EMA which is acting as a strong resistance broke. With CPI data coming out this week, we can expect a move in either direction.

Bull Case - 4150 is the new key level. We did manage to test and break 4100 and finish above that level last week, so buyers need to step up and have convection to stay above 4150 to see any further moves, the next stop would be 4175-4185 where we might find meaningful resistance. Further upside is after 4200 which seems like a big resistance.

Bear Case - There was strong buying of any dips under 4100, the new key area of 4150 acted as a strong resistance last week where the buyers pushed higher but found sellers. So, if we remain under 4150, the next level down is 4085-4075 until we find meaningful support again then at the 4020 area.

Weekly POC: 4121 | Range: 3723 - 4300

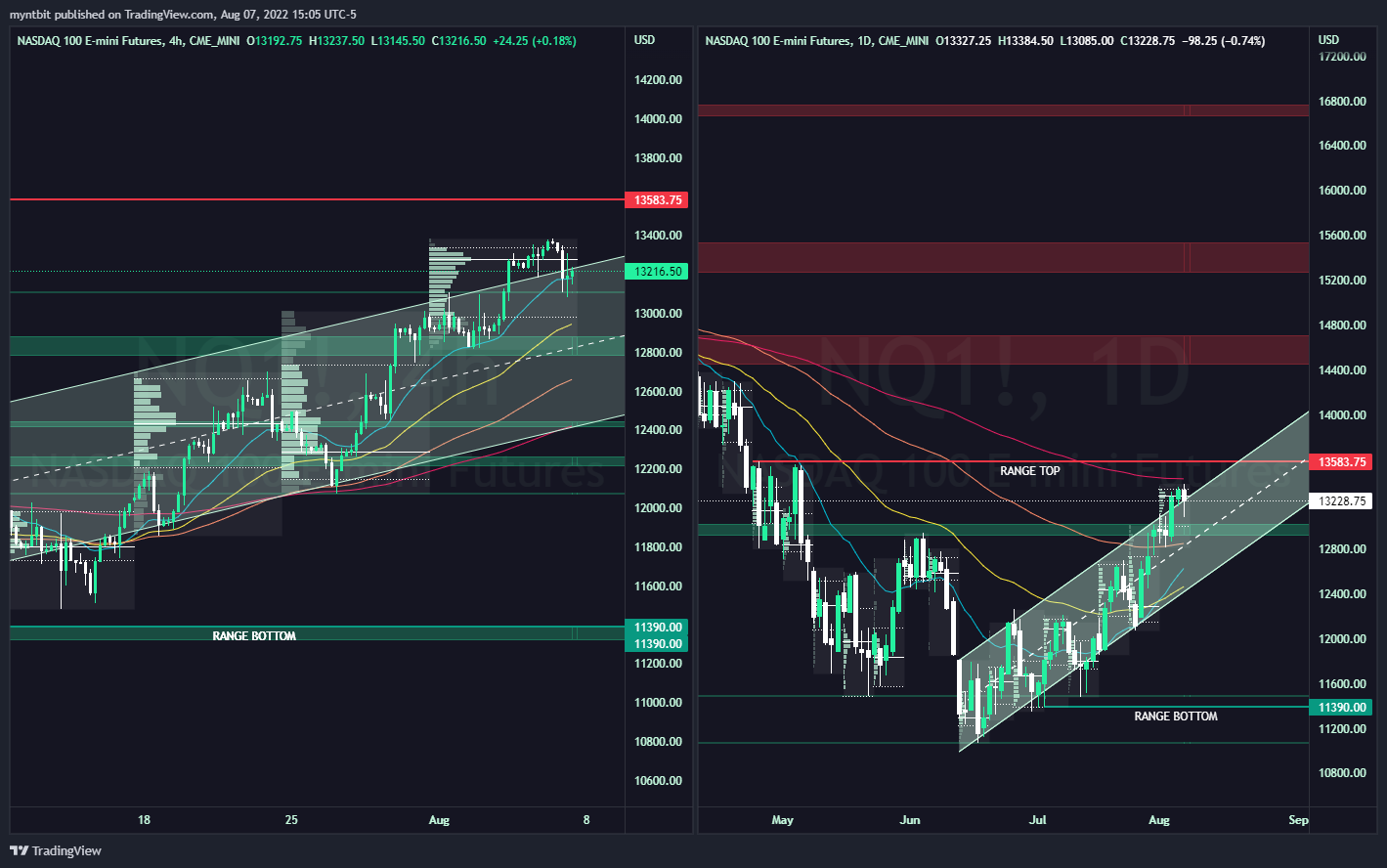

/NQ - Emini Nasdaq 100

Last week, NQ was strong than ES due to several key earnings and a stronger tech sector. On the daily timeframe, it is under the 200 EMA which has been held since April 2022.

Bull Case - Again similar to last week, the Key level on NQ is 13000. If we stay above it the next stop is 13300 then a trip to our range top at 13500. After that, we open the possibility of testing the 14000 level.

Bear Case - If we remain under 13000, we could test 12850 before seeing any meaningful support but with further weakness in NQ, we could see 12400 getting tested.

Weekly POC: 13276 | Range: 11390 - 13583

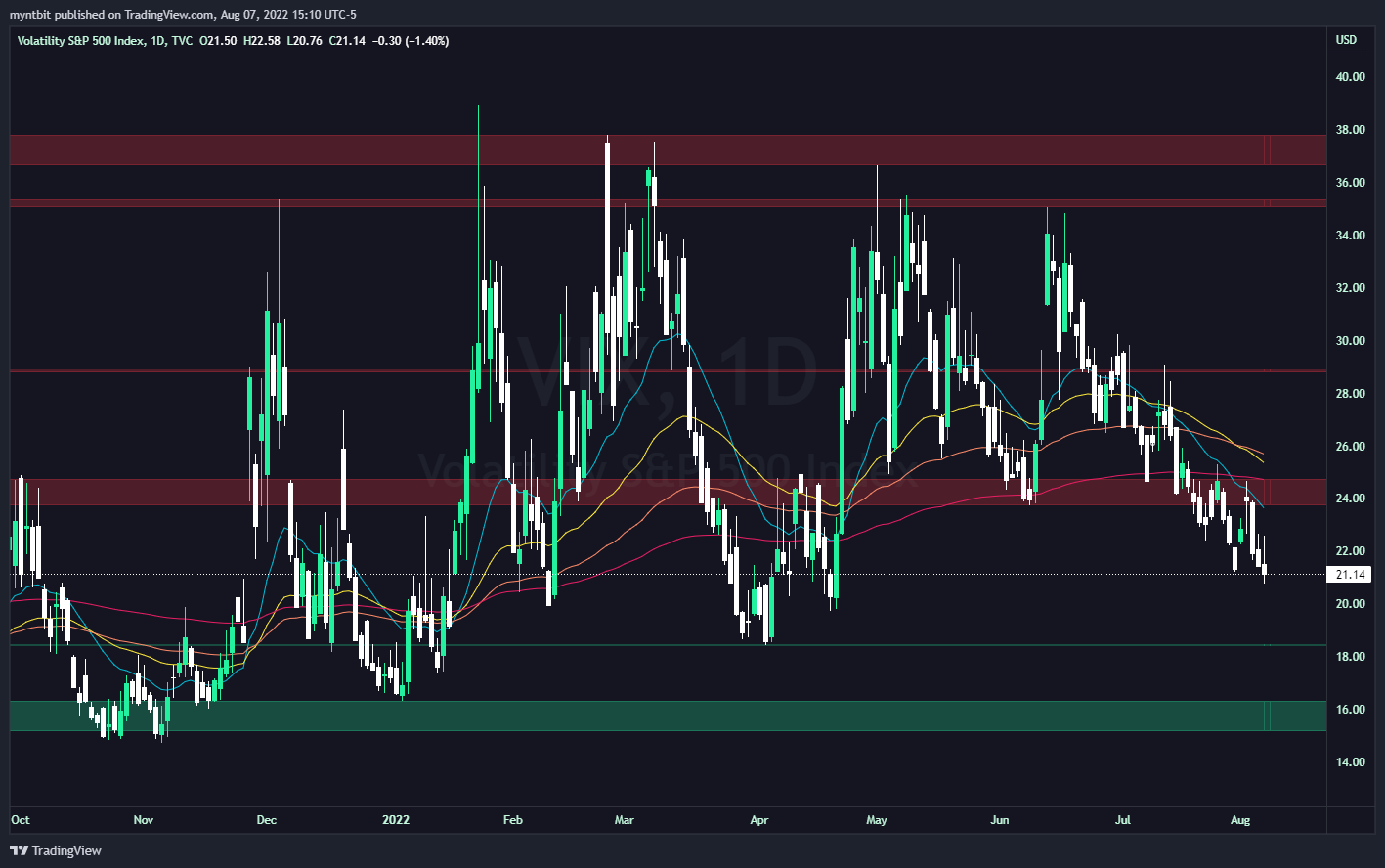

VIX - Volatility Index

VIX has been acting weird recently. Even with negative news on the macro (US/China tensions, Jobs data, etc.) and micro (earnings, layoff, etc.) fronts, it remained subdued. This also indicates the current sentiment of investors & traders reflecting the strength of the market. The CPI data is coming up next week, so we are expecting higher volatility this week. The bottom of our range is at 18.50 which is key support, if that is to be broken we might see further upside in the markets.

Range: 18.50 - 29.00

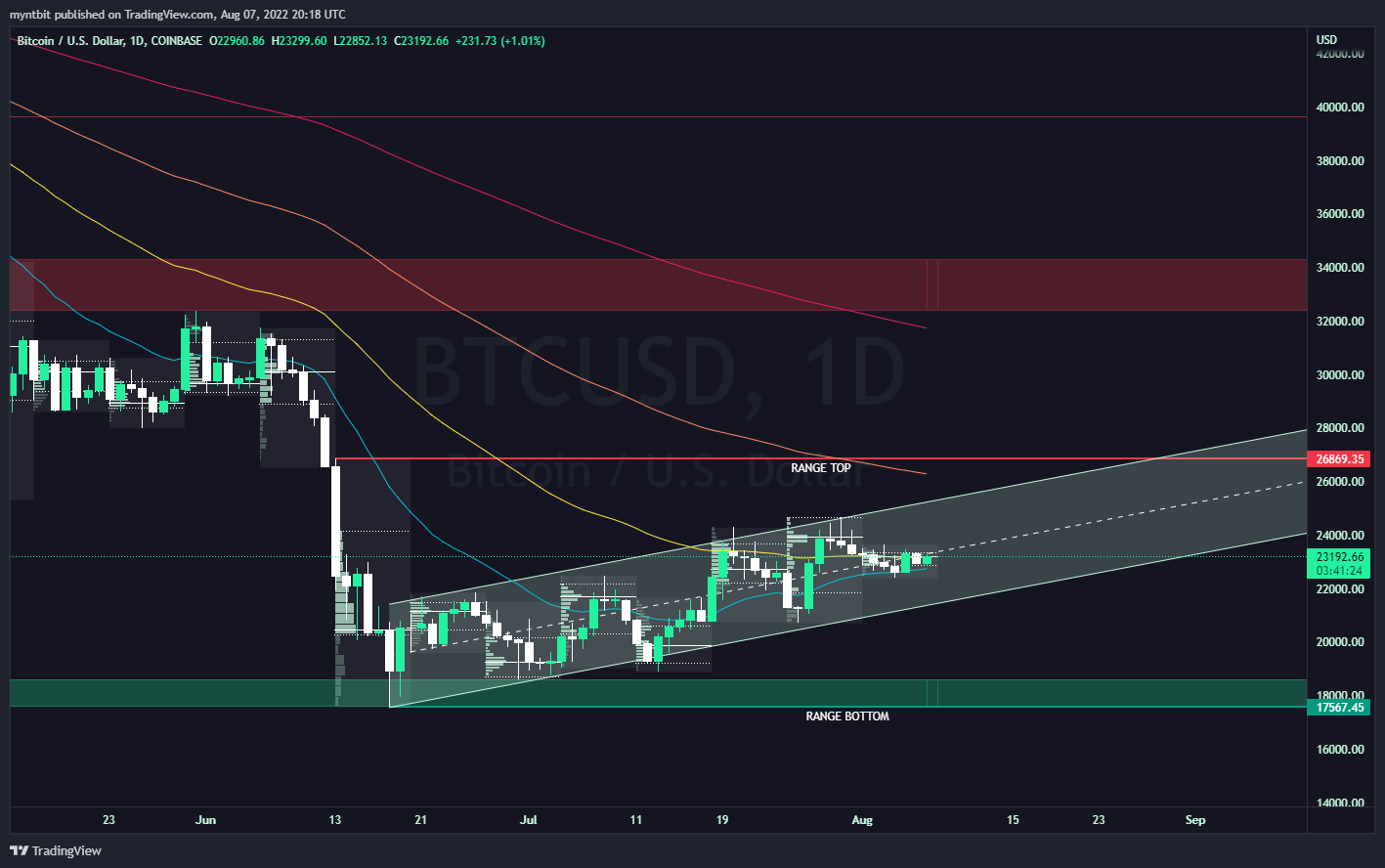

Crypto Markets

Crypto has been acting as a leading indicator for the market recently. Both Bitcoin and Ethereum have shown strength which has been reflected in the tech sector. The ranges for both still remain the same from last week until we see a move above or below them.

#BTC - Bitcoin

Range: 17567 - 26869

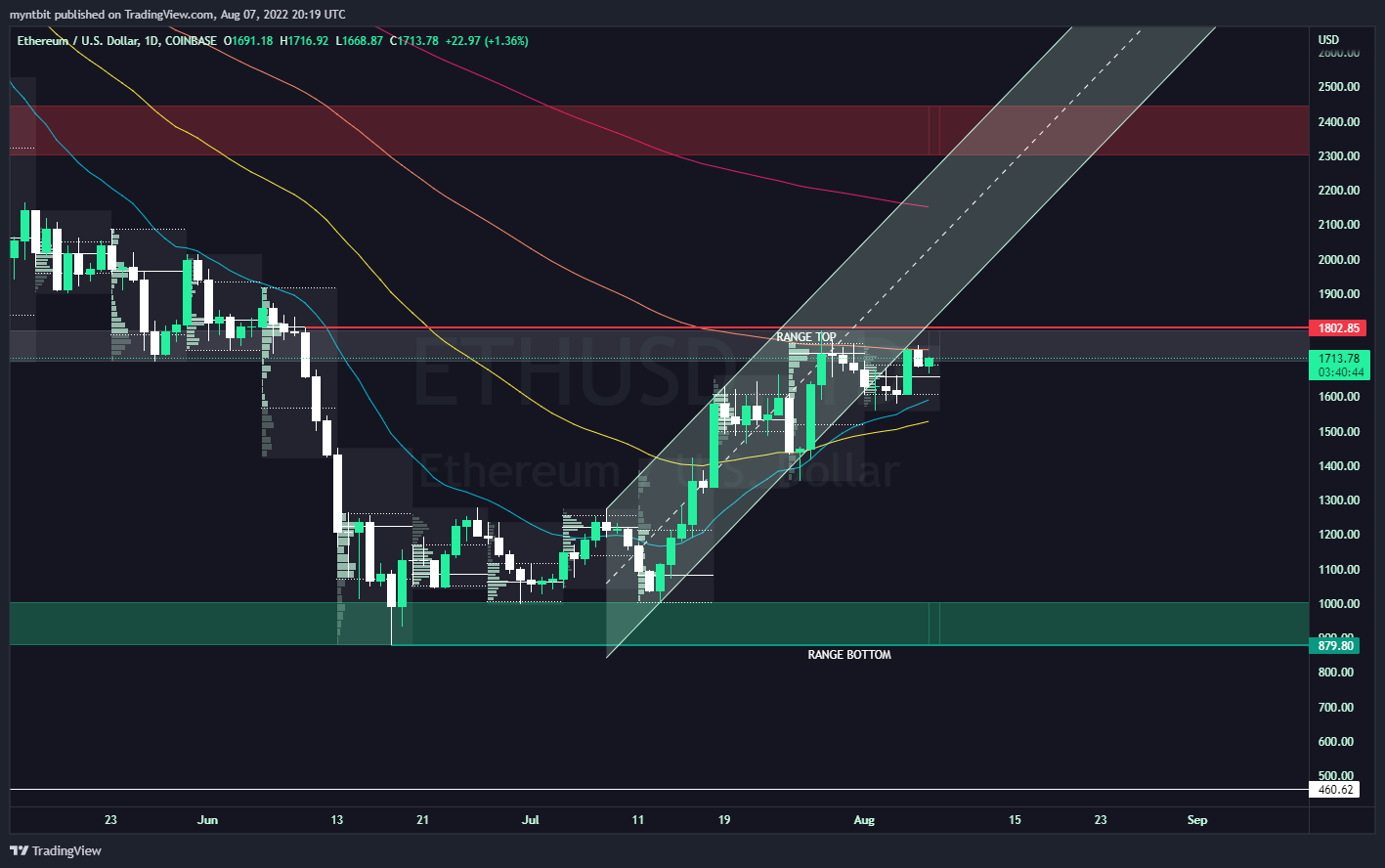

#ETH - Ethereum

Range: 879 - 1800

Stocks To Watch Next Week

For More Stocks To Watch Next Week...

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions which we are sharing publicly for educational purposes. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Briefing.com, FXstreet, Google Finance, Unusual Whale, Refinitiv, and/or Tradingview. We are just an end-user with no affiliations with them.