03.13.2023 | Weekly Market Newsletter | Vol. 2 Issue 10

Market Trader's Weekly Newsletter brings potential setups with a time horizon from days to week depending on price action. The following research is based on Fundamentals & Technical Analysis.

What is included in this newsletter?

WEEKLY REVIEW & LOOKING AHEAD - An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices. Key takeaways to be mindful of as we look forward to the upcoming trading week.

FUTURES MARKETS - A technical review of the major indices and futures that represent the market's overall health.

STOCKS WATCHLIST - Trends, key levels, and trade targets are identified for individual names presenting potential opportunities in the market.

Weekly Review

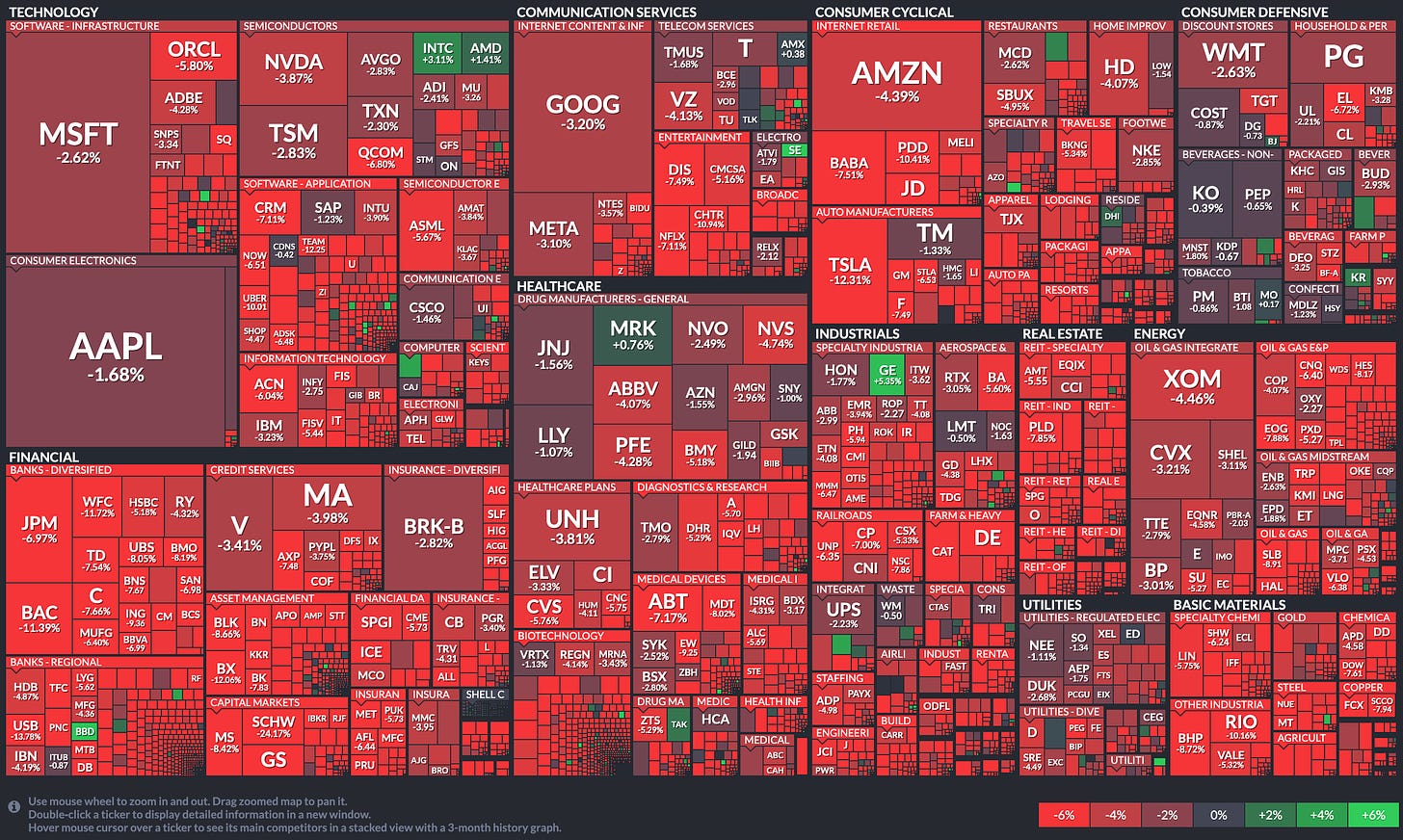

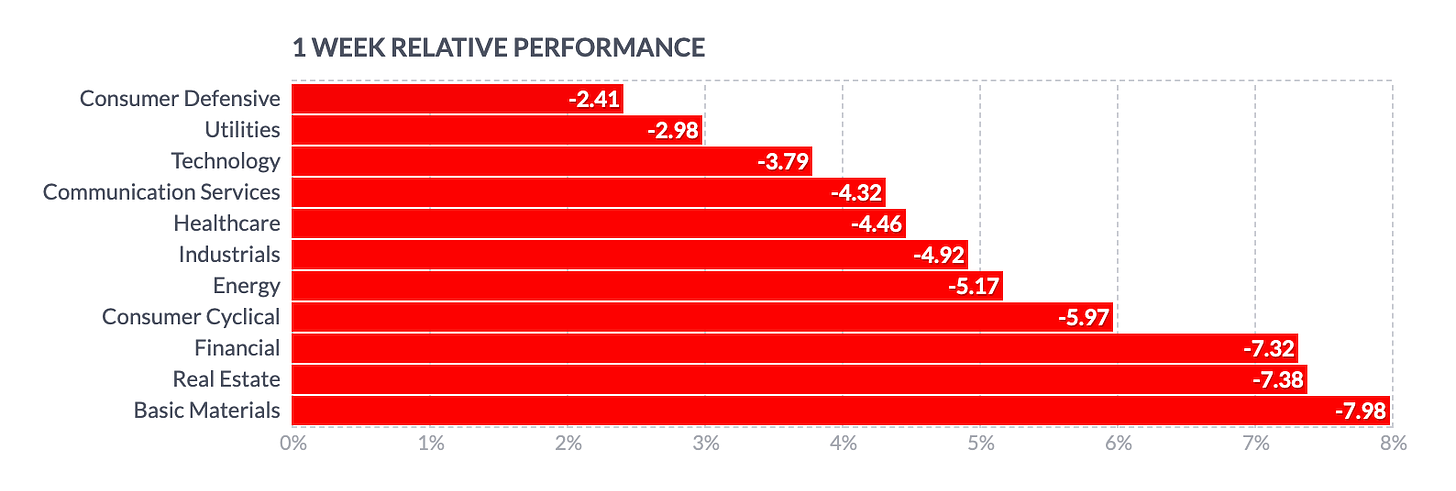

This week was a losing week for the stock market. The S&P 500 saw downside moves, slicing through support at its 50-day and 200-day moving averages. The market started to shake after Fed Chair Powell's remarks to Congress caused investors to rethink the possibility of a 50 basis points rate hike at the March FOMC meeting. The news of SVB Financial's Silicon Valley Bank being shut down added to concerns about a possible contagion effect. As a result, the 2-yr note yield declined 27 basis points, and the 10-yr note yield dropped 26 basis points. The worst-performing sectors this week were the financial, materials, real estate, consumer discretionary, energy, and industrial sectors. The consumer staples sector was the best performing, declining 1.9%.

Weekly Performance Heatmap

Overall Stock Market Heatmap

Sector Performance

Looking Ahead

Next week, investors will have access to various US market data before the Federal Open Market Committee (FOMC) meeting. February's Consumer Price Index (CPI) and Producer Price Index (PPI) will be released early in the week, with analysts expecting lower inflation rates than the previous month's. As the week progresses, more inflation indicators and housing market data will be released. Internationally, multiple countries will release inflationary readings, including China, which will release its 1-year lending rate, industrial production, and retail sales data. The UK's Chancellor of the Exchequer is scheduled to release the annual budget on Wednesday morning. The Fed's media blackout period will begin on March 11 ahead of the March 22 FOMC meeting. ECB's Christine Lagarde is expected to speak on Thursday morning after the central bank releases its rate decision.

Earnings Calendar

Economical Events

Future & Commodities Markets

Below are the levels for this upcoming week - updates will be provided throughout the week in the discord if the levels are reached throughout the week.

Note: Since last week, using May expiry contracts for all futures

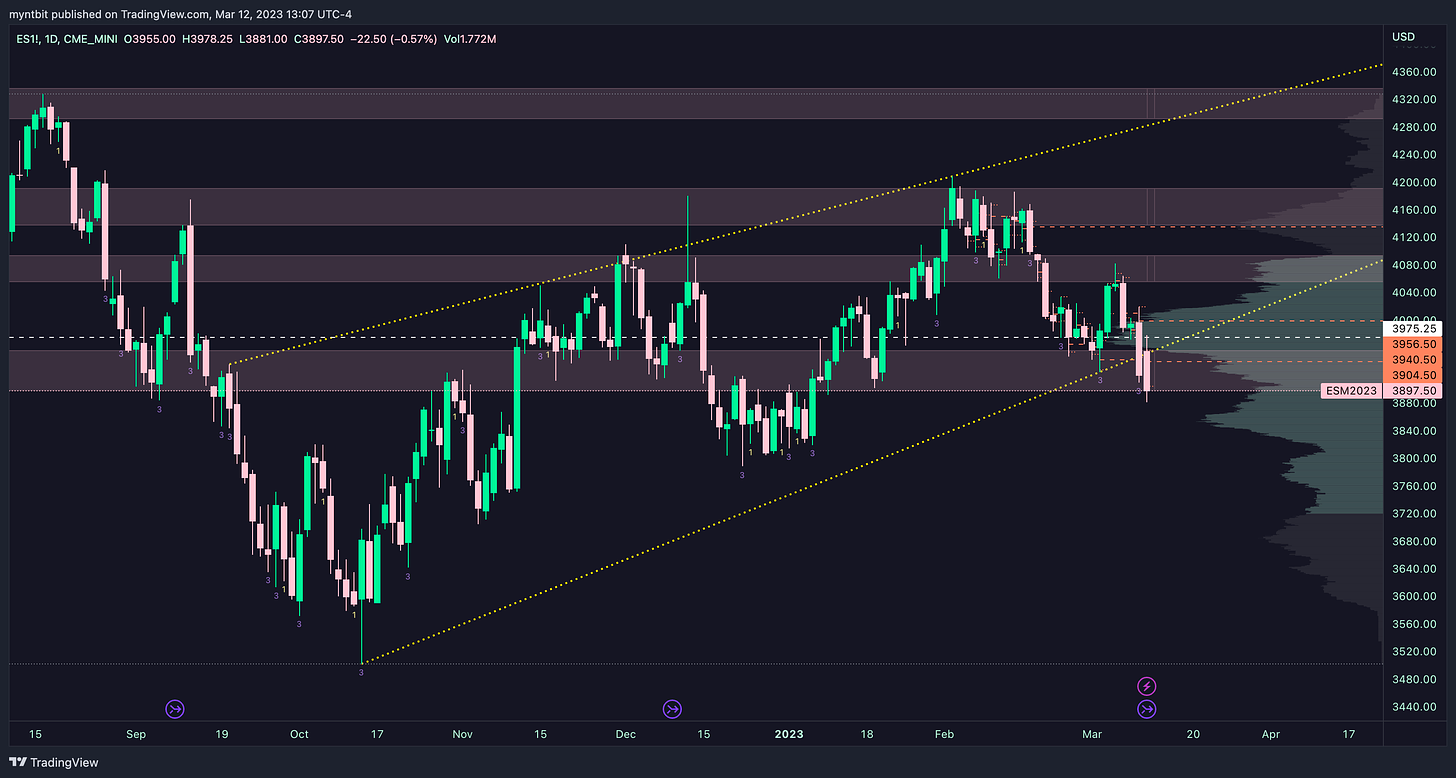

/ES - Emini S&P 500

Upside: If we hold and stay above the 3900, we could expect to test of 3940-3950 and if we manage to break above that, then next stop is 3980.

Downside: If we fail to hold 3900, then we could go down to retest the 3880 but failure to hold that level as support will open a test of 3850-3830./NQ - Emini Nasdaq 100

Upside: If we hold and stay above 12000, then we can test 12180-12250 (back into the consolidation zone) and the next level up would be near the top of the range at 12400.

Downside: If we fail to hold 12000, then we could go down 11800 (critical support) then test the critical support at 11650.Stocks Watchlist

Updates on the stocks will be provided in the discord throughout the week (link is below) 👇

Thank you for reading MyntBit Newsletter. Please share on Twitter!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Briefing.com, ForexFactory, Finviz, Tradytics, Wells Fargo Advisor, and/or Tradingview. We are just end-users with no affiliations with them.

Thanks for reading MyntBit Newsletter! Subscribe for free to receive new posts and support our work.