02.05.2023 | Weekly Market Newsletter | Vol. 2 Issue 6

Market Trader's Weekly Newsletter brings potential swing setups with a time horizon from days to months depending on price action. The following research is based on Fundamentals & Technical Analysis.

What is included in this week's edition?

WEEKLY REVIEW & LOOKING AHEAD - An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices. Key takeaways to be mindful of as we look forward to the upcoming trading week.

FUTURES MARKETS - A technical review of the major indices and futures that represent the overall health of the market.

STOCKS/OPTIONS - Trends, key levels, and trade targets are identified for individual names presenting potential opportunities in the market.

Weekly Review

The stock market had a roller coaster of a week. At the beginning of the week, investors sold some stocks due to concerns about inflation and ahead of important market-moving data releases and earnings reports. However, sentiment shifted on Tuesday as investors felt the Fed may pause their interest rate hikes. On Wednesday, the Fed raised its interest rate target as expected, but the market rebounded due to positive comments from the Fed Chair about the economy. The market continued to rise on Thursday with positive earnings reports and data releases. On Friday, some stocks dropped due to disappointing earnings and stronger-than-expected economic data, which raised concerns about the possibility of more rate hikes by the Fed. The U.S. Dollar and Treasury yield increased in response to the economic data releases.

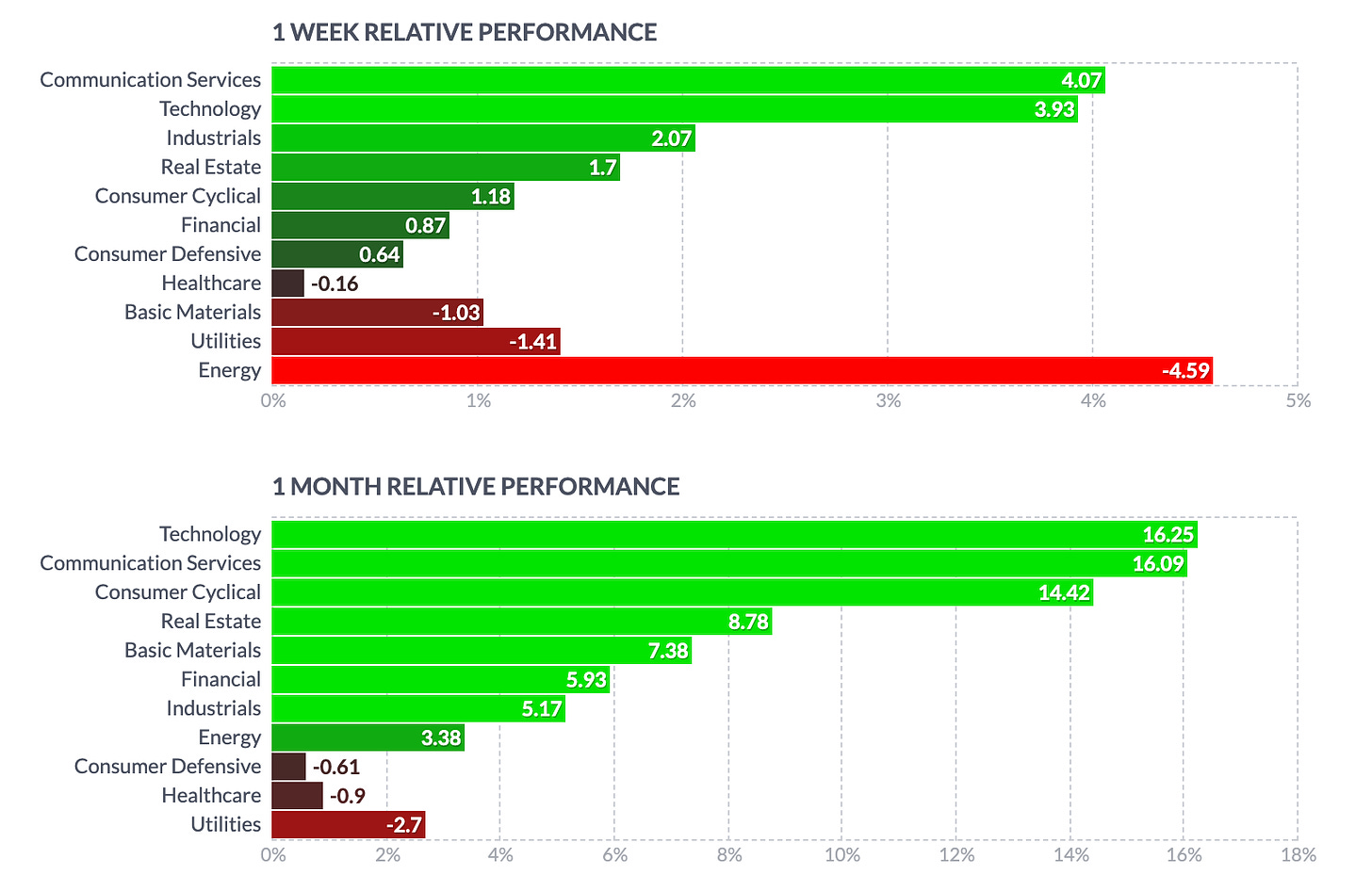

Weekly Performance Heatmap

Overall Market Heatmap

Sector Performance

Looking Ahead

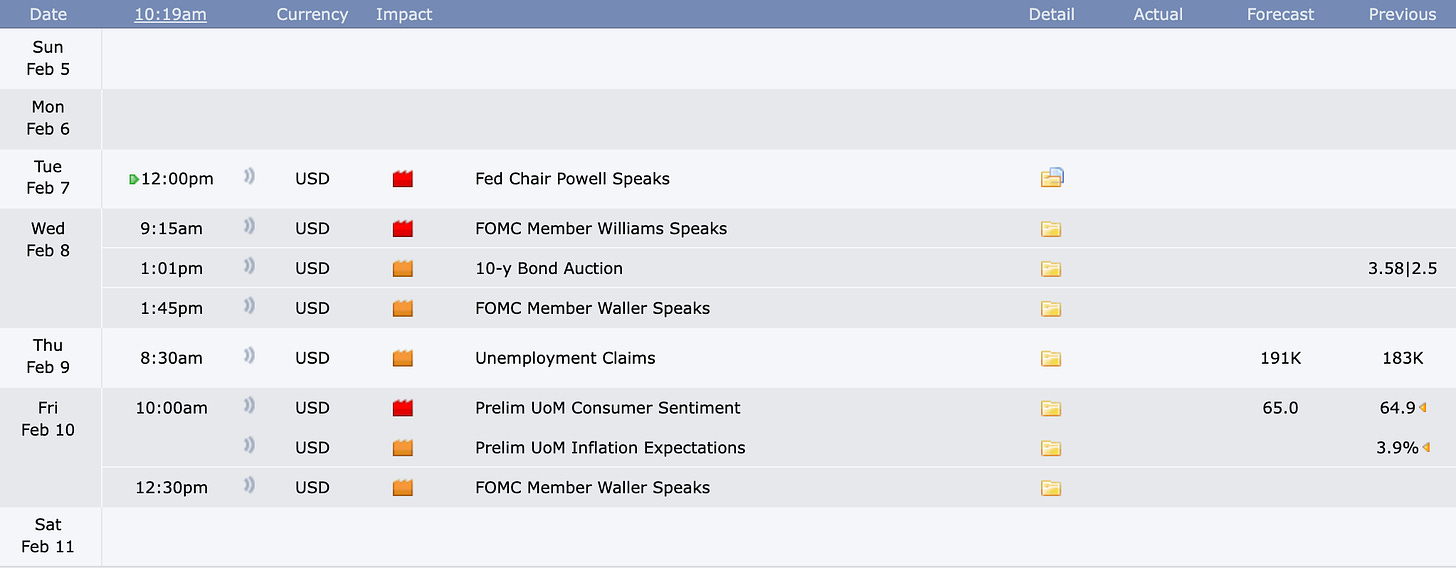

Next week, there won't be many important economic events happening in the US after a busy previous week. On Tuesday, there will be a report about consumer credit in December and on Friday, there will be a report about how consumer sentiment about the economy in February (see economical events below). Around the world, there will be reports about prices and business activity from countries like Germany, the UK, Japan, and China. The head of the Bank of England will speak on Monday and some important people from the Federal Reserve will speak about money and economics throughout the week. Some big companies will also be reporting how much money they made in the last quarter of the year (see earnings calendar below).

Earnings Calendar

Economical Events

Future & Commodities Markets

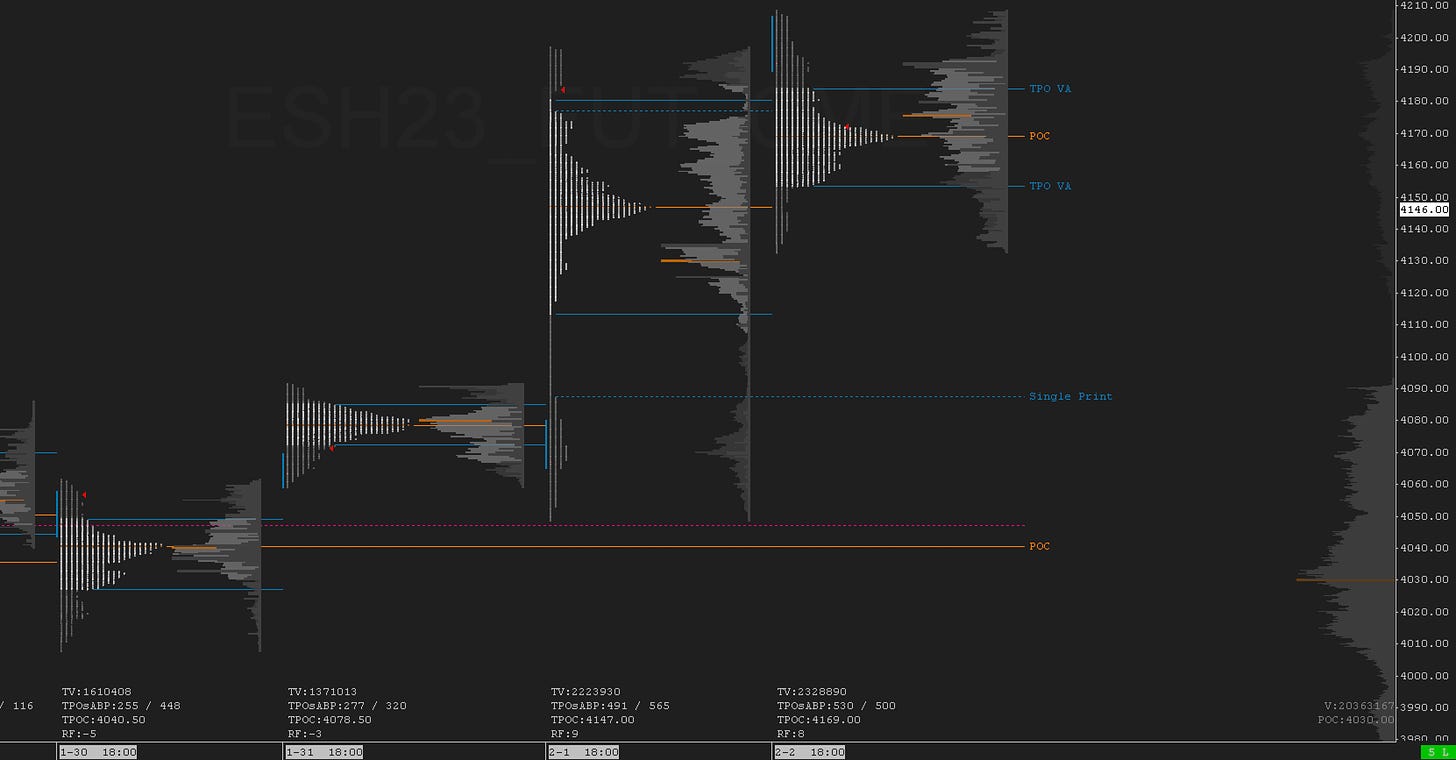

/ES - Emini S&P 500

After the FOMC meeting, ES continued to rally past both of the targets for the past week at 4110 and 4175 to a high of the week at 4210 but finished the week at 4140 after NFP/unemployment data. Now the question is will we continue this rally further or we sell off. Below are the levels for this upcoming week.

Upside: If we hold and stay above the 4150, we could expect to retest 4190-4200 and if we manage to break above last week's high then we can target 4231 (market is extended, so risk to reward is minimal).

Downside: If we fail to hold 4150, then we could go down to test the 4110 (last week's low) but failure to hold that level will open a test of 4050.TPO chart shows single prints around 4090

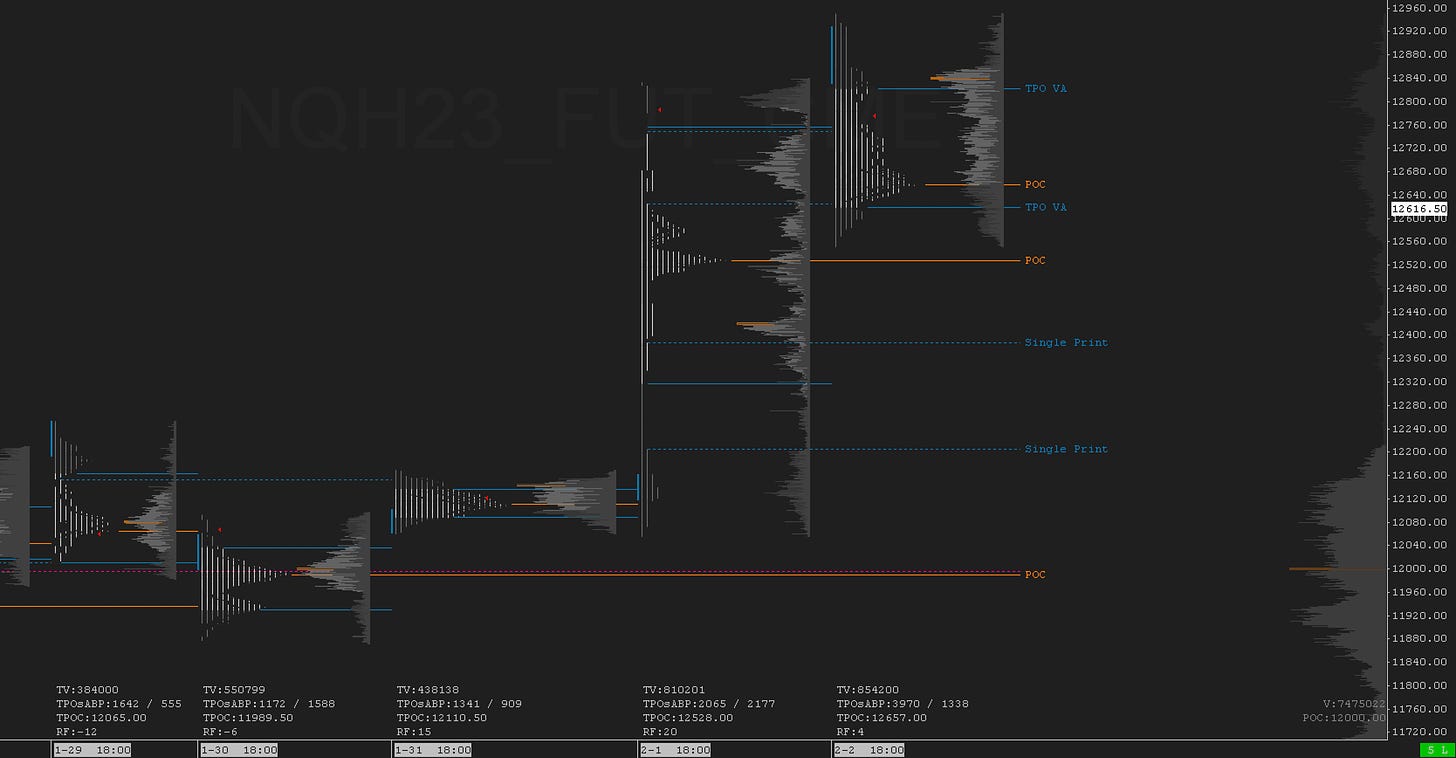

/NQ - Emini Nasdaq 100

Tech stocks have still continued to show strength but after AMZN, GOOGL & AAPL earnings there was some weakness in the market. For the upcoming week, there are still earnings coming in for other stocks so let’s look at the levels below.

Upside: If we hold and stay above 12650, then we can retest 12850-12875 with a chance of testing 12980-13000.

Downside: If we fail to hold 12650, then we could go down 12350-12400 to close the single prints and then test the critical support at 12000.TPO has a very thin profile and multiple single print around 12400 and 12200

VIX - Volatility Index

VIX fell below 18 with a low of 17.06 but finished above 18 for the week. Again, this level has been critical this year.

Upside: 20.01, 21.67 (above 20 is key for bears)

Downside: 17.36, 16.34 (under 20, possibly under 18 is key for bulls)Stock/Options

Weekly Watchlist for Feb 05 ‘23

Will be released later today…

Thank you for reading MyntBit Newsletter. Please share on Twitter!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Briefing.com, ForexFactory, Finviz, Tradytics, Wells Fargo Advisor, and/or Tradingview. We are just end-users with no affiliations with them.

Thanks for reading MyntBit Newsletter! Subscribe for free to receive new posts and support our work.