01.30.2023 | Market Trader Vol. 2 Issue 5 - Weekly Newsletter

Market Trader's Weekly Newsletter brings potential swing setups with a time horizon from days to months depending on price action. The following research is based on Fundamentals & Technical Analysis.

What is included in this week's edition?

WEEKLY REVIEW & LOOKING AHEAD - An overview of current market standing, fundamental matters with implications upon the market, and general sentiment regarding the major US indices. Key takeaways to be mindful of as we look forward to the upcoming trading week.

FUTURES & COMMODITIES MARKETS - A technical review of the major indices, futures, and commodities that represent the overall health of the market.

Briefing's Weekly Review

The January rally did not slow down this week as investors digested a slate of market-moving earnings results and data releases. The positive bias had the S&P 500 maintain and extend its position above its 200-day moving average.

Things got started on an upbeat note on Monday after a Wall Street Journal article over the weekend by Nick Timiraos highlighted the possibility of the Fed pausing its rate hikes this spring, along with a recent survey of businesses by the NABE that conveyed a lower possibility (56% vs nearly two-thirds before) of the U.S. being in a recession or entering one.

The market hit some turbulence on Tuesday with a lot of aberrant stock prices for a number of NYSE-listed stocks. The aberrations led almost instantly to volatility halts with market participants/observers wondering what was happening. The official explanation turned out to be an "exchange-related issue." That issue, fortunately, got resolved quickly and stocks soon returned to trading in a normal manner.

The NYSE declared a number of trades as erroneous from Tuesday morning and some trades were busted that traded outside of trading bands.

Market participants were also digesting some disappointing earnings/guidance from the likes of 3M (MMM), Verizon (VZ), Union Pacific (UNP), and General Electric (GE), along with the news that the U.S. filed an antitrust lawsuit against Google over alleged dominance in digital advertising.

Defense-related companies Lockheed Martin (LMT) and Raytheon Technologies (RTX) reported pleasing quarterly results, which helped offset some weakness.

There was also an element of geopolitical angst in play midweek after Germany and the U.S. reached an agreement to supply tanks to Ukraine for its fight against Russia.

Price action on Wednesday was integral to keeping the rally effort alive this week. Valuation concerns following Microsoft's (MSFT) disappointing fiscal Q3 outlook and expected growth deceleration for its Azure business fueled a broad retreat to kick off the session.

Investors also had a negative reaction initially to results and/or guidance from the likes of Dow component Boeing (BA), Texas Instruments (TXN), Kimberly-Clark (KMB), and Norfolk Southern (NSC) while Capital One (COF) went against the grain after its earnings report.

Sentiment started to shift, however, when buyers showed up fairly quickly after the S&P 500 slipped below its 200-day moving average. Most stocks either narrowed their losses or completely recovered and closed the session with a gain.

Following Wednesday's strong reversal, Tesla (TSLA) reported strong quarterly results and outlook, which drove a continued rebound in the mega cap space, and Chevron (CVX) announced a massive $75 billion stock repurchase program announcement.

There was also a slate of pleasing data releases Thursday morning that helped support a positive bias. Namely, the Advance Q4 GDP Report, weekly initial jobless claims, and December durable goods orders all came in better than expected.

The upside moves accelerated in the afternoon trade likely driven by some short-covering activity and a fear of missing out on further gains.

The rally effort continued on Friday despite Intel (INTC) reporting ugly results and guidance, KLA Corp. (KLAC) issuing below-consensus guidance, Chevron (CVX) missing on earnings estimates, and Hasbro (HAS) issuing a Q4 profit warning.

Market participants received some relatively pleasing inflation data in the December Personal Income and Spending Report.

Briefly, the PCE Price Index was up 0.1% month-over-month (Briefing.com consensus 0.0%) while the core-PCE Price Index, which excludes food and energy, was up 0.3%, as expected. That left the year-over-year changes at 5.0% and 4.4%, respectively, versus 5.5% and 4.7% in November.

There was a sharp pullback ahead of Friday's close, however. Market participants most likely wanted to take some money off the table following a big run and ahead of a big week of market moving catalyst next week that will include, among other things, the FOMC decision, earnings reports from Alphabet (GOOG), Meta Platforms (META), Apple (AAPL), and Amazon.com (AMZN), followed by the January Employment Report.

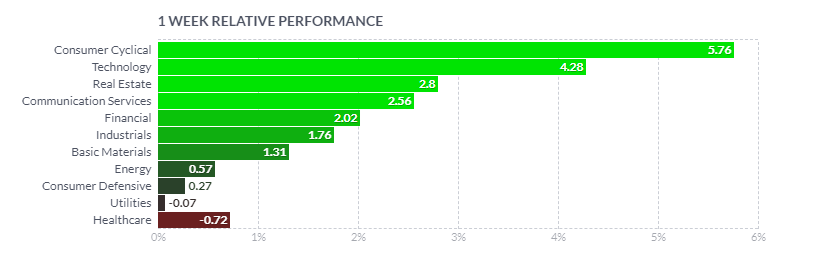

Only two S&P 500 sectors registered losses this week -- utilities (-0.5%) and health care (-0.9%) -- while the consumer discretionary (+6.4%), information technology (+4.1%), and communication services (+3.3%) sectors led the outperformers.

The 2-yr Treasury note yield rose one basis point this week to 4.21% and the 10-yr note yield rose four basis points this week to 3.52%.

Weekly Performance Heatmap

Overall Market Heatmap

Sector Performance

Looking Ahead

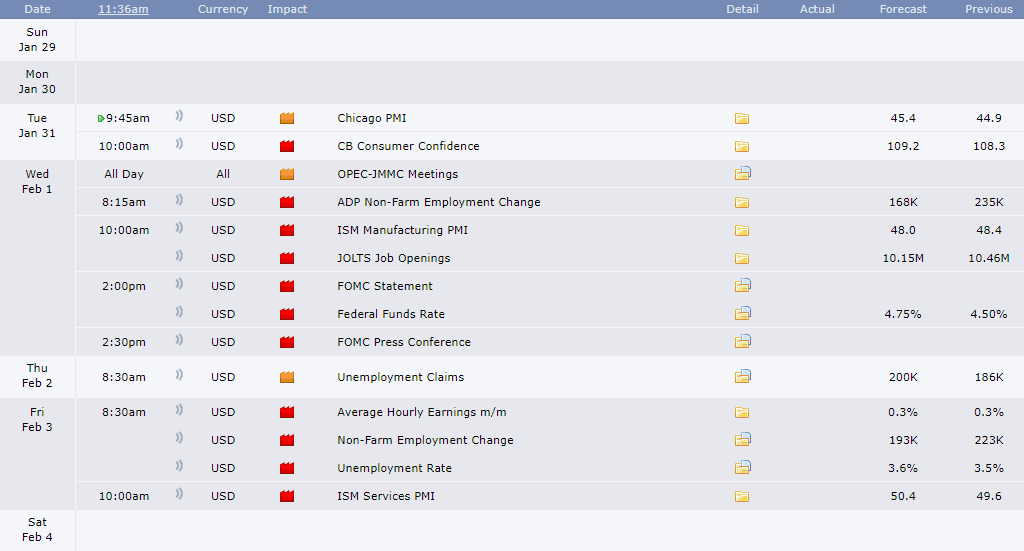

Next week, all eyes will be on the January jobs report for signs of softening in what has proved to be a resilient labor market. The unemployment rate is expected to tick upwards to 3.6%, while nonfarm payrolls are expected to show a decline in the number of jobs added. Investors will also receive January’s finalized S&P Global PMI readings along with January’s Institute of Supply Management’s Service Index and Manufacturing Index.

In the central bank sphere, the Fed is scheduled to meet on January 31 and February 1 with the release of the Federal Open Market Committee’s (FOMC) rate decision at 2 pm ET. Directly following the rate decision, Fed Chairman Jerome Powell is slated to hold a press conference regarding the decision.

Internationally, on Thursday the Bank of England (BOE) and the European Central Bank (ECB) are scheduled to release their rate decisions with ECB’s President Christine Lagarde speaking directly after the European rate announcement. Fourth-quarter earnings season continues, with multiple notable companies posting profit tallies

Earnings Calendar

Economical Events

Future & Commodities Markets

/ES - Emini S&P 500

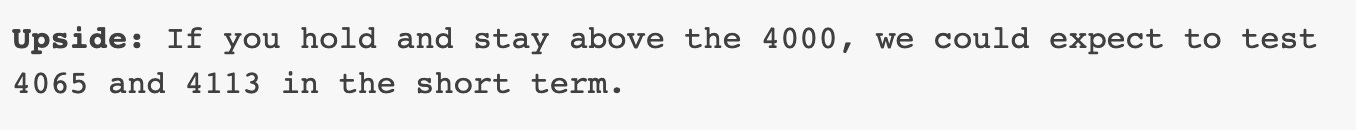

The rally continues, the ES markets opened under 4000 and rallied all the way to 4110 before finishing at 4084. The weekly upside level played out right on spot…

ES has now broken above the downward trendline on all timeframes and filled gaps up to 4110. Below are the levels for this upcoming week, keep in mind there are important events and earnings coming up this week (see above sections).

Upside: If we hold and stay above the 4065, we could expect to test 4110 and 4175 (we are getting too stretched in the short term).

Downside: If we fail to hold 4065, then we could go down to test the 4025 this will open a failure and retest of 3950./NQ - Emini Nasdaq 100

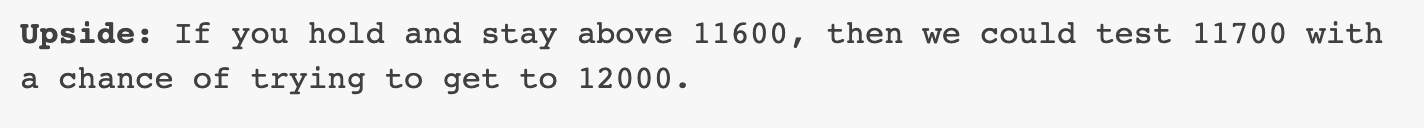

January has been incredible for the tech stocks, they have led the rally again this week after the TSLA earnings with some strong price action as NQ also played out according to our planned upside plus more, finishing at 12222.

For this week, there are several big tech earnings so let’s look at the upcoming week’s level.

Upside: If we hold and stay above 12100, then we could test 12350 with a chance of trying to get to 12650.

Downside: If we fail to hold 12100, then we could go down 11850 and then test the critical support at 11650.VIX - Volatility Index

VIX finished at lows for the week right above 18. Again, this level has been critical this year so let’s watch what the volatility looks like in the upcoming week with major news events.

Upside: 20.01, 21.67 (above 20 is key for bears)

Downside: 17.36, 16.34 (under 20, possibly under 18 is key for bulls)Stock Watchlist

Weekly Watchlist for Jan 30 -Feb 3

01/23 - 01/29: Weekly Watchlist Performance Update

Thank you for reading MyntBit Newsletter. Please share on Twitter!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Briefing.com, ForexFactory, Finviz, Tradytics, Wells Fargo Advisor, and/or Tradingview. We are just end-users with no affiliations with them.

Thanks for reading MyntBit Newsletter! Subscribe for free to receive new posts and support our work.

Good read! Thank you 🤗❤️