01.20.2023 | Daily Newsletter

MyntBit's Daily Newsletter is dedicated to providing traders with today's recap and bringing setups to watch for stocks and futures for the next trading day.

What is included in tomorrow's newsletter?

Daily Recap

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Today's Recap

The stock market retreat continued today, building on Wednesday's sizable losses. Today's negative bias was fueled by lingering growth and rate hike concerns following a slate of economic data this morning.

Weekly initial claims (actual 190,000; Briefing.com consensus 212,000) decreased to their lowest level since late September, implying no new difficulties in the labor market that could put a quick stop to the Fed’s hiking cycle.

At the same time, investors received weak building permits data for December (actual 1.330 mln; Briefing.com consensus 1.370 mln), highlighting the deteriorating economic backdrop and rising risk of a policy mistake triggering a deeper setback. However, that report contained one positive element, as single-family starts grew 11.3% month-over-month.

Piling onto the market's concerns, JPMorgan Chase CEO Jamie Dimon said in a CNBC interview this morning “I think there’s a lot of underlying inflation, which won’t go away so quick,” adding that he thinks rates will top 5.0%.

In addition to the aforementioned growth and rate hike worries, there may have been an element of profit taking behind the recent weakness after a big run to start 2023. Including today's losses, the S&P 500 and Nasdaq Composite are still up 1.6% and 3.7%, respectively, this year.

The main indices were pinned in negative territory for the entire session, but there was a recovery attempt in the afternoon trade that seemed to coincide with Fed Vice Chair Brainard giving a speech. Ms. Brainard's remarks did not include anything surprising. She said "Even with the recent moderation, inflation remains high, and policy will need to be sufficiently restrictive for some time to make sure inflation returns to 2 percent on a sustained basis."

The recovery attempt didn't last, however, and the main indices faded from session highs ahead of the closing bell.

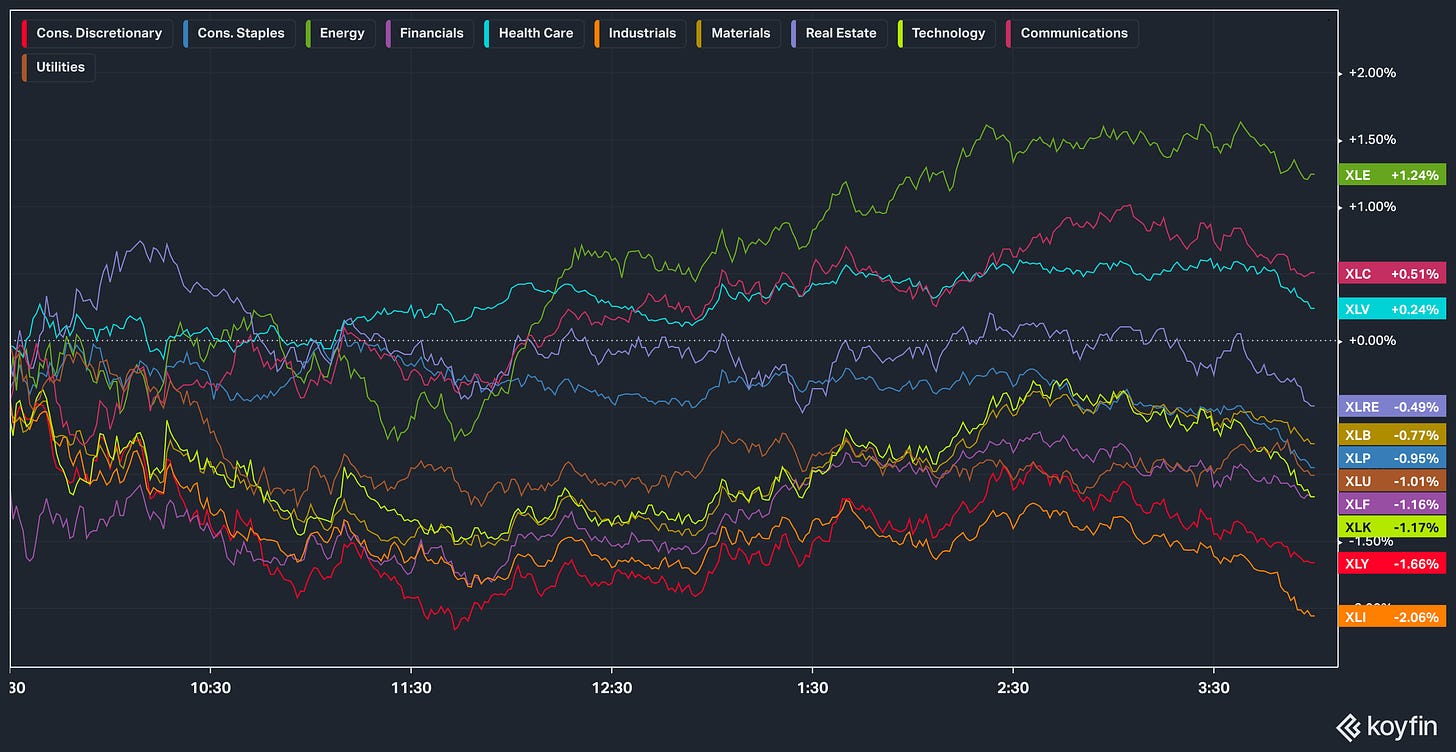

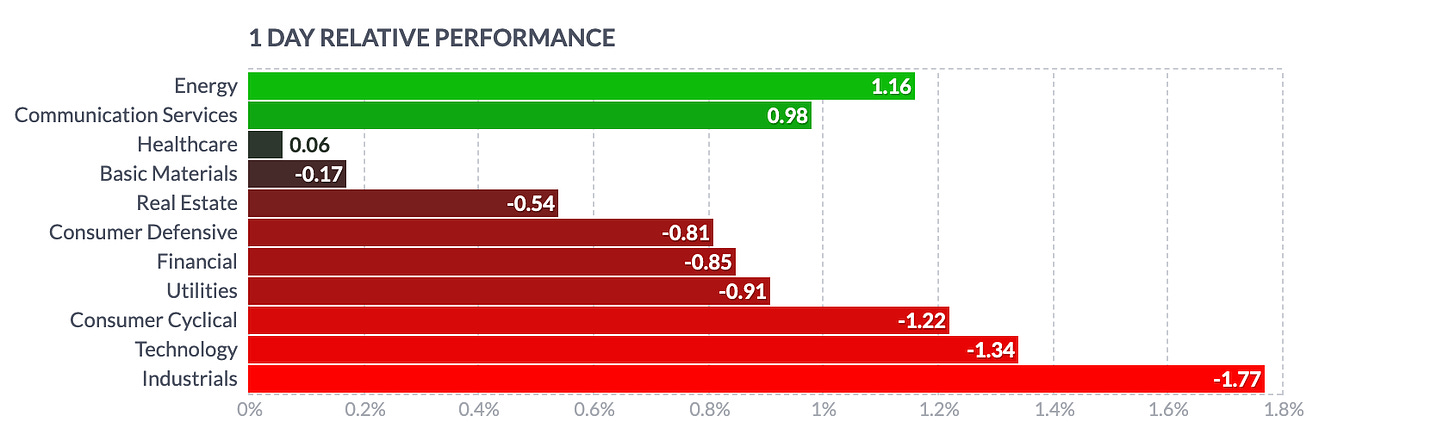

Most of the S&P 500 sectors traded down with the industrial (-2.1%) sector showing the steepest loss. Other influential laggards included the consumer discretionary (-1.7%), financial (-1.2%), and information technology (-1.1%) sectors.

The energy sector (+1.1%) led the outperformers amid rising oil prices. WTI crude oil futures rose 1.5% to $80.73/bbl.

Treasury yields made relatively small upside moves today. The 2-yr note yield rose three basis points to 4.12% and the 10-yr note yield rose two basis points to 3.40%.

In an expected development, Treasury Secretary Yellen notified Congress via a letter that the debt ceiling has been reached, prompting the Treasury Department to begin employing extraordinary measures.

Market Snapshot

Market Heatmap

Sector Heatmap

Earnings Calendar

Economical Events

Future & Commodities Markets

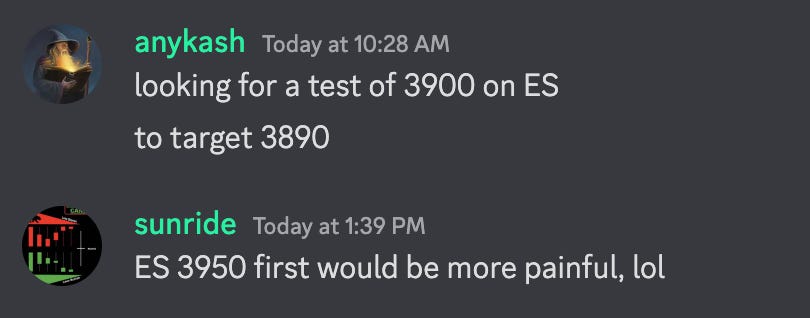

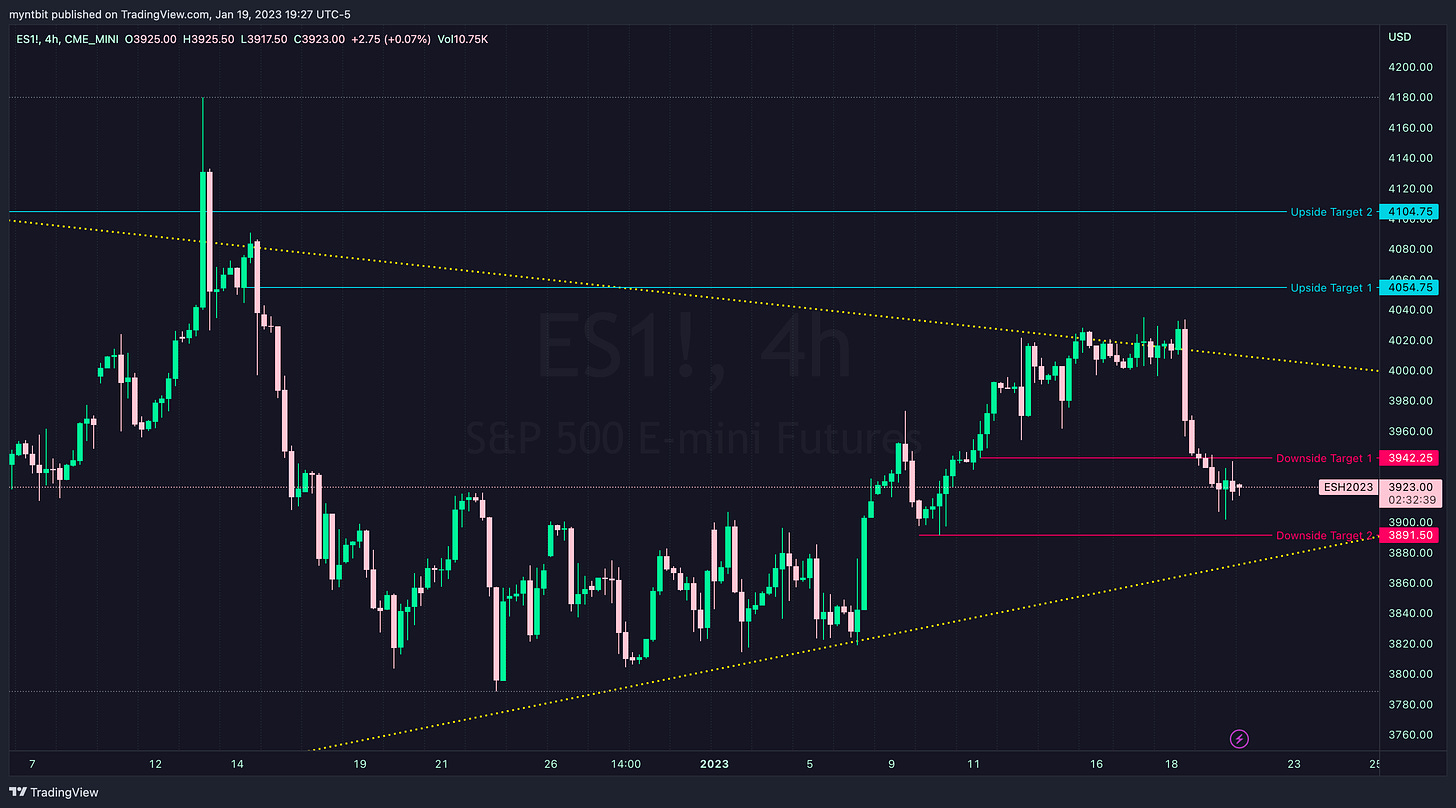

/ES - Emini S&P 500

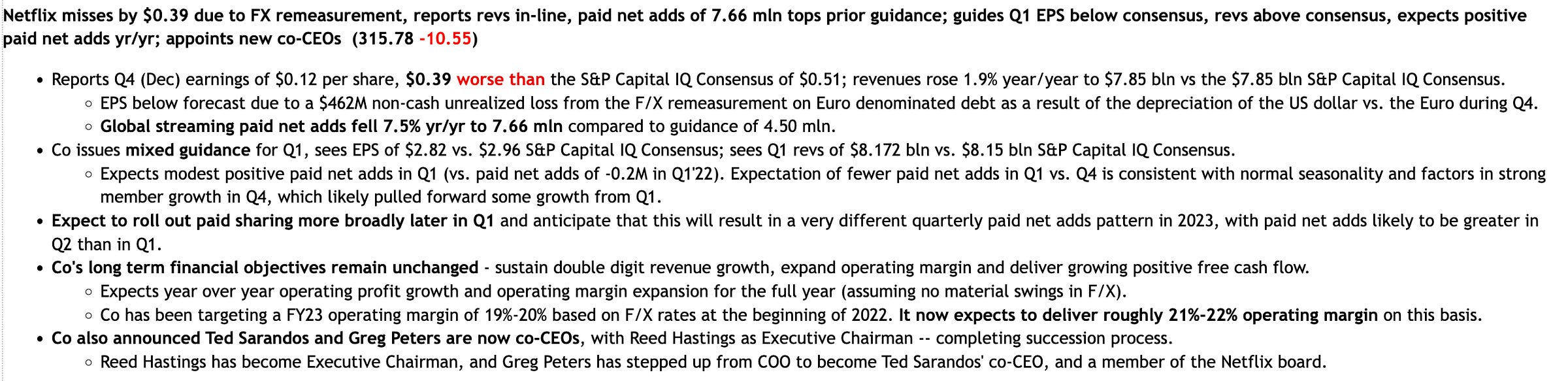

Today, markets opened with a huge gap down, and ES opened below 3930 and tested 3900 before reversing up to 3940s to finish under 3920. Something to note, NFLX reported earnings after hours and is currently over 6%.

For tomorrow, see the levels below:

Upside: If you hold and stay above 3920, we could expect to test 3940-3942 and then target 3970.

Downside: If we fail to hold 3920, then we could go down to test the 3900 and then 3890-3880.

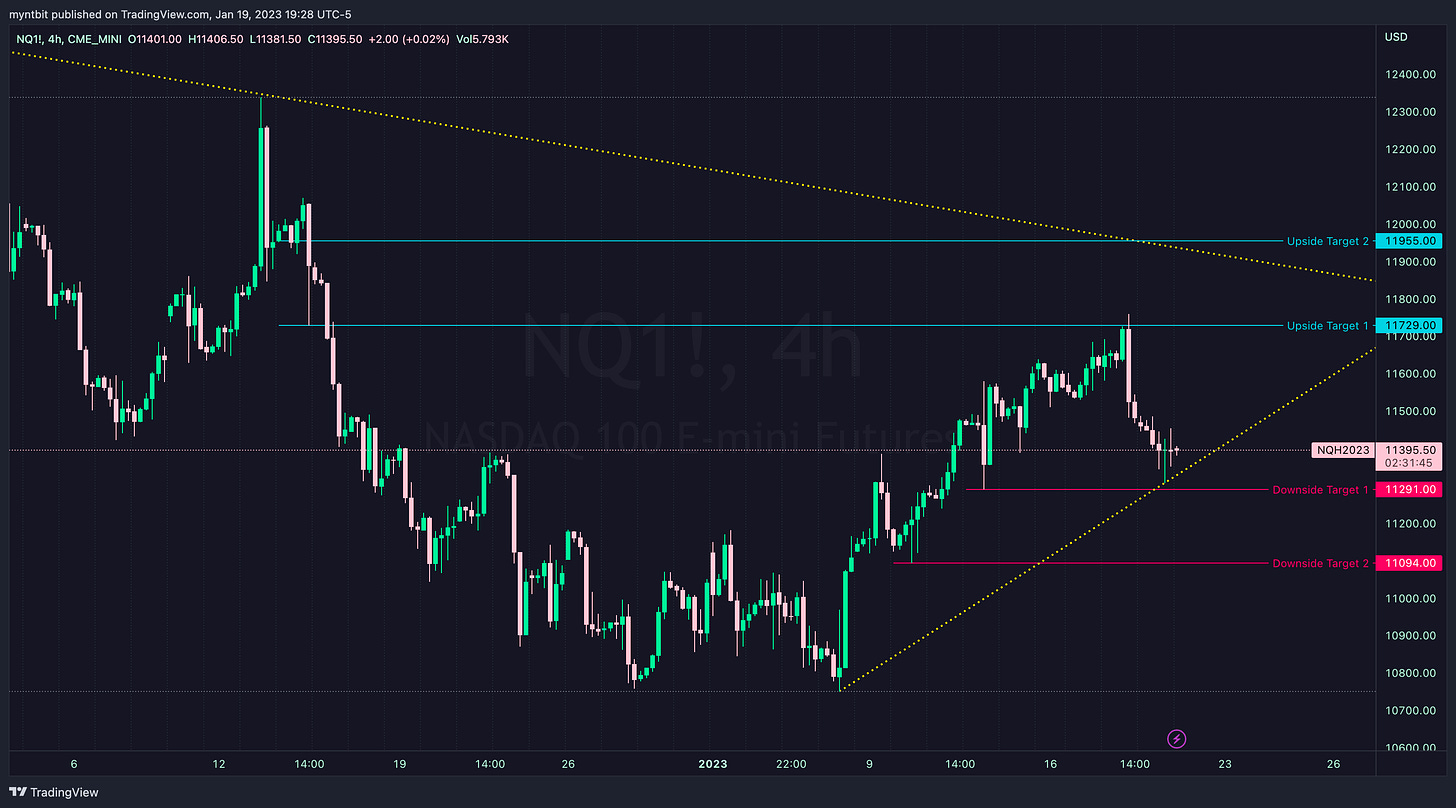

/NQ - Emini Nasdaq 100

Similar to ES, NQ opened below 11500 the key level and dipped down to 11300 close to our downside target before bouncing. Tomorrow will be interesting with NFLX's positive earnings after hours, will there be a shift in sentiment? So for tomorrow, see below:

Upside: If you hold and stay above 11500 once again we could test 11700-11800 as a new higher low has been formed.

Downside: If we fail to hold 11500, then we could go down to 11300-11280 and then to the critical support at 11000.

VIX - Volatility Index

VIX stayed above 20 and rallied to our target at 21.67 and then rejected back to 20.53. For now, the bearish sentiment is still valid.

Upside: 21.67

Downside: 20.01, 17.36, 16.34

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Briefing.com, ForexFactory, Finviz, Tradytics, Wells Fargo Advisor, and/or Tradingview. We are just end-users with no affiliations with them.

Thanks for reading MarketTrader by MyntBit! Subscribe for free to receive new posts and support my work.