01.19.2023 | Daily Newsletter

MyntBit's Daily Newsletter is dedicated to providing traders with today's recap and bringing setups to watch for stocks and futures for the next trading day.

What is included in tomorrow's newsletter?

Daily Recap

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Today's Recap

The day started on an upbeat note for the stock market, but sentiment quickly shifted and the resulting retreat effort had the main indices close with a loss of at least 1.2%. General growth concerns, which had been put on the backburner to start 2023, seemed to be back in play today.

The initial positive bias, which had the S&P 500 trading above the 4,000 level, was presumably fueled by optimism about a slowdown in inflation reflected in the December Producer Price Index (PPI) (actual -0.5%; Briefing.com consensus -0.1%).

Any optimism that may have come from the pleasing PPI report quickly dissipated, though, as investors digested the weak retail sales and manufacturing data from December, cognizant that the Fed is likely to remain on its rate hike path.

Briefly, retail sales fell 1.1% month-over-month in December (Briefing.com consensus -0.8%) after falling a revised 1.0% in November (from -0.6%) and industrial production decreased 0.7% month-over-month in December (Briefing.com consensus -0.1%) after decreasing a revised 0.6% in November (from -0.2%).

St. Louis Fed President Bullard (non-FOMC voter) also fueled the market's concern about the Fed remaining on its rate hike path in spite of a weakening economic backdrop. Mr. Bullard said that he would prefer that the Fed stay on a more aggressive path, according to CNBC, but he added that the prospects for a soft landing have improved.

Market participants received more official commentary on the economy this afternoon when the FOMC released its latest Beige Book at 14:00 ET. On balance, contacts generally expected little growth in the months ahead.

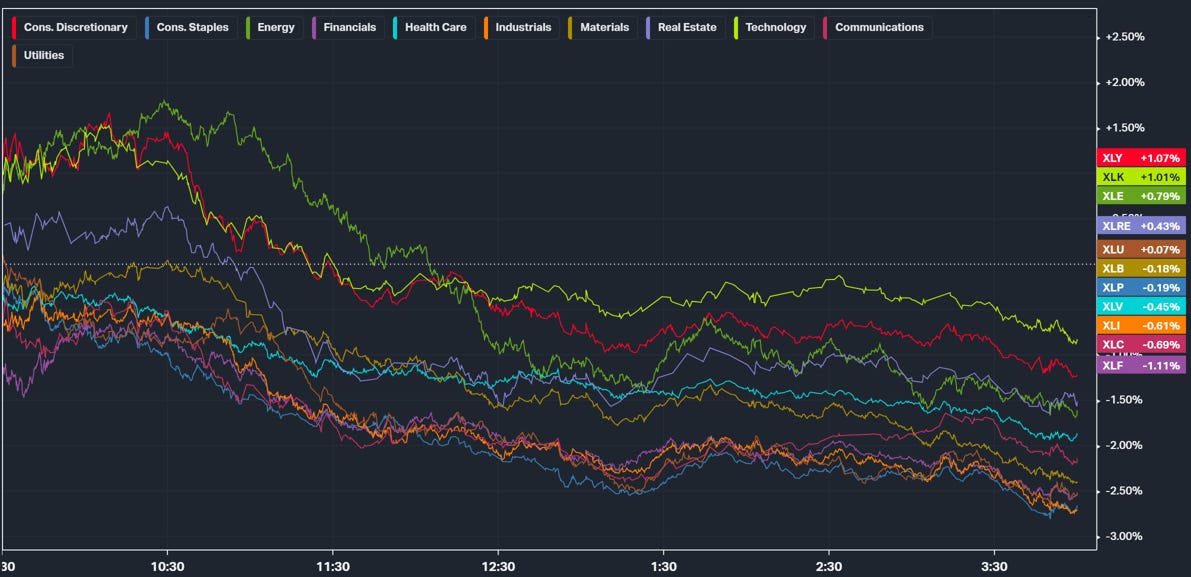

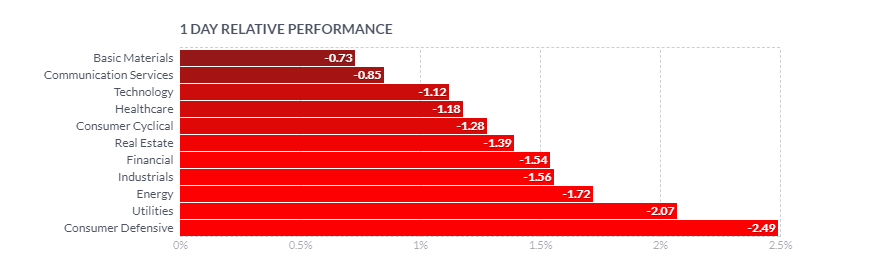

Today's selling efforts had the S&P 500 take out support at its 200-day moving average (3,975) close near its worst level of the day. All 11 S&P 500 sectors registered losses ranging from 0.9% (communication services) to 2.7% (consumer staples).

Just about everything came along for the retreat. The Invesco S&P 500 Equal Weight ETF (RSP) logged a 1.5% loss versus a 1.6% loss for the S&P 500 and a 1.2% loss in the Vanguard Mega Cap Growth ETF (MGK).

Treasury yields took a noticeable turn lower today, but the drop in market rates was not supportive for stocks because it was a manifestation of concerns about weaker growth which, in turn, should lead to lower earnings estimates. The 2-yr note yield fell 11 basis points to 4.09% and the 10-yr note yield fell 16 basis points to 3.38%.

Market Snapshot

Market Heatmap

Sector Heatmap

Earnings Calendar

Economical Events

Future & Commodities Markets

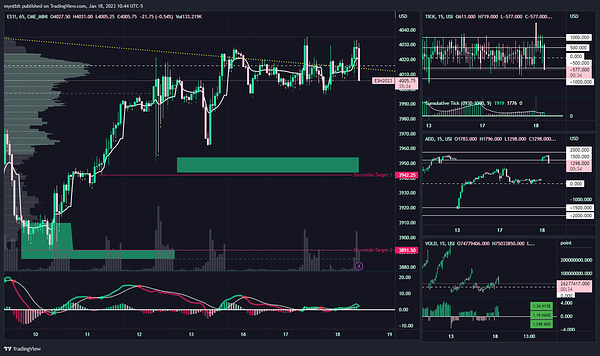

/ES - Emini S&P 500

When the PPI and Retail data were released in the morning, ES tested 4035 upper level from today’s levels, and then when 4000 and 3990 support broke it proceed to sell off to our first target at 3942 for the week. For tomorrow, see the levels below:

Upside: If you hold and stay above 3950, we could expect to test 3970 and then target 3990-4000.

Downside: If we fail to hold 3950, then we could go down to test the 3930 and then 3890.

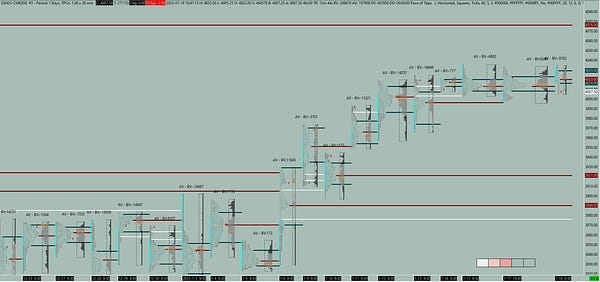

/NQ - Emini Nasdaq 100

Similar to ES, NQ initially rallied off of the economic data pre-market to above 11700 but then finished the day off under 11500. Something to note, tech was amongst the stronger sectors today. So for tomorrow keeping it the same, see below:

Upside: Again, if you hold and stay above 11500, then we could test 11700-11800.

Downside: If we fail to hold 11500, then we could go down to 11280 and then to the critical support at 11000.

VIX - Volatility Index

VIX has been struggling under 20 for the last few days but it finished the day above 20 which support the bearish narrative in the short term.

Upside: 21.67

Downside: 20.01, 17.36, 16.34

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Briefing.com, ForexFactory, Finviz, Tradytics, Wells Fargo Advisor, and/or Tradingview. We are just end-users with no affiliations with them.

Thanks for reading MarketTrader by MyntBit! Subscribe for free to receive new posts and support my work.