01.18.2023 | Daily Newsletter

MyntBit's Daily Newsletter is dedicated to providing traders with today's recap and bringing setups to watch for stocks and futures for the next trading day.

What is included in tomorrow's newsletter?

Daily Recap

Look Ahead - Economic & Earnings Calendar

Key Futures Levels - S&P 500 (/ES) and NASDAQ (/NQ)

Today's Recap

Today's trade had a more cautious tone after the stock market's strong start to 2023. Investors digested earnings results from a few notable banks before the open, which received mixed reactions and may have reined in some expectations for the Q4 earnings season.

Dow component Goldman Sachs (GS 349.92, -24.08, -6.4%) sold off today after reporting below-consensus earnings and revenue, along with increased provisions for credit losses. Morgan Stanley (MS 97.01, +5.35, +5.8%), meanwhile, received a favorable reaction to its quarterly results despite a Q4 earnings miss.

The poor performance from Goldman Sachs kept the Dow Jones Industrial Average in negative territory for the entire session. The Nasdaq and S&P 500, however, logged modest gains of 0.6% and 0.4%, respectively, at early session highs.

Shortly after the open, the S&P 500 was trading above the 4,000 level and there was some noticeable conviction on the buy side. Advancers led decliners by a greater than 2-to-1 margin at the NYSE and a 3-to-2 margin at the Nasdaq.

The modest upside enthusiasm dissipated, though, and the main indices all settled into narrow trading ranges for the remainder of the session. By the afternoon, the 4,000 level became a point of resistance for the S&P 500.

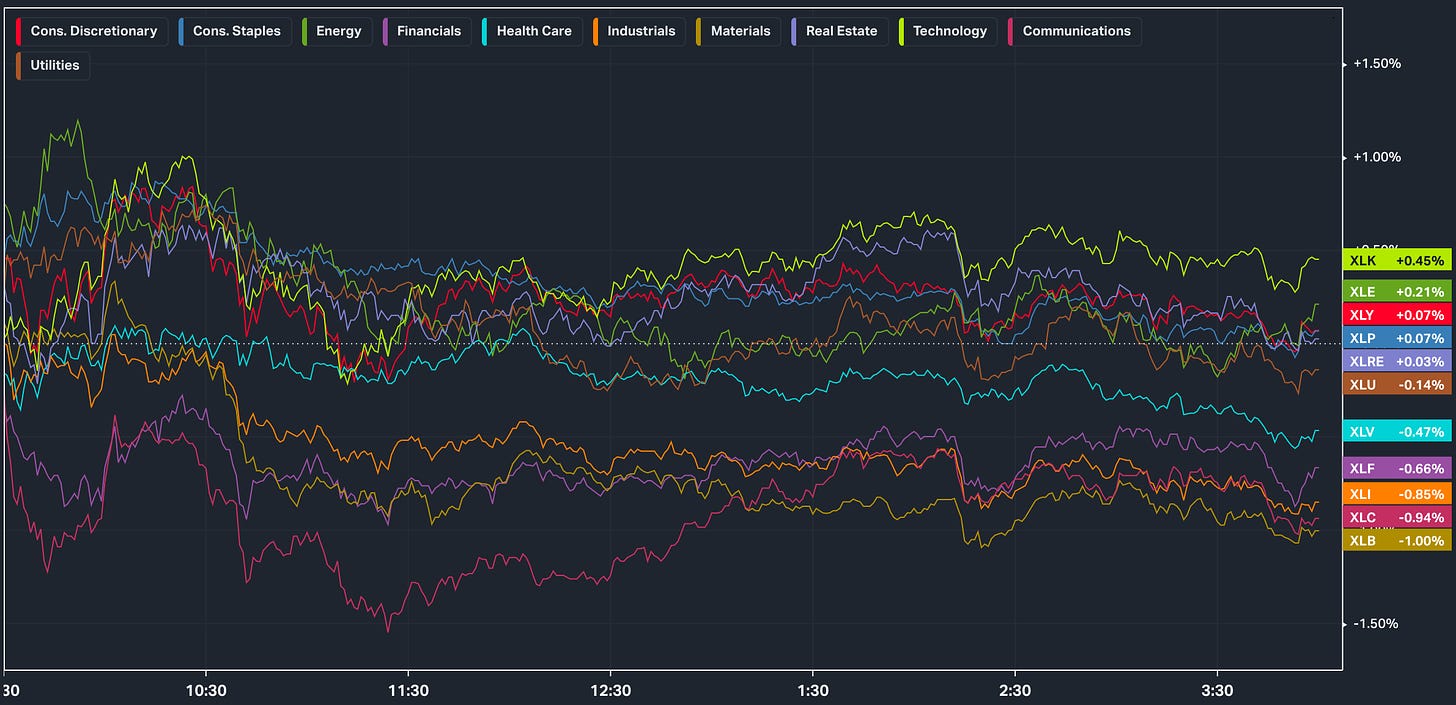

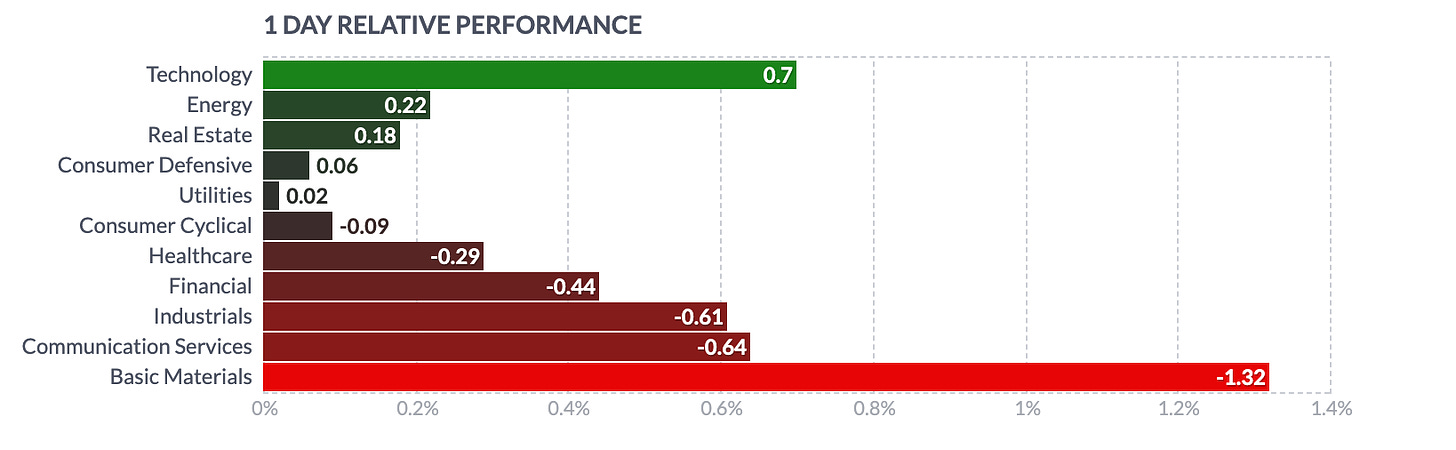

Some mega-cap stocks maintained sizable gains today, offering a measure of support to the broader market. Apple (AAPL 135.94, +1.18, +0.9%) and Tesla (TSLA 131.49, +9.09, +7.4%) were standouts in that regard, boosting their respective S&P 500 sectors -- information technology (+0.4%) and consumer discretionary (+0.1%) -- towards the top of the leaderboard.

The materials (-1.1%) and communication services (-0.9%) sectors were today's worst performers.

Market Snapshot

Market Heatmap

Sector Heatmap

Earnings Calendar

Economical Events

Future & Commodities Markets

/ES - Emini S&P 500

Upside: If you hold and stay above the 4000, we could expect to test 4035 and then target 4065.

Downside: If we fail to hold 4000, then we could go down to test the 3952 and then 3900.

/NQ - Emini Nasdaq 100

Upside: If you hold and stay above 11500, then we could test 11700 again with a chance of trying to get to 12000.

Downside: If we fail to hold 11500, then we could go down to 11280 and then to the critical support at 11000.

VIX - Volatility Index

Upside: 20.01, 21.67

Downside: 17.36, 16.34

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents our personal opinions that we share publicly for educational purposes. Futures, stocks, and bonds trading of any kind involves a lot of risks. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Briefing.com, ForexFactory, Finviz, Tradytics, Wells Fargo Advisor, and/or Tradingview. We are just end-users with no affiliations with them.